With at least a partial trade deal looming on the horizon, investors are becoming less fearful of a potential recession — and that means interest rates are likely to rise higher.

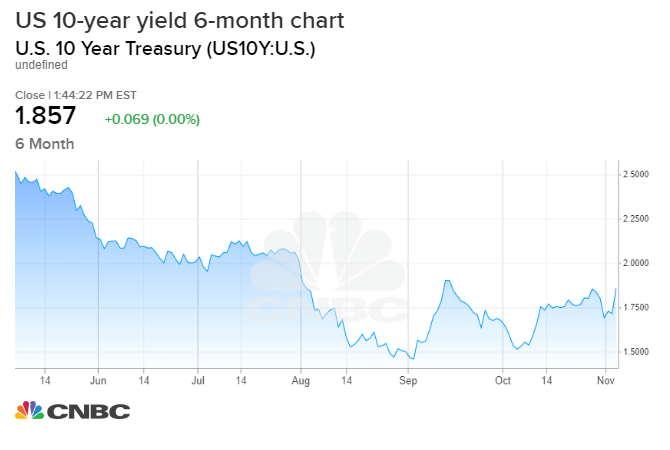

Since last week’s interest rate cut, both the third of the year and third in more than a decade, bond yields have bounced back and forth but are steadily higher on the hopes that the U.S. and China are moving to another phase of trade talks. The fears of the worst possible outcome — a sort of trade cold war — have largely subsided and the steepening of the yield curve is at its widest level since March, when it inverted several times, a sign of an impending recession.

“The one thing in Washington that’s affecting markets, and the only thing, is the trade deal,” National Alliance’s Andrew Brenner told CNBC. “Brexit, impeachment, budget deficit, lack of a budget — none of those things are affecting the market at this point. … How quickly you resumed higher rates and how quickly the curve is steepening out tells me the trend is changing, and we’re moving to a very large trend higher in interest rates.”

A trade deal, even a partial one, would help the sagging global economy, which has slowed due to the ongoing tit-for-tat tariffs fight between the world’s two largest economies. The yield on the 10-year Treasury ticked up as high as 1.86% on the promising trade deal news, as well as better-than-expected numbers coming from the services sector for the month of October.

“On July 31, the Fed eased that afternoon and the 10-year closed at 2.01. The next evening, Trump fired off his tweets about more tariffs on China,” Wells Fargo Director of Rates Strategy Michael Schumacher said.

Soon after that, the yield on the 10-year fell to 1.429% by Sept. 3 as recession warnings blared.

“The ultimate move was about 60 basis points. We think a lot of that is being unwound,” he continued, adding that he expects another 15-basis point move by the year’s end. “You can’t call the trade situation resolved, but it does seem to be improved.”

“I think a lot of this is optimism over the trade deal possibly getting done. I think some of the manufacturing data is turning,” Morgan Stanley portfolio manager Jim Caron said. “There’s early indications that some of the cyclical parts of the economy are starting to come back. If that’s the case, we’re just not priced properly for it yet.”