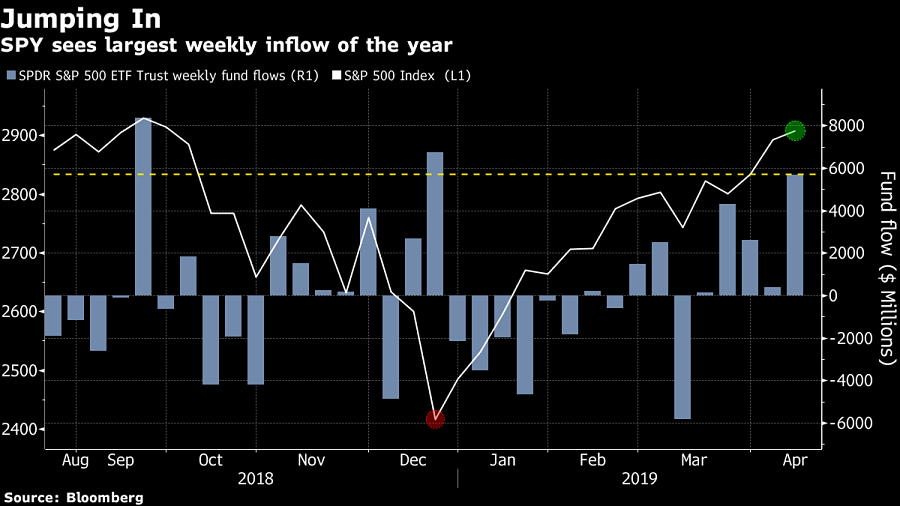

Since December’s bloodbath, the S&P 500 has grown a staggering $4 trillion dollars, and exchange-traded fund (ETF) investors are celebrating and betting there’s even more room to run.

“You didn’t have to know accounting, you just had to believe in America. And you didn’t have to pick the right stock, you just picked America.”

Whenever billionaire investing legend Warren Buffett is asked for his best advice for would-be investors his answer is simple: Put your money in inexpensive index funds — ETFs — that mirror the U.S. economy and let the American tailwind do the work.

“You didn’t have to know accounting, you just had to believe in America. And you didn’t have to pick the right stock, you just picked America,” Buffett said. “That isn’t a tailwind. It’s more like a hurricane. American business has done incredibly well, and America’s done incredibly well.”

According to Bloomberg, investors poured more than $5.6 billion into the SPDR S&P 500 ETF Trust known as SPY last week. The last time this happened was when stocks were on the brink of a bear market in 2018. This time, the cash infusion comes as the S&P 500 nears new heights.

Per InvestmentNews:

Investors may be “looking at the headlines saying, ‘Well, maybe it’s got another 10%,”‘ said Delores Rubin, a senior equity trader at Deutsche Bank Wealth Management. “People recognize growth is still there.”

Although stocks are already up 16% this year, fueling a temptation to bail and pocket the profits, the appeal to remain invested persists as earnings season gets underway. The first quarter should mark a bottom for the year, and Wall Street strategists are being forced to boost their year-end price targets or get left behind.

Growth stocks, which have helped fuel the record bull market, are also seeing renewed interest, capping three straight weeks of inflows in the period ending April 12, their longest streak since November, Bloomberg Intelligence data show. That puts growth funds on track for their best month of the year.

“Moving forward, we are just seeing an earnings slowdown and things are likely to re-accelerate into the back half of 2019,” said Jeff Schulze, investment strategist at ClearBridge Investments, which has about $142 billion in assets under management. “Recession isn’t on the horizon and global growth is likely turning.”