You may recall October 2008. We were in the midst of a financial crisis.

Lehman Brothers went under the month before. Within days, Bank of America saved Merrill Lynch. But then Washington Mutual, the sixth largest bank in the country, collapsed.

Investors were worried. So were consumers. Politicians were terrified with an election just weeks away.

On October 16, Warren Buffett shared his assessment of the crisis. He wrote: “Buy American. I Am.” in The New York Times.

In that piece, Buffett was characteristically optimistic:

The financial world is a mess, both in the United States and abroad. Its problems, moreover, have been leaking into the general economy, and the leaks are now turning into a gusher. In the near term, unemployment will rise, business activity will falter and headlines will continue to be scary.

So … I’ve been buying American stocks.

Last weekend, he spoke to shareholders and the world at Berkshire Hathaway’s annual meeting. And this time, Buffett was less optimistic.

When asked if the banking system will fail, he said: “It shouldn’t, I don’t think it will, but it could, and the incentives in bank regulation are so messed up and so many people have an interest in having them messed up, it’s totally crazy.”

He also noted that he’s prepared for more banks to fail. Berkshire is holding about $128 billion in cash and Treasury bills. He said of this: “We want to be there if the banking system temporarily even gets stalled in some way — it shouldn’t — I don’t think it will, but I think it could.”

If Buffett’s worried, we should be too because Buffett’s concerns extend beyond which bank will fail next.

He’s worried about the financial system.

Now, as I like to say, we aren’t Warren Buffett. That means we can take advantage of opportunities that are too small for him to focus on.

Right now, the banking system is that opportunity. And one particular area of the sector is especially vulnerable.

Today, I’ll share a trade idea you can use to play it yourself.

The Best Short Trade I See in Commercial Real Estate

In the current banking crisis, one of the biggest opportunities Buffett can’t trade lies in commercial real estate (CRE).

Right now, the CRE space is making its way into stormy waters.

Goldman Sachs says that regional banks provide 45% of the funding for CRE. The research expects losses on these loans to be small. The problem with this is that even small losses will lead banks to tighten their credit standards.

That will make it difficult for small businesses to secure financing for things like rent, which could lead to larger losses in CRE.

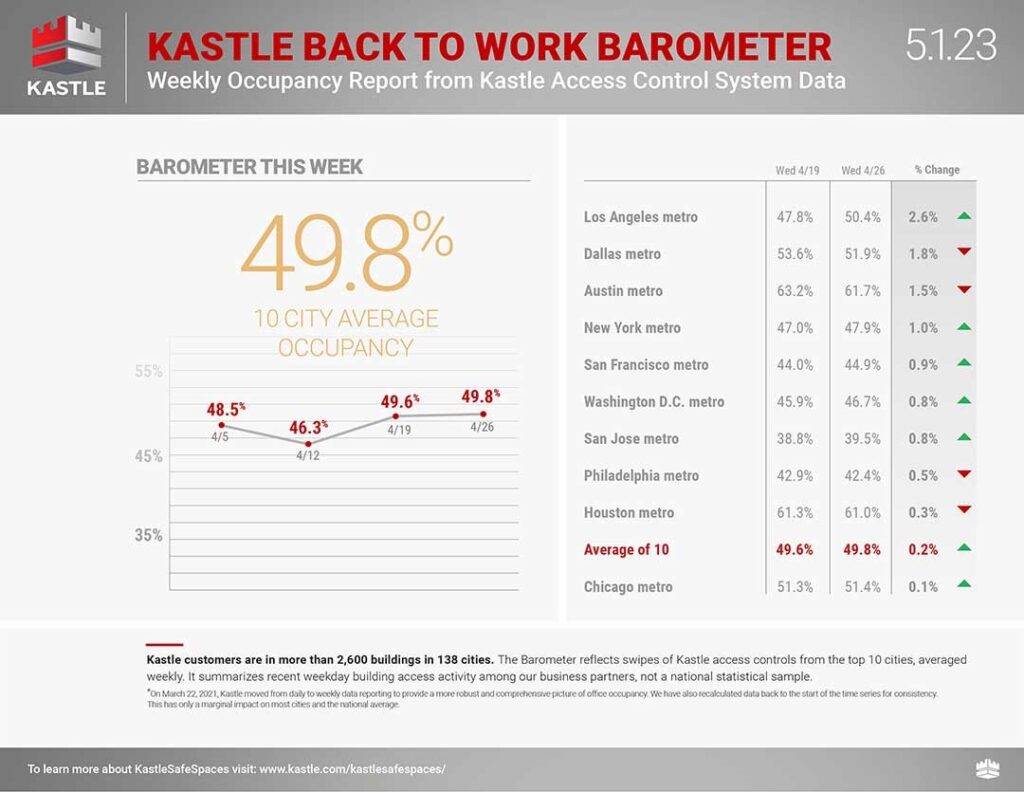

The lasting trend of remote workers is also negatively affecting CRE. Kastle manages keycard access for many buildings and has detailed data on who’s entering buildings at different times. And its data shows that offices are less than half full in many major metro areas across the U.S.

Workers show up more on Tuesdays. Average occupancy rates are 58.5% that day. On Friday, the rate falls to just 32.7%.

Friday was often the day workers gathered at nearby bars and restaurants for happy hour after a long week. Those businesses are now suffering.

Going to the office just a few days a week also affects other surrounding businesses — dry cleaners, downtown gyms and coffee shops. New York City businesses are losing an average of over $4,600 in spending for each worker who comes in less. In Philadelphia, the loss is about $2,100.

Lower revenue caused by a decrease in customer traffic from office workers is forcing businesses to downsize. And as leases in downtown areas across America come up for renewal, vacant storefronts will increase.

This provides an investment opportunity as this trend continues…

How to Play a Falling Commercial Landlord

New York City is among the hardest hit by this trend. And one company is dangerously exposed to it.

SL Green Realty Corp. (NYSE: SLG) is Manhattan’s largest office landlord. The company has interests in 61 buildings totaling 33.1 million square feet. That’s about 6% of the market. About 90% of that space is leased — down 1% from a year ago. About 8% of SLG’s leases expire this year, creating the potential for an even lower occupancy rate.

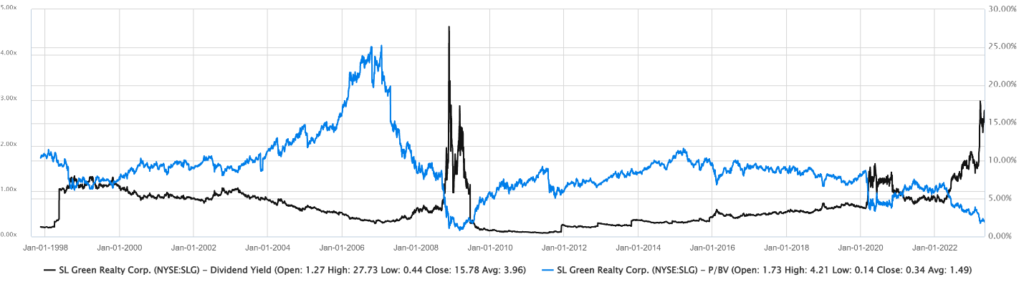

Investors might be drawn to the dividend yield of more than 14%. The yield hasn’t been this high since 2008.

But before you buy into that yield, take a look at the chart below. The dividend yield is the black line. The blue line is the price-to-book (P/B) value. That can help us find a trade in SLG…

The current P/B ratio is 0.36. The 2009 low was 0.14. That indicates SLG could fall 50% or more in a prolonged commercial real estate crisis.

One way to benefit from an expected decline is to buy put options on SLG. Options expiring in July 2024 allow time for the trend to develop.

The SLG July 19, 2024 $25 put trades at about $8.50. Each contract covers 100 shares, so the trade costs $850 to open. If SLG falls 50%, the option will gain at least 55%.

This is a good trade, but it is expensive. Many options trade for just $1 or $2. This one is so expensive because traders are concerned about the crisis and bidding up the price of trades that profit from it.

Nonetheless, it’s still attractive given the likelihood of a large decline in stocks and real estate over the next year.

According to Buffett, the size of Berkshire Hathaway prevents him from shorting stocks like SLG in a way that would have a significant impact on his bottom line. When the sector collapses, he may be a buyer. Until then, he’ll watch patiently.

That leaves this trade open for folks like us. And I believe, even with the SLG put options priced high, there are few better trades to take advantage of an imminent CRE crisis.

Until next time,

Mike Carr

Senior Technical Analyst

P.S. As individual investors, we have the opportunity to benefit from many special situations that large investors simply can’t.

One is the $5 rule, which comes from a set of SEC regulations that prohibit large firms from trading stocks so long as they trade under $5 per share.

My colleague Adam O’Dell uncovered a handful of stocks trading below $5 right now the he believes could rise 500% over the next year. Naturally, when they rise above $5, we can expect the large institutions to take notice.

You can learn more about them here, but don’t delay. Adam’s offer to access his newest research comes down in two days.