It’s the main question on everyone’s mind: What happened to the oil market and how can I profit?

First, let me answer the question, “What Happened to the Oil Market?”

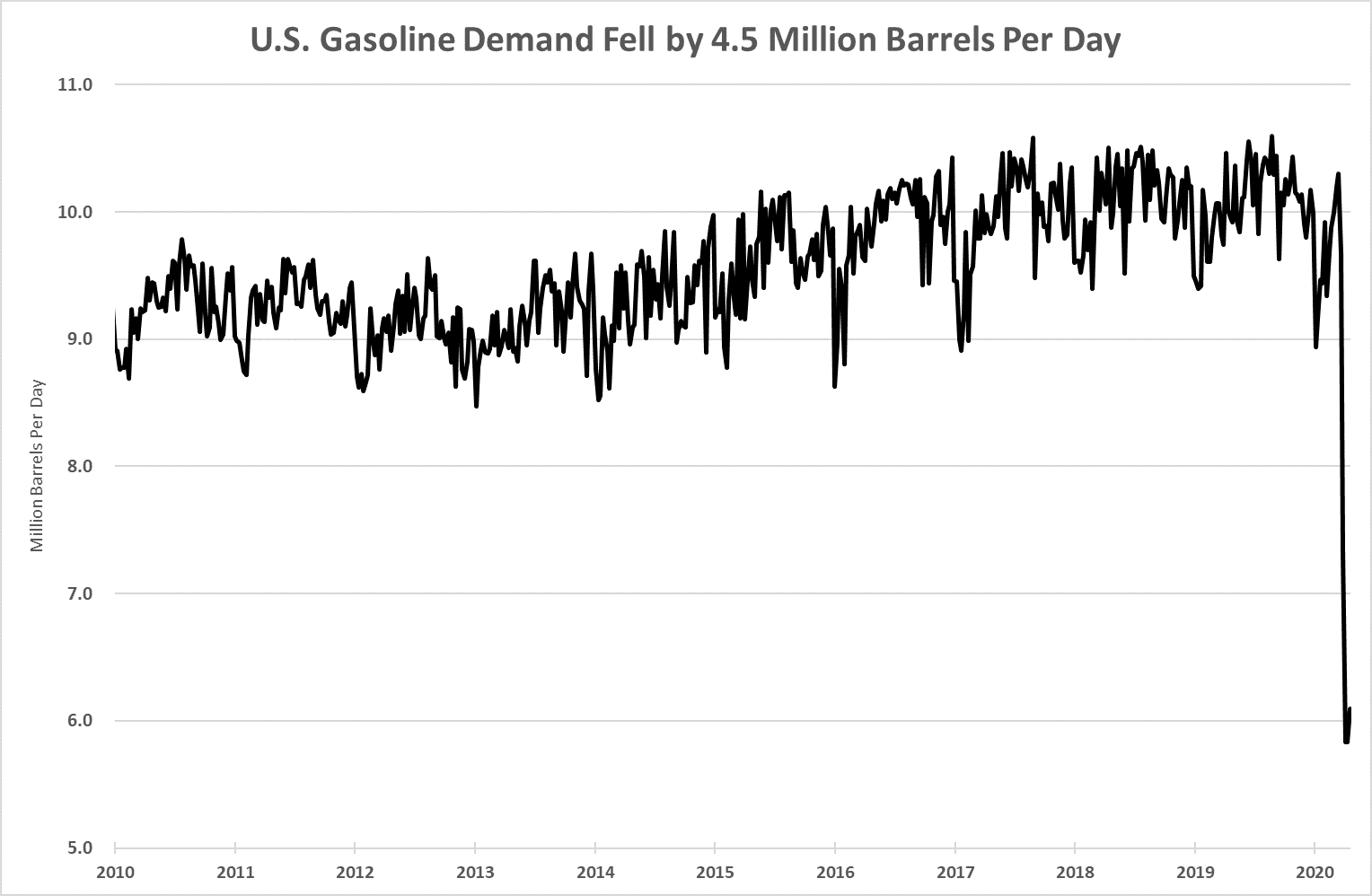

Demand destruction …

It takes two barrels of oil to make a barrel of gasoline. The U.S. saw its demand for gasoline fall by 4.5 million barrels per day in three weeks.

That implies oil demand destruction of 9 million barrels per day. To put that in perspective, that’s about 10% of the world’s total daily oil demand.

U.S. Energy Information Administration (EIA) data shows we can hold 653 million barrels of oil in storage. Oil in storage increased by 19 million barrels from April 3 to April 10. That’s about 2.7 million barrels per day.

At that rate, it will take less than two months to fill all the storage in the U.S. That’s a terrifying situation because when the storage is full, the entire system bogs down.

Eventually, the industry must sell every barrel pumped into storage. All that stored oil extends the length of the glut … and therefore low oil prices.

And yet, investors don’t care.

The SPDR Oil & Gas Exploration and Production ETF (NYSE: XOP), which holds a basket of 57 oil and gas producers, bottomed on March 23 and is up 50% from that low. I don’t know who’s buying it, but that is a huge mistake.

Many of those companies held in the ETF won’t survive the next year. Its top holding, EQT Corp (NYSE: EQT) has more debt than market value. And it only had one profitable year (on a free cash flow basis) in the last 12 years.

There are at least five companies in the fund’s top 15 holdings that could file for bankruptcy in 2020. These companies are unprofitable at $40 per barrel oil … they are dumpster fires at $20 per barrel.

Two high-profile shale companies already filed. Chesapeake Energy (NYSE: CHK) and Whiting Petroleum (NYSE: WLL) were both darlings of the shale patch. Both took on enormous debt, overspent for assets, and then imploded when the price of oil and gas fell.

With the current glut of oil, we won’t see price recovery for 18 months to two years. And that’s if we can get back to work by the fall. The longer people stay home, the longer this will take to play out.

And every day we have sub-$40 oil prices is another nail in the coffin for many of the companies held by XOP. These companies will start to drop by August … and we’ll see a cascade of bankruptcies into 2021.

There are buys in the sector today. But you must follow some strict guidelines. That’s what I specialize in, in my Real Wealth Strategist Newsletter. We know the best companies to hold as the industry weathers this incredible collapse.

Good Investing,

Matt Badiali