Like it or not, everyone needs insurance. Does that mean Aflac stock is a good way to bolster your portfolio?

Aflac Inc. (NYSE: AFL) is a Fortune 500 company that provides supplemental health and life insurance products to customers around the world.

The company’s primary business is actually in Japan, where it is one of the largest insurers. But it also operates in the United States, Europe, and other markets outside of Japan.

Aflac has built a strong reputation for providing exceptional customer service and financial security.

Here’s what to expect from Aflac in 2023, and how its stock scores within our proprietary Stock Power Ratings system.

Aflac’s Business Model

Aflac’s business model is focused on providing supplemental insurance policies that are designed to cover expenses associated with unexpected illnesses or accidents.

These policies are typically offered as add-ons to existing health or life insurance plans, which help reduce the overall cost of coverage for individuals and families.

In addition to its core product offerings, Aflac also provides a variety of other services, including employee benefits programs and investment products.

Aflac’s Growth Outlook

Aflac was growing at an impressive rate despite economic uncertainty caused by the COVID-19 pandemic.

But things have changed a bit over the last year.

It reported total revenue of $4.82 billion in the third quarter of 2022, which was 7.96% lower growth year over year. (We’ll see how that’s reflected in Aflac stock’s growth factor rating below.)

Furthermore, Aflac has committed to expanding its international presence over the next few years by opening new offices in Asia and South America.

This expansion should position the company well for continued success in 2023 and beyond.

Aflac’s Technology Initiatives

In addition to its organic growth initiatives, Aflac is also investing heavily in technology initiatives such as artificial intelligence and machine learning.

These technologies will allow Aflac to better serve its customers by providing personalized services based on individual need and preferences.

Additionally, these technologies will enable more efficient operations through automated processes such as policy underwriting and claims processing.

Does that mean Aflac stock is well set to outperform in 2023 and beyond?

Here’s what Stock Power Ratings says.

Aflac Stock Power Ratings

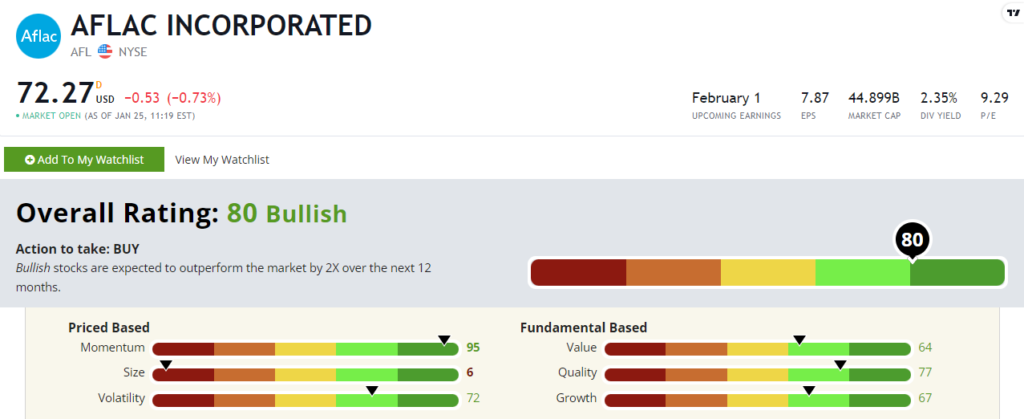

Aflac stock rates a “Bullish” 80 out of 100. That means our system expects the stock to outperform the broader market by 2X over the next 12 months!

I mentioned Aflac’s lack of revenue growth in its last reported quarter. And you can see that is reflected in its good — but not great — growth factor rating of 67 out of 100.

But I want to focus on its best rating: momentum at 95.

Aflac stock crushed the overall market over the last 12 months.

AFL gained almost 18%, while the broader S&P 500 lost more than 6%.

That’s proof that even in a bear market, individual stocks can outperform.

And Stock Power Ratings helps us find those tickers with potential.

Bottom Line: Overall, investors should be optimistic about Aflac’s prospects for 2023.

With investments in both organic growth initiatives as well as cutting-edge technologies, investors can expect a great return.

And our Stock Power Ratings system confirms that.