Nothing is static in the markets — the “best” and “worst” stocks are always changing.

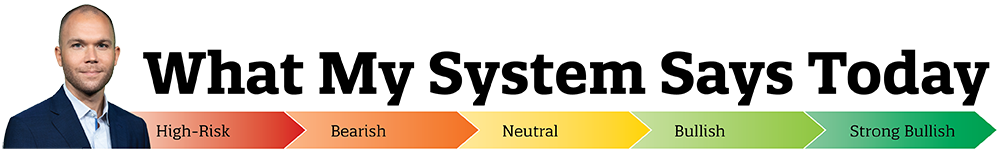

That’s why I designed my proprietary Green Zone Power Rating system to identify the right stocks for bullish markets … bearish markets … and everything in between.

And my free newsletter, What My System Says Today, is hyper-focused on showing you how powerful a systematic approach to investing is…

Each weekday, I’ll analyze the market using my Green Zone Power Rating system — the same system that drives my Green Zone Fortunes investing service.

On Monday … learn which market sectors are leading and lagging, then start your stock-picking as we drill down into the best and worst stocks within those sectors.

On Tuesday … discover how our sector “X-Ray” tool can reveal the true makeup of a market segment and its individual components, viewed through the lens of our six-factor rating system.

On Wednesday … I’ll share a “wildcard” piece of analysis and a list of stocks that meet the criteria of my custom-designed stock screener.

On Thursday … get access to the week’s list of Brand-New “Super Bulls” — stocks with ratings that have improved to 80 or higher on my Green Zone Power Ratings system compared to the previous month.

On Friday … get an insider’s “sneak peek” at companies scheduled to report earnings the following week. We’ll highlight companies that are poised to report increasing (or decreasing) earnings per share (EPS), and thus stoke bullish (or bearish) action on their stocks in the market.

That’s what you can expect each week in What My System Says Today! It’s a data-driven approach underpinned by Wall Street-caliber tools you can only get here at Money & Markets.

Just enter your email address below for a free subscription to What My System Says Today.

The World’s #1 Energy Superhighway Is Now Under Threat March 4, 2026 What My System Says Today At its narrowest point, the Strait of Hormuz is just 21 miles wide. Yet, this slender stretch of water is one of the most critical trade corridors on Earth — linking Europe, Asia and the Middle East. An average of 138 vessels — most of them Very Large Crude Carriers (VLCCs) and liquefied natural gas […]

The World’s #1 Energy Superhighway Is Now Under Threat March 4, 2026 What My System Says Today At its narrowest point, the Strait of Hormuz is just 21 miles wide. Yet, this slender stretch of water is one of the most critical trade corridors on Earth — linking Europe, Asia and the Middle East. An average of 138 vessels — most of them Very Large Crude Carriers (VLCCs) and liquefied natural gas […] War, What Is It Good For? March 3, 2026 What My System Says Today With the war in Iran entering its fourth day, we remain unsure about how long it will last and what the world might look like once the smoke clears. President Donald Trump has suggested it might last four to five weeks, but he was also clear that it could go on “far longer.” Given that […]

War, What Is It Good For? March 3, 2026 What My System Says Today With the war in Iran entering its fourth day, we remain unsure about how long it will last and what the world might look like once the smoke clears. President Donald Trump has suggested it might last four to five weeks, but he was also clear that it could go on “far longer.” Given that […] We’re at War… Here’s How to Navigate What Comes Next March 2, 2026 What My System Says Today News broke this weekend that the U.S. began a bombing campaign against Iran. But unlike the June 12-Day War, which saw the U.S. and Israel attack Iran’s nuclear facilities, this one escalated quickly. The bombing resulted in the death of Iran’s Supreme Leader Ayatollah Ali Khamenei and a large swath of the country’s leadership. At […]

We’re at War… Here’s How to Navigate What Comes Next March 2, 2026 What My System Says Today News broke this weekend that the U.S. began a bombing campaign against Iran. But unlike the June 12-Day War, which saw the U.S. and Israel attack Iran’s nuclear facilities, this one escalated quickly. The bombing resulted in the death of Iran’s Supreme Leader Ayatollah Ali Khamenei and a large swath of the country’s leadership. At […] Earnings Report Card: Why Revenue Growth Is Setting the Tone for Earnings Season February 27, 2026 What My System Says Today Welcome to another earnings Friday at What My System Says Today. Before I get into “bullish” and “bearish” earnings, I want to start with revenue. Every company aims to grow its revenue every quarter and every year. It doesn’t always work out that way, but the goal remains the same. Revenue growth is important because […]

Earnings Report Card: Why Revenue Growth Is Setting the Tone for Earnings Season February 27, 2026 What My System Says Today Welcome to another earnings Friday at What My System Says Today. Before I get into “bullish” and “bearish” earnings, I want to start with revenue. Every company aims to grow its revenue every quarter and every year. It doesn’t always work out that way, but the goal remains the same. Revenue growth is important because […] What Do Hawaiian Resorts and Gritty Industrials Have In Common? February 26, 2026 What My System Says Today Today, I’ll be putting a spotlight on the stocks that just earned a fresh “Bullish” rating in my Green Zone Power Ratings System. But before I cover today’s winners, let’s pause for a moment and talk about the elephant in the room: Nvidia’s (NVDA) earnings. Nvidia had a fantastic fourth quarter. Revenues rose 73% to […]

What Do Hawaiian Resorts and Gritty Industrials Have In Common? February 26, 2026 What My System Says Today Today, I’ll be putting a spotlight on the stocks that just earned a fresh “Bullish” rating in my Green Zone Power Ratings System. But before I cover today’s winners, let’s pause for a moment and talk about the elephant in the room: Nvidia’s (NVDA) earnings. Nvidia had a fantastic fourth quarter. Revenues rose 73% to […] Inside the Infrastructure Behind the AI Boom February 25, 2026 What My System Says Today Welcome from the frigid, grassy plains of Kansas, as I spend a week with my grandson before returning to the sun of South Florida. Today, I want to unpack a topic you hear about a lot in financial media, but that many investors don’t fully understand: hyperscalers. A hyperscaler is a massive provider of cloud, […]

Inside the Infrastructure Behind the AI Boom February 25, 2026 What My System Says Today Welcome from the frigid, grassy plains of Kansas, as I spend a week with my grandson before returning to the sun of South Florida. Today, I want to unpack a topic you hear about a lot in financial media, but that many investors don’t fully understand: hyperscalers. A hyperscaler is a massive provider of cloud, […] The HALO Trade Lives February 24, 2026 What My System Says Today We might as well call 2026 the year of the “anti-AI” trade. Investors aren’t worried that AI will be a flop. In fact, it’s the exact opposite of that. They’re concerned that AI will work a little too well and disrupt large swaths of the white-collar economy. In my experience as an investor, the more […]

The HALO Trade Lives February 24, 2026 What My System Says Today We might as well call 2026 the year of the “anti-AI” trade. Investors aren’t worried that AI will be a flop. In fact, it’s the exact opposite of that. They’re concerned that AI will work a little too well and disrupt large swaths of the white-collar economy. In my experience as an investor, the more […] Industrials Keep Chugging Ahead February 23, 2026 News, What My System Says Today The Supreme Court shot down President Donald Trump’s “Liberation Day” tariffs on Friday. It ruled in a 6-3 majority opinion that the International Emergency Economic Powers Act does not give Trump the authority to set tariffs on a country-by-country basis. Unfortunately, this isn’t the end of tariff uncertainty… If anything, it was just the end […]

Industrials Keep Chugging Ahead February 23, 2026 News, What My System Says Today The Supreme Court shot down President Donald Trump’s “Liberation Day” tariffs on Friday. It ruled in a 6-3 majority opinion that the International Emergency Economic Powers Act does not give Trump the authority to set tariffs on a country-by-country basis. Unfortunately, this isn’t the end of tariff uncertainty… If anything, it was just the end […] Earnings Report Card: A Big Earnings Week Ahead for Software Stocks February 20, 2026 What My System Says Today It’s another earnings Friday here at What My System Says Today… and next week is shaping up to be a real doozy for software stocks. No other corner of the market has been as directly impacted by the meteoric rise of AI as the ongoing AI boom… and in fact, recent releases by AI pioneer Anthropic […]

Earnings Report Card: A Big Earnings Week Ahead for Software Stocks February 20, 2026 What My System Says Today It’s another earnings Friday here at What My System Says Today… and next week is shaping up to be a real doozy for software stocks. No other corner of the market has been as directly impacted by the meteoric rise of AI as the ongoing AI boom… and in fact, recent releases by AI pioneer Anthropic […] FOMO Is Dead… But These Stocks Are Alive! February 19, 2026 What My System Says Today Is the “fear of missing out” (FOMO) dead? It might be a little too early to start planning a funeral, as the “FOMO” trade has proven to be remarkably durable. But we’ve definitely seen a marked shift in the market this year. For instance, take a look at meme-stock darling Carvana (CVNA). Between the beginning […]

FOMO Is Dead… But These Stocks Are Alive! February 19, 2026 What My System Says Today Is the “fear of missing out” (FOMO) dead? It might be a little too early to start planning a funeral, as the “FOMO” trade has proven to be remarkably durable. But we’ve definitely seen a marked shift in the market this year. For instance, take a look at meme-stock darling Carvana (CVNA). Between the beginning […]