Welcome to the Friday earnings edition of What My System Says Today.

It’s hard to believe that the third-quarter earnings season kicks off next week.

Although the sector doesn’t report immediately, I thought it was a perfect time to analyze companies in one of the hottest areas of the market: information technology.

Big Tech has been driving the latest market surge, with the S&P 500 tech sector gaining 25% since the start of 2025.

Now, a big part of an earnings report is guidance. This is where companies inform analysts and investors about their projected earnings and revenue for the next quarter and the remainder of the year.

Oftentimes, a stock will move higher or lower based on those projections, rather than on actual quarterly numbers. For example, a company may have substantial quarterly revenue and earnings, but issue weak guidance. Wall Street anticipates future weakness and penalizes the stock.

The data firm, FactSet, recently analyzed quarterly guidance for the upcoming quarter and found that 112 S&P 500 companies have issued forward guidance for the third quarter.

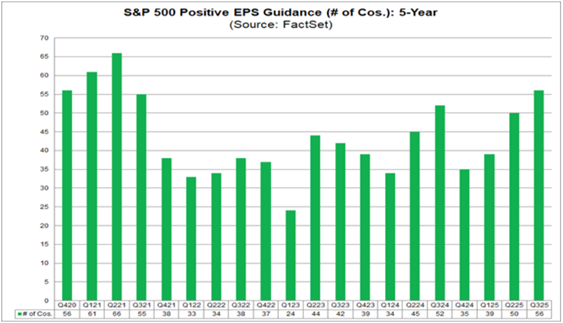

Of that number, 56 issued negative guidance, and 56 issued positive guidance:

The interesting thing here is that the number of companies issuing positive guidance (50% of the total) is higher than the 5-year average (43%) and the 10-year average (39%).

It’s the highest tally since the second quarter of 2021.

On the sector level, information technology has the highest number of companies issuing higher guidance (36).

Breaking it down further, software (12) and semiconductors & semiconductor equipment (9) are the IT industries with the brightest outlook.

We’ll see how things shake out when Big Tech starts reporting later this month, but for now, let’s look to the present and analyze potentially “bullish” earnings for the next week…

“Bullish” Bank Earnings to Watch

These stocks are expected to beat their previous quarter’s earnings per share (EPS), and thus, if those expectations are met or exceeded, they could potentially trade higher.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are 10 companies that made this week’s list:

It’s not surprising to see a lot of big banks on the list here.

After all, the financial sector traditionally marks the start of earnings season.

You’ll see some pretty big names on this list: Goldman Sachs Group (GS), Blackstone Inc. (BX), State Street Corp. (STT), U.S. Bancorp (USB), Charles Schwab Corp. (SCHW) and Bank of America Corp. (BAC).

There is one thing that links all of these names together: They all have robust trading desks.

These banks generate revenue from sources beyond just checking accounts and loans. They also earn commissions from placing large trades for institutional investors.

It’s these commissions that have carried these banks to higher earnings in recent quarters. More trading means more commissions … means more revenue.

All of these major banks will beat expectations and surpass their EPS from the previous quarter.

For some, like Blackstone, it could elevate their Green Zone Power Rating above “High-Risk,” while for others, it may push them higher into “Bullish” territory.

Now, we’ll look at potentially “bearish” earnings for next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Here are 10 companies that passed this screen:

Financials aside, the surprise for me here is United Airlines Holdings Inc. (UAL).

As one of the largest airline carriers in the United States, the company should be thriving from increased summer travel demands.

However, over the last four quarters, the company has not broken above the $2.97 it reported in the second quarter.

In fact, the trend shows that in the quarter following a high EPS, United reports a drop.

I expect this quarter to be no different.

I see United coming in line, or slightly higher than expectations, but still lower than the previous quarter.

A slight beat on expectations could hold UAL in “Bullish” territory on our Green Zone Power Rating system.

That’s all I have for you today.

Make sure to enjoy your weekend!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets