Welcome to 2026!

I certainly hope that every one of you had a safe and Happy New Year.

Today is Friday, the day after the holiday, so it is back to business for us.

With the turn of the new year, I thought I would start off this earnings Friday edition with a look at the strongest sector (based on analysts’ “buy” recommendations, anyway) heading into the new year.

Then, we’ll close things out with a look at potential “bearish” and “bullish” earnings coming up next week.

So, let’s jump in and get started…

Analysts Optimistic Of Tech In 2026

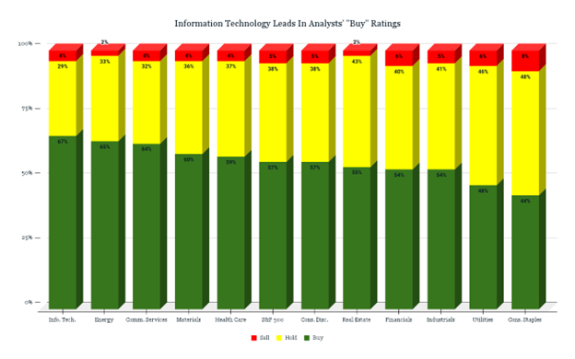

If you didn’t already know, there are 12,696 ratings on stocks in the S&P 500. That means each of the 500 stocks in the benchmark index is covered and rated by analysts more than 25 times.

That’s a lot of coverage. However, it’s certainly understandable considering the trading volume of the S&P 500 compared to other indexes.

Of those 12,696 ratings, 57% are “buy” ratings, 38% are “hold”, and just 5% are rated as “sell.”

The percentage of “buy” ratings is above the 5-year average of 55%. However, both “hold” and “sell” ratings are actually below their 5-year averages.

Things get interesting when you break it down by market sector…

One of the most notable aspects is that analysts remain optimistic about tech stocks heading into the new year, despite concerns over an AI bubble and near-record-high valuations for tech stocks.

Analysts are also optimistic about the energy and communication services sectors.

The most pessimistic sectors heading into 2026 are utilities and consumer staples. Both have “sell” ratings that are above the broader index average. Interestingly, both also have “buy” ratings below 50% — the only two sectors to have percentages that low.

I do believe the tech phase of the market has some legs, but it’s also a good idea to look at other market sectors for potential investment opportunity.

Now, let’s switch gears and look at “bullish” and “bearish” stock earnings for next week…

“Bullish” Earnings to Watch

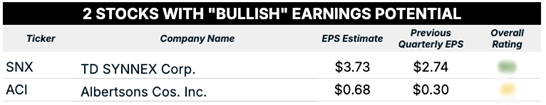

These stocks are expected to beat their previous quarter’s earnings per share (EPS), and thus, if those expectations are met or exceeded, they could potentially trade higher.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are two companies that made this week’s list:

Not that it’s a big surprise, but the one here I would keep my eye on is TD SYNNEX Corp. (SNX), an IT distribution company based in California.

One thing to keep in mind is that SNX has beaten both EPS and revenue expectations in four of the last five quarters.

However, $3.73 is a pretty lofty goal for SNX. The company’s highest EPS reported in the last five quarters was $3.58.

I can see a beat here on both earnings and revenue for the quarter. The company continues to work closely with AI giants Microsoft Corp. (MSFT) and Amazon.com Inc. (AMZN).

The most curious thing would be to see how a beat impacts SNX’s already “Strong Bullish” rating on Adam’s Green Zone Power Ratings system.

Now, let’s look at potentially “bearish” earnings for next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Here are three companies that passed this screen:

Nothing on this list really stands out, but in terms of earnings to watch next week, I will keep an eye on Constellation Brands Inc. (STZ).

The beverage company has fallen short of analysts’ expectations in two of the last five quarters.

While the difference between last quarter and expectations is just $0.01, a drop below those estimates could provide insight into discretionary spending, as STZ specializes in beer, wine, and spirits sales and distribution.

If STZ reports either an earnings or sales decline (or both), it will certainly not help the stock’s “High-Risk” rating on the Green Zone Power Ratings system.

That’s all from me today.

I hope you all have a great weekend.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets