Gold prices have enjoyed an impressive run of late.

Over the past 12 months, gold prices have skyrocketed 74% compared with the benchmark S&P 500 Index’s 14.1% rise.

If we zero in a little closer, the difference between the metal and the broad market is even clearer…

Gold Outshines S&P 500 in 2026

Since the beginning of 2026, gold prices have increased nearly 28% while the S&P 500 has only jumped 3%.

To folks outside the investing world, the uptrend in gold prices is linked to geopolitical conflict or market volatility.

It only makes sense.

When global unrest or periods of heightened market volatility occur, investors often scramble for a “safe haven” to protect their wealth.

Moreover, there is an even greater correlation related to gold – one that actually checks the pulse of macroeconomics.

Let me explain…

High-Stakes Seesaw

One of the biggest correlations with gold is the Federal Reserve’s real interest rates — the “real” rate is the Fed’s interest rate minus inflation.

Think of the relationship between gold and the rate as a high-stakes seesaw.

When one goes up, the other almost inevitably goes down.

If you’re tracking the global economy, it’s arguably the most important pulse to check in the world of macroeconomics.

Gold is a “barren” asset. It doesn’t pay you a dividend like a tech stock, and it doesn’t pay you interest like a savings account or government bond. It just sits there, looks pretty and holds its value.

When “real” rates are high, investors ditch gold to chase yield, causing gold prices to fall.

And when rates are low, inflation may be eating at your savings faster than the bank is paying interest. Getting in on gold starts to look like a genius move because it doesn’t lose value to inflation the way the dollar does. As a result of investors flooding into the precious metal, gold prices march higher.

Since the Fed began aggressively hiking rates following the COVID-19 pandemic, gold prices have soared to record highs.

One key factor driving this trend is that investors are staring down more than $34 trillion in U.S. debt, betting that the Fed will need to print more money to keep the system afloat.

Of course, geopolitics also play a role because when there is political tension at home or abroad, the “fear bid” for gold overrides the “rate bid.”

What all of this suggests is that the “old world” of Fed-driven markets is coming to an end. Gold is acting like an insurance policy against the entire financial system, not just a hedge against a bad month on Wall Street.

Miners Raking in the Rankings

The last step in my research was to analyze a gold-related exchange-traded fund (ETF) using Adam’s Green Zone Power Ratings system.

For this exercise, I went with the VanEck Gold Miners ETF (GDX). This fund holds some of the largest publicly traded gold miners.

The results were interesting…

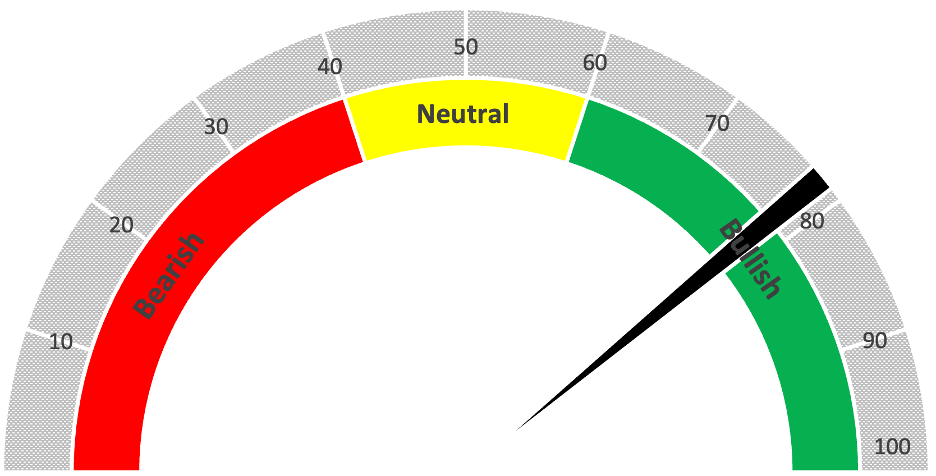

GDX Rates “Bullish”

The average rating of U.S.-based gold miner stocks was a “Strong Bullish” 77 out of 100.

In fact, only five of the 25 stocks I researched had an overall rating below 70. Despite that, the ETF averaged a 91 on Momentum and an 84 on Growth.

Gold and gold miners certainly remain popular with investors hedging against, not just down days on Wall Street, but the uncertainty of the entire financial system.

That’s all from me today.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets