Editor’s Note: Matt Clark is enjoying some rare time away from his analyst desk and will be back in action shortly.

With the first debate between Biden and Trump less than 36 hours away, we wanted to revisit a piece Matt wrote right before Super Tuesday in March.

He walks through how we got to this match-up, how U.S. markets perform when either party is running the White House and one approach as we close in on November 5…

Of course, if you’re looking for stocks that are set to soar — no matter who wins — our chief investment strategist, Adam O’Dell, has you covered.

He’s recommending three stocks with massive potential based on a mega trend that both candidates agree is critical for America’s future.

The thing is, you likely won’t hear a peep from either on the topic come Thursday night.

To see why, click here to watch Adam’s urgent presentation now.

— Money & Markets team

Why It Doesn’t Matter Who Wins This Election

This February, I sat on stage for a panel at Banyan Hill’s Total Wealth Symposium.

The topic? Investing in an election year…

Questions ranged from what stocks should you buy if former president Donald Trump wins the 2024 election to whether the stock market will collapse if President Joe Biden keeps his seat.

Even in Adam O’Dell’s Max Profit Alert trade room, a subscriber asked how stocks might react to Super Tuesday — the day when presidential and congressional frontrunners emerge.

It’s clear that the 2024 election cycle is on everyone’s minds … whether it’s the race for control of Congress or who will occupy the White House for the next four years.

In today’s Money & Markets Daily, I’ll dive into each of these questions and also show you how to best invest for the 2024 election cycle.

The Election Impact on Stocks

We’re currently on track for a close election in November, with both Biden and Trump carrying the lead in different polls.

So will the market crash if Biden wins reelection?

Probably not. He’s already been in office for nearly four years, and the market hasn’t crashed yet.

There’s research that tells the same story on how the market reacts to general election results.

Republican or Democrat? Doesn’t Really Matter

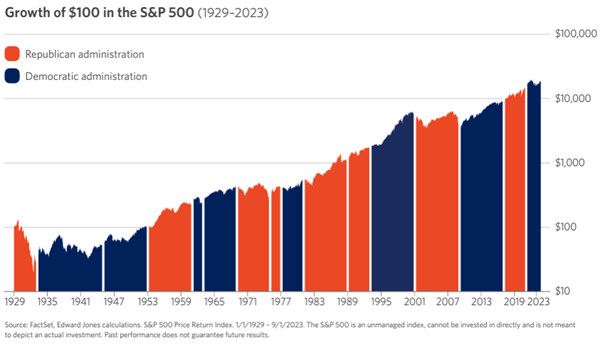

Source: FactSet

The data going back to 1929 shows that the market increases no matter who the president is.

Edward Jones found that the stock market has increased under every political combination in Washington. The average annual return was just above 10% every year since 1970.

What this tells me is that changes in government policies can have an impact on investment returns, but the market doesn’t really care who is in the White House or Congress.

Moving on to the second question…

What stocks should I buy if Trump wins a second term as president?

Any stock in a heavily regulated sector (think pharmaceuticals, oil and gas, etc.) could gain more strength under a Trump presidency, given his stance against government oversight.

That still leaves one lingering question: How do you invest in an election year?

I have an answer for that, too…

Remove the Noise From Your Investing Strategy

As we inch closer to November 5, media headlines will start flying with wall-to-wall election coverage.

Some of those headlines may prompt you to change your investment strategy … but don’t let that happen.

Remember, the mainstream media is entirely in the business of selling advertisements. They love writing outlandish headlines because it gets more eyes on their ads for lipstick or fast food.

But the stock market tends to chug along regardless of broken campaign promises or rousing debate soundbites.

In fact, there’s one small industry that’s already set to soar regardless of who wins in November.

It’s a pivotal new industry that could transform everything from AI to Green Energy … but you’re practically guaranteed that neither candidate will mention it at this Thursday’s debate.

For the full story on this breakout new sector, check out Adam’s free video presentation HERE.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets