I launched my Green Zone Power Rating system over five years ago.

One of the great things about having this powerful system at my team’s and my fingertips on a daily basis is our ability to spot “signals” in the data, which can otherwise be cluttered with “noise.”

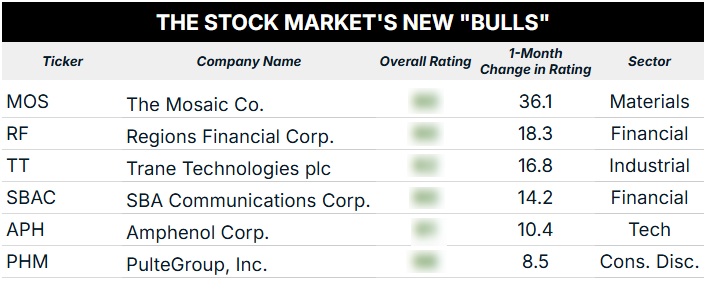

One example of that can be seen in this week’s “new bulls” screen.

A mid-cap chemical company’s rating has rocketed into “Bullish” territory on my system … and today, I’ll show you why.

But before we do, a quick “thank you” is in order…

Thank You, and Keep It Coming!

Last week, I asked for some feedback regarding our revamped What My System Says Today newsletter, and I wanted to take a moment to highlight Ted W.’s note:

I like your revamped daily newsletter. I’m often searching for some new hot tip. What I like best is the ‘daily’ feature. You and Matt seem to be keeping your finger on the pulse. Others have random or weekly statements, and that’s alright for them. It can’t be easy writing a daily comment, but you do a good job of it.

Keep it up!!

Thank you, Ted! Matt Clark and I, along with the rest of the Money & Markets team, really strive to exceed expectations, so it’s great to hear that we’re hitting the mark. We’ll keep at it!

If you want to reach out with your own comment, email us anytime at Feedback@MoneyandMarkets.com.

Now, back to the meat of today’s topic…

When a Stock Soars to the Bullish Zone

Once again, this “New Bulls” screen is showing us stocks that are now poised to outperform the market by 2X to 3X based on meeting two criteria:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”) in my Green Zone Power Rating system.

- The stock must have been rated less than 60 for each of the last four weeks.

In short, these are stocks that have been rated “Neutral” or worse … but now are rated “Bullish” or better.

And we have a shorter list this week:

While we have a good mix of sectors represented in this week’s list, I want to focus on The Mosaic Co. (MOS) — specifically, its 36-point ratings improvement over the last month.

Trust me, that’s a significant one-month change!

And you might be wondering what caused it …

Well, when my team and I started digging deeper into the dramatic increase in MOS’ rating, Matt pointed out that the stock’s much-improved Growth factor rating was a big contributor. He noted that The Mosaic Co.’s earnings per share (EPS) and net income scores (two individual metrics that contribute to the Growth rating) had jumped higher over the last month.

That tracks with what we observed earlier this month, when, on May 6, The Mosaic Co. reported a 435% increase in EPS over the prior year’s quarter!

Looking at the stock’s price action, that uber-strong earnings growth was encouraging to investors — the stock is up roughly 19% since that call!

It was a breakout moment for the stock … As you’ll see below, shares had been steadily trending lower since early 2022.

MOS Broke Out of 3-Year Trend

All told, we love to see breakouts like this one, where a “technical” breakout in the stock’s price is accompanied by an equally convincing surge in growth of the company’s underlying fundamentals.

Long-time readers know the Green Zone Power Rating system is built to not only identify which stocks are “behaving nicely” (i.e., based on momentum and volatility measures) … but are also underpinned by solid companies, based on measures of Quality, Growth and Value.

At the end of the day, we think you should have a closer look at all stocks that make our weekly “New Bulls” report … but particularly close attention should be paid to stocks that show the largest increase in their overall rating over the past month, especially when you can also see why the increase occurred.

The Mosaic Co. (MOS) certainly fits the bill in that regard.

To good profits,

Editor, What My System Says Today