I’ve never been an early adopter.

I’d love to rush out and get the latest tech, but life has taught me that there’s always something buggy with the first iteration of a product.

So, despite being an Apple guy, I won’t make a beeline to my closest Apple Store to buy the latest iPhone when it’s released … no matter what fancy new specifications it comes with.

I did it one time…

I drove two hours to stand in line at the Kansas City store (I don’t even remember the iPhone model; it was that long ago).

After waiting another two hours, I made my purchase and rushed back home.

I unwrapped the box, set everything up and thought I was ready to go. However, after a few days, I had to drive back to the store and return the phone because it kept overheating.

I learned right then and there never to buy technology when it’s first released. Be patient and wait for the bugs to be worked out.

I say all of this the day after Apple Inc. (AAPL) held its product event from its headquarters in Cupertino, California.

That event, along with an interesting conversation with a neighbor, pushed me to investigate AAPL more using our Green Zone Power Rating system.

Here we go…

“How Can Its Stock Be Rated That Low?”

My analysis of AAPL actually started over the weekend when one of my neighbors asked about my work, and I showed him the Green Zone Power Rating system.

I just happened to use AAPL as an example of how the ratings work…

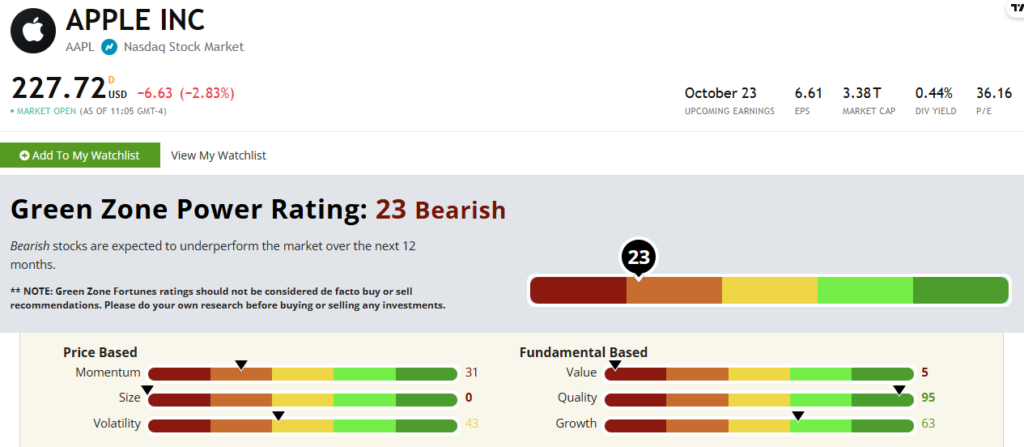

AAPL In “Bearish” Territory

AAPL’s Green Zone Power Rating in September 2025.

My neighbor was confused:

“I don’t get it. Apple is a great company that sells a lot of stuff. How can its stock be rated that low?”

It’s a great question, and one I was happy to answer.

First, there’s the obvious… Size (0). Apple has a $3.5 trillion market cap. As we’ve mentioned before, our research shows that larger companies tend to lag the returns of similar, smaller companies. While that hasn’t been obvious in recent years, thanks to investors glomming onto the very largest mega-cap tech stocks, it does hold true over the arc of history.

He then asked me about AAPL’s Value rating (5).

I only needed to show him one stat to illustrate why the stock’s Value rating was what it was…

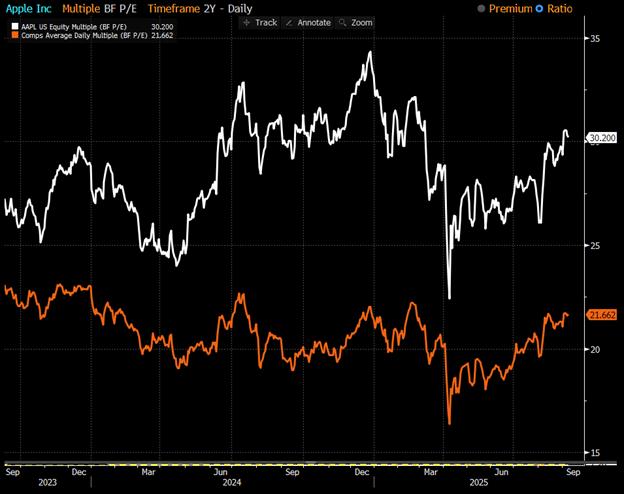

AAPL Trading With Higher P/E Than Peers

AAPL’s current P/E ratio (white line in the chart above) is 30.2, compared to its peer average of 21.7. I explained that meant investors in AAPL were paying more for each dollar of earnings than they would be buying one of its peers.

Note: Those peers include big names like Samsung Electronics Co. Ltd. and HTC Corp.

I told him it wasn’t necessarily bad, but considering that Apple’s earnings per share (EPS) have declined over the last three quarters, it puts things into perspective.

The next rating he asked me about was Momentum (31).

“I thought tech stocks were booming. Why is Apple’s stock rated so low there?”

Again, a valid point and a good question.

He’s right, tech stocks have been doing well. In the last 12 months, the SPDR Technology ETF (XLK) is up almost 30% — outpacing the S&P 500’s 20% gain.

AAPL, on the other hand, hasn’t fared as well.

AAPL Only Up 8% In 12 Months

In the last 12 months, AAPL has managed just an 8% gain… thanks in large part to increased tariffs for products coming in from Asia.

Because Apple outsources a lot of the components used in its technology to companies in Asia, it’s become more expensive for Apple to ship those components into the U.S. for final assembly.

Thus, Wall Street has made the share price pay for it.

“That doesn’t mean Apple is a bad company, right? I should still invest in it, yeah?”

Well, yes to the first question, but maybe not so much to the second — at least if you follow the Green Zone Power Rating system’s guidance.

Apple is not a bad company. It does a good job of maintaining (and growing) its margins and returns. Plus, its revenue and EPS are on track to hit high marks in 2025. That’s why it boasts a (95) on our Quality factor and a less stellar — but still solid — (63) on the Growth factor.

However, considering AAPL as a whole, now is not the time to invest.

Speaking on the sector more broadly, there are plenty of tech stocks that are buys right now.

You have to know where to look and what to look for.

In fact (and I didn’t tell my neighbor, but I’ll tell you), Adam recommended a smaller tech firm to his Green Zone Fortunes subscribers back in July 2024.

It was rated “Strong Bullish” at the time, and it still is. It even just hit the No. 1 spot on Adam’s weekly “Top 10” list he publishes exclusively for Green Zone Fortunes subscribers, pointing to more outperformance ahead.

Unlike AAPL, this stock has gained more than 160% since Adam’s recommendation, all while developing critical technologies that Apple and other big names in the smartphone space use.

I encourage you to click here to see how you can join up and find the exact ticker I’m talking about. Adam is featuring this stock in his Green Zone Fortunes update later today, so it’s a perfect time to join up.

That’s all from me today.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets