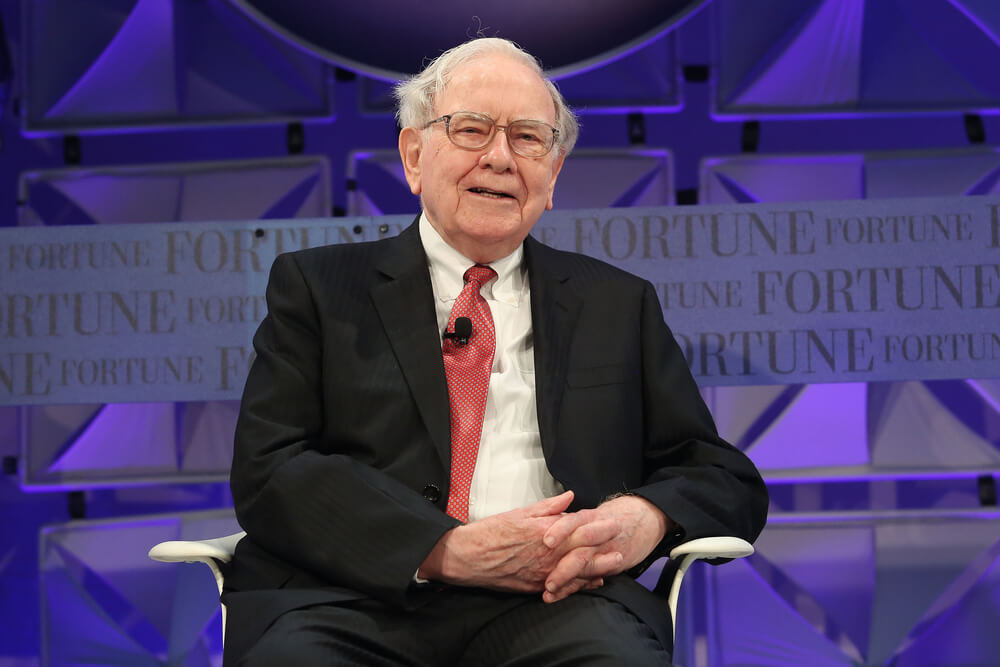

Billionaire investor extraordinaire Warren Buffett is bullish on bank stocks, and he says they’ll be worth a lot more in about a decade, so it’s probably a good time to get in while many are still relatively cheap.

Per Yahoo Finance:

“They’re a business I understand, and I like the price at which they’re selling relative to their future prospects,” Buffett said in a wide-ranging interview with Yahoo Finance’s editor-in-chief Andy Serwer. “I think, 10 years from now, that they’ll be worth more money. And I feel there’s a very high probability I’m right.”

Buffett is particularly bullish on JPMorgan, the biggest bank in the U.S. During the third quarter of 2018, Buffett’s Berkshire Hathaway bought up 35.6 million shares of in JPMorgan & Chase, and then added another 14.5 million shares during the fourth quarter. JPMorgan is the ninth-largest stock holding for Buffett, totaling 50.1 million shares in all.

JPMorgan shares were trading around $105 per share at 2 p.m. EDT on the East Coast today. Buffett said while there are other stocks that will net bigger returns, bank stocks are a great option for long-term investors. JPMorgan shares have gone up 73 percent over the past five years.

“I don’t think that it will turn out to be the best investments at all, of the whole panoply of things you could do, but I’m pretty sure that they won’t disappoint me,” Buffett added.

Buffett, 88, has publicly praised JPMorgan’s CEO Jamie Dimon for years but had not owned the stock until late last year. Last year, he told Yahoo Finance that he made a “mistake” by not buying JPMorgan earlier.

Lately, Buffett has been bullish on bank stocks. Berkshire Hathaway holds large positions in Bank of America (BAC), Goldman Sachs (GS), Bank of New York Mellon (BK), and PNC Financial (PNC).

Buffett has been a long-time holder of Wells Fargo’s stock (WFC) with the position dating back to 2001. He’s trimmed the position slightly in recent quarters, though it’s still a top three holding for Berkshire.