Hey folks, Adam here!

It’s time for your first Tuesday edition of What My System Says Today…

As I revealed yesterday, the team and I have revamped your daily newsletter to better deliver on our data-driven approach to helping you navigate the markets.

Each day, Monday through Friday, we’ll share with you a unique piece of analysis based on the systems that drive Green Zone Fortunes, my flagship premium newsletter.

I’m calling today’s edition “Sector Spotlight,” and here’s what you can look forward to every Tuesday:

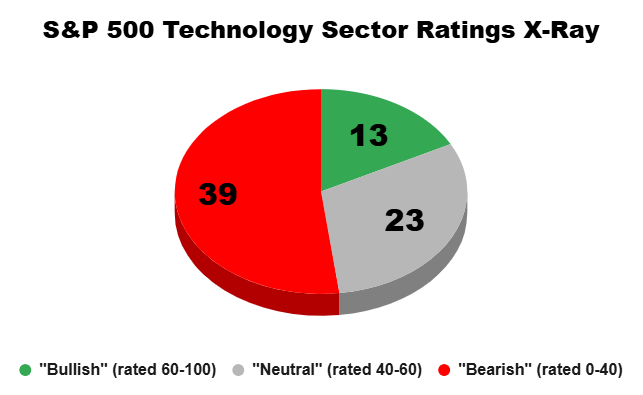

- I’ll “X-Ray” a specific sector of the S&P 500, letting you know how many of the stocks within the sector are currently rated “Bullish,” “Neutral,” or “Bearish” on my Green Zone Power Rating system. You’ll see this analysis in the pie chart below.

- I’ll show you which Green Zone Power Rating factors the sector’s stocks rate well or poorly on. Specifically, we’ll be looking at Momentum, Value, Quality and Growth.

- I’ll point you toward valuable opportunities and point out pitfalls you should do your best to avoid.

This week’s “Sector Spotlight” is all about the technology sector, which in recent years has been driven by some of the biggest large- and mega-cap stocks in the world, the so-called “Big Tech” stocks.

Today, you’ll see why the S&P 500’s tech sector doesn’t look nearly as bullish when we examine its individual stock components “under the hood.” Our analysis also highlights the difference between good businesses and good investments.

Let’s dig in…

Tech Sector: More Bearish Stocks Than Bullish

Step #1 in assessing a sector’s strength is done simply by noting the general direction of its trend — is it “up” or “down”?

Step #2 involves judging the individual stocks within the sector, which is generally called “breadth” analysis. Most of the time, if a majority of individual stocks within a sector are sending a “bullish” message, a bullish trend in the sector’s market prices can be trusted.

Recently, the technology sector has been in a meaningful pullback. It began when prices peaked on February 19 and has so far led to a drawdown of around 15% — heftier than the broader S&P 500’s drawdown of about 9%.

With this negative short-term price trend as a backdrop, it’ll be interesting to see how the 75 technology sector stocks in the S&P 500 look when viewed individually through the lens of four of the factors that underpin my Green Zone Power Rating system.

First, we’ll simply consider my system’s Overall rating, which can broadly be categorized into one of three buckets:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

The pie chart below effectively “x-rays” the 75 technology stocks in the S&P 500, asking how many of them currently rate Bullish, Bearish or Neutral.

Have a look…

Key Insights:

- Only 13 stocks currently rate “Bullish” (60-100).

- With 39 stocks rated 40 or below, the majority of the S&P 500’s technology sector stocks are rated “Bearish” overall.

Is it surprising to hear that most “big” “tech” stocks are now poorly positioned to deliver market-beating returns ahead?

Are the tech companies we hear about daily in trouble?

Let’s dig a bit deeper and learn where the chinks in Big Tech’s armor lie…

Why Is the Tech Sector “Bearish” Now?

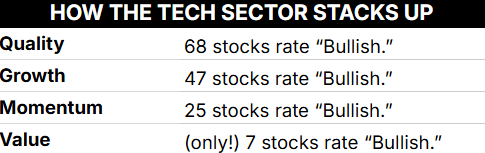

We looked at the tech sector’s Overall Green Zone Power Ratings above. Now, we’ll drill down into four of my system’s individual factors.

We’re simply asking: “How many S&P 500 technology stocks rate ‘Bullish’ (60 – 100) on Momentum, Value, Quality or Growth?”

This analysis gives us a feel for the dominant characteristics of the sector’s component stocks.

Listed in order, from the factor with the most “bullish” stocks down to the factor with the least number of bullish stocks, here’s how “Big Tech” shapes up today:

As I see it, this analysis reflects a truth about “Big Tech” that I believe we all know deep down…

These are quality businesses, yes … but the valuations of these businesses have gotten out of hand — their stocks are “expensive!”

As a whole, I expect the broader technology sector will face headwinds until investors begin to feel there are at least “fairly” valued stocks, if not “bargains,” to be had.

This doesn’t mean you should panic and sell every tech stock you own!

We naturally hold a number of technology sector stocks in the Green Zone Fortunes model portfolio … we’re just very selective about which ones we’ll hold.

It’s not enough to buy a quality business … you have to buy at the right price to make an attractive return.

To that end, avoiding a sector’s most expensive stocks can go a long way toward steadying your portfolio, particularly in a down market.

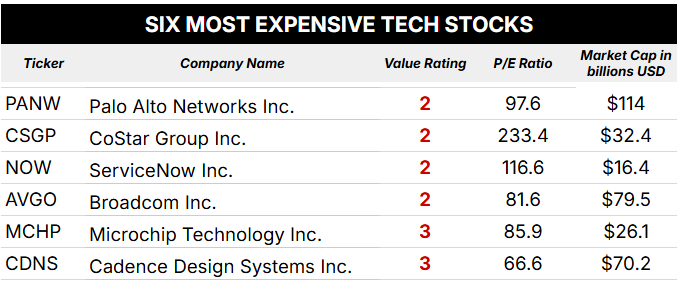

So we’ll finish off our “Sector Spotlight” on the tech sector today by listing the six most expensive tech stocks in the S&P 500, according to the Value factor rating of my Green Zone Power Rating system.

Here, you can see each stock’s Value rating, price-to-earnings (P/E) ratio and market cap…

And I’ll tell you this much…

None of these stocks are in the Green Zone Fortunes portfolio.

Are they in yours?

That’s all for today … I’ll be back with another edition of What My System Says Today tomorrow.

To good profits,

Adam O’Dell

Editor, What My System Says Today

P.S. If you’d like to find out which tech stocks are in the Green Zone Fortunes portfolio, as well as gain full access to my Green Zone Power Ratings system, click here to see how you can join now!