Are you interested in Weber stock? Weber Inc. (NYSE: WEBR) have been around since 1952, when George Stephen Sr. took a half-sphere of metal and created the first kettle-style charcoal grill.

With its efficient shape, the grill was able to cook food evenly without having to move the coals around. Over the years, Weber grills have come a long way in terms of design, innovation, and safety features.

But what does the future look like for this iconic grill brand?

Let’s take a look back at its history and a peek into what 2023 may hold.

History of Weber Grills

Weber Grills started out as an innovative charcoal grill manufacturer in 1952. Today, it make some of the most popular grills on the market.

It offers gas, charcoal, electric and portable grills with innovative features such as Flavorizer bars that help distribute heat more evenly while also adding flavor to grilled foods.

The company has also made strides in sustainability over the years; its most recent models use recycled materials and energy-saving components like LED lights that reduce power consumption.

Weber Stock’s 2023 Outlook

Weber Grills continues to be an innovator in the outdoor cooking industry. It has introduced new products over the past several years that are designed with convenience and efficiency in mind.

In 2021, it debuted a brand-new line of Summit series gas grills which feature advanced technology like Wi-Fi connectivity so you can control your grill remotely from your phone or computer.

As we look ahead to 2023, many expect Weber will continue to develop cutting edge technology for its grills — including voice activation capabilities — that will make outdoor cooking easier than ever before!

But does that mean Weber stock is worth a buy?

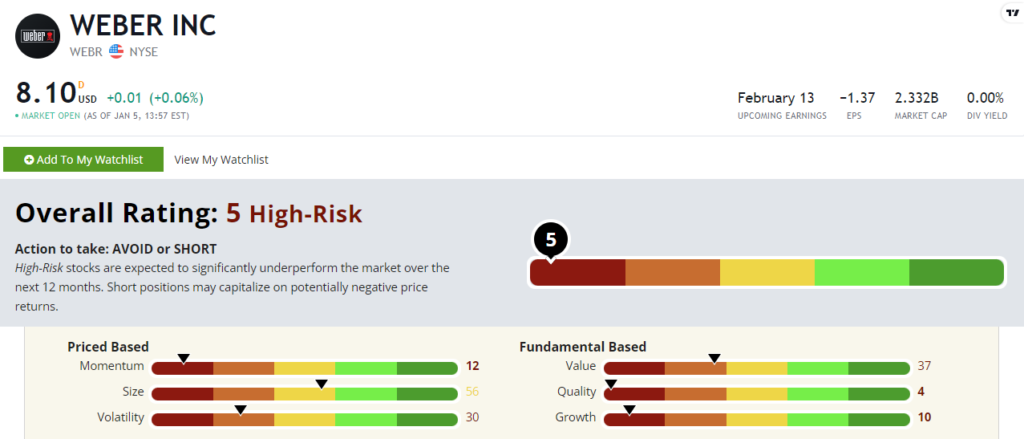

Weber Stock Power Ratings

Here’s how WEBR rates within our proprietary Stock Power Ratings system.

Weber stock rates a lowly 5 out of 100. That means this “High-Risk” stock is set to underperform the broader market over the next 12 months.

Looking at its individual factor ratings, WEBR rates worst on quality at 4 out of 100 and growth at 10 out of 100. It has fallen short on earnings per share expectations for the first three quarters of 2022!

But what’s most telling about Weber stock’s trajectory is its low scores on momentum (12) and volatility (30). Over the last five years, WEBR has lost 55% of its share value. And almost 30% of those total losses came in the last 12 months of rocky, up-and-down trading.

If you follow Stock Power Ratings, Weber stock looks like one to avoid right now. We’ll see if investors change their minds and see WEBR in a more favorable light as the months go on.

What about you? Are you holding WEBR in your portfolio? Or have you used Stock Power Ratings to look up other stocks to buy or sell? Tell us about your experience in the comments below, or reach out to our team at StockPower@MoneyandMarkets.com!