Brazilian fintech StoneCo Ltd (Nasdaq: STNE) is about to launch its initial public offering (IPO). You might be thinking, “Great, another fintech company…” but this one is different. It’s attracted investments from both Warren Buffett and Jack Ma.

Emerging as a massive disruptor to the global banking industry, fintech companies have become one of the hottest topics of the past year. Within the sector, few places have seen more growth than Brazil.

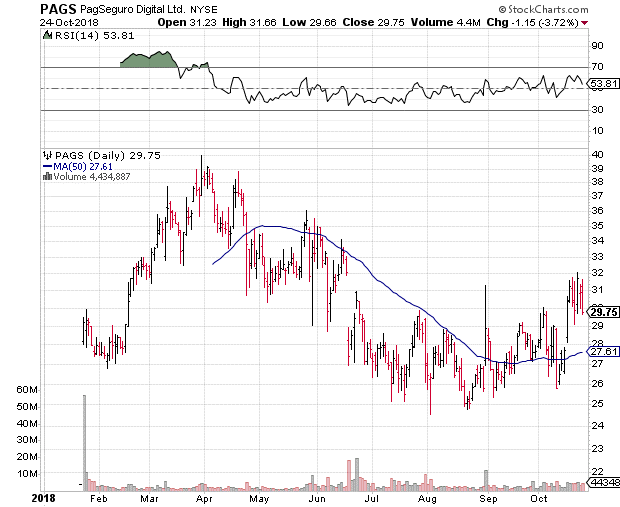

At the beginning of 2015, Brazil had about 54 fintech payment processing companies. Now there are more than 210 such firms running around. In fact, StoneCo competitor PagSeguro Digital (Nasdaq: PAGS) IPO’d back in January at $21.50, raising $2.3 billion in the process.

But there’s something different about StoneCo’s IPO. It’s attracted interest from Buffett’s Berkshire Hathaway (NYSE:BRK.A) and Jack Ma’s Ant Financial, an affiliate of Alibaba Group Holding Ltd (NYSE:BABA).

Ant Financial, an affiliate of billionaire Jack Ma’s Alibaba Group Holdings Ltd.’s (BABA), has become the latest high profile investor to express an interest in buying a big stake in Brazilian fintech firm StoneCo Ltd ahead of its initial public offering (IPO) next Thursday.

According to Bloomberg reports, Berkshire is interested in buying 14.2 million STNE shares ahead of StoneCo’s listing. Ant Financial, meanwhile, is reportedly investing $100 million in the IPO, or about 4.3 million shares if STNE prices it at the top end of it’s expected range.

But it’s not just Buffett and Ma investing millions in StoneCo’s IPO, Madrone Capital Partners, a private equity firm backed by the Walmart Inc. (NYSE:WMT) heirs, currently holds a 9.3 percent stake in StoneCo and is expected to pick up an addition 2.4 million ahead of the offering.

Diving into the IPO, StoneCo is offering 54.9 million shares, with an expected price range of $21 to $23 per share. At the top of this range, StoneCo could raise as much as $1.26 billion. That would make it the fourth IPO this year to top the $1 billion mark.

One key piece of data driving these high-dollar Brazilian fintech IPO’s is a quirk of the country’s economy. According to a recent report, only two-thirds of Brazilians currently pay for goods and services with cash. This represents a massive market for fintech payment processing firms and is why the number of such companies has nearly quadrupled in the past three years.

But, should you follow Buffett and Ma into the StoneCo IPO? If you’re looking for short-term gains, that answer is … maybe?

The stock surged in the months following it’s IPO, soaring as high as the $40 region. That enthusiasm quickly faded, however, and PAGS dipped below its IPO for most of the summer months. The shares have finally recovered a bit, oddly enough, during the recent rout of U.S. stocks.

As for STNE stock, you could expect similar post-IPO performance, but those big short-term gains will depend largely on Wall Street’s mood — which has been quite dour recently. For longer-term investors, it would be a smart move to wait for STNE to stabilize before adding the shares to your portfolio … even with Warren Buffett and Jack Ma backing the company.