A single component powers all of our computers and smartphones…

Semiconductors.

These small chips conduct electricity more efficiently than any other product … making them invaluable in the tech industry.

While semiconductor market growth is strong, our Stock Power Ratings system shows that not all companies involved are great investments.

This is the case with one company that helped shape the American tech industry for decades: Intel Corp. (Nasdaq: INTC).

INTC’s Fall From Grace

A quick look at our Stock Power Ratings system helps you see the real picture of a company.

The company started in 1968 as one of the pioneers of the Silicon Valley boom.

You might recognize Intel because of its microprocessors used in computers, smartphones and even gaming consoles.

This is a strong brand that supplies chips for some of the biggest tech companies out there.

And Intel’s investors have enjoyed plenty of success over the last 50 years.

In its most recent bull market run, INTC soared 622.1% higher from February 2009 to March 2021.

But Intel has fallen back to reality.

That’s reflected in its Stock Power Ratings…

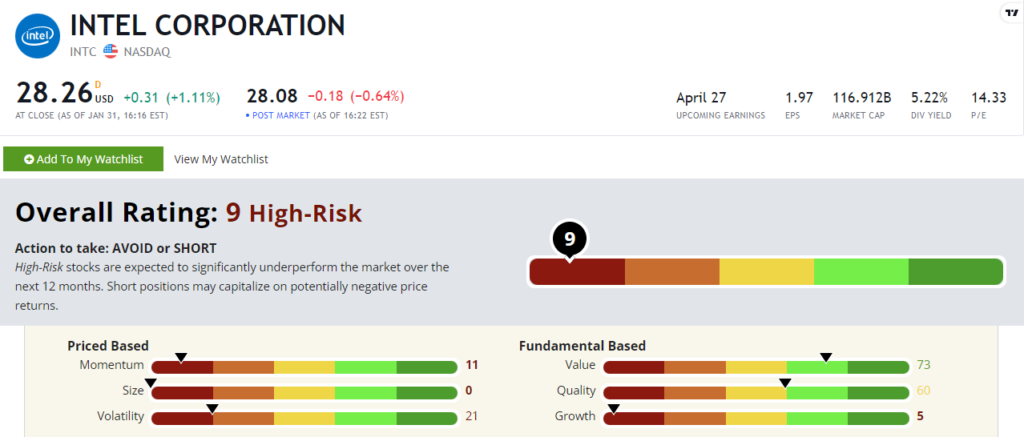

INTC scores a “High-Risk” 9 out of 100 on our Stock Power Ratings system. We expect it to underperform the broader market over the next 12 months.

Intel Stock: Red Technicals With Low Growth

I’m not going to sugarcoat this.

Intel is in a tough spot, according to its latest quarterly report:

- The company recorded a 32% year-over-year decline in total revenue!

- It also recorded a net loss of $664 million for the quarter.

That shows why INTC scores a 5 on growth. (Note: INTC’s growth rating was at 54 just last week. You can see how Stock Power Ratings adapted after that abysmal quarterly call.)

It also scores in the red on our momentum and volatility factors (more on that in a second).

INTC has a price-to-earnings ratio that’s half the industry average … which is good. It scores a 73 on value.

But a strong value cannot overcome the downward spiral this stock has been on over the last 12 months. This has “value trap” written all over it.

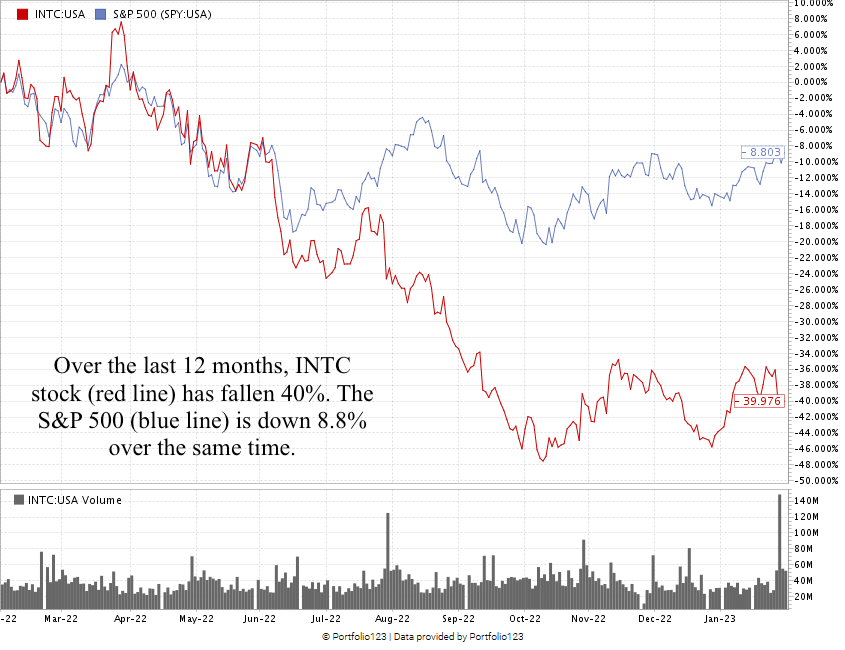

INTC stock has had a rough 12 months, falling 40% Its share price is just $3 above its 52-week low.

The S&P 500 has dropped 8.8% over the same time:

Created in February 2023.

INTC stock-price decline shows why it scores an 11 on our momentum factor.

Intel stock scores a horrible 9 overall on our proprietary Stock Power Ratings system.

This is a “High-Risk” stock that we expect to underperform the broader market over the next year.

The demand for semiconductors isn’t going away anytime soon.

But INTC has struggled in an extremely competitive market.

A quick look at our Stock Power Ratings system shows that its massive earnings collapse makes Intel stock one to avoid.

Note: Mike Carr’s newest strategy is all about how to profit during the “Silicon Shakeout.”

Tech stocks struggled during 2022, and Mike sees more losses on the horizon. But that’s the perfect environment for his trades that he believes have the opportunity to gain 442%, 564% and even 824% before the summer!

Click here to watch his free presentation now.

Stay Tuned: A Strong Bullish Homebuilder

Tomorrow, we’re returning to our original Stock Power Daily form.

I’ll share all the details on a homebuilder that’s thriving — despite the housing market wreck.

Stay tuned…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?