Editor’s Note: If you haven’t had a chance to check out Adam’s $5 Stocks to Watch report yet, go here to find close to 300 tickers that Adam is screening right now. And then read on as Senior Technical Analyst Mike Carr breaks down why big money managers won’t touch these stocks (yet) below…

My friend, Adam O’Dell, showed you yesterday why large investors — aka hedge funds and other institutional money managers — avoid stocks priced under $5. He also notes these stocks often outperform large caps.

At first glance, that doesn’t add up. Why would the world’s largest investors ignore some of the best potential gains?

Many firms instruct portfolio managers to avoid low-priced stocks because the SEC applies special rules to stocks under $5. There are some good reasons for that — many of which benefit you as an individual investor.

Today, I want to explain what prevents big investors from trading these stocks and how this restriction benefits you.

$5 Stocks Are Short-Proof

As one example, stocks trading under $5 per share aren’t eligible for short selling. That means large investors can’t easily bet against them.

Short sellers benefit from price declines by selling shares they don’t own. Brokers loan them the shares to sell. If prices fall, they buy shares at a lower price. Just like in any other investment, the difference between the sale price and the buy price is the profit.

Or it could be a loss. If the price goes up, short sellers lose money. Since prices can move up quickly, losses can get out of hand just as fast.

Plus, short sellers need to repay the loan their broker gave them. And the broker can demand repayment if prices rise, forcing short sellers to take a loss.

You might not think this is relevant because you don’t short stocks. But when you’re a large investor, you usually want other investors to be able to short a stock that you own. That’s because short sellers add liquidity to the market.

Market makers, for example, are often short sellers. Though, not usually for the same reasons large investors are.

If you place a buy order, the market maker sells shares to you. But they might not own the shares you want. To fill your order, they might sell short. This gets your trade done.

On the other hand, when you sell a stock, market makers buy. Here, they have another incentive to short.

Trades are filled in microseconds. But prices move in nanoseconds. By shorting before they buy your stock at a lower price, market makers can lock in a risk-free profit.

Short selling “greases the skids” for your orders.

This usually doesn’t matter to us as individual traders. But if you’re trading billions of dollars, you need to be sure market makers can fill your orders. Stocks that can’t be sold short will be harder to trade, so institutional traders simply don’t trade them.

That’s one reason hedge funds avoid $5 stocks. But it works to your benefit.

A stock that large investors can’t easily short won’t be targeted in the same way other stocks are. Block Inc. (NYSE: SQ), for example, was recently targeted by Hindenburg Research and lost 20% in two days after Hindenburg released a bearish report on the company. That cost the company billions of dollars. With sub-$5 stocks, that risk simply doesn’t exist.

Why Big Money Managers Hate Making Too Much Money

Another reason larger investors avoid low-priced stocks is because they don’t help them meet their goals. That sounds counterintuitive when you consider the type of gains these stocks can make, but let me explain…

If you manage $1 billion, your goal isn’t necessarily to make money in the market. It’s to earn a bonus.

You do that by at least matching the market. If you just buy the top 50 stocks in the S&P 500, you’ll almost certainly come close to matching the market. You get your bonus.

But there’s a problem… If you’re just buying the top 50 S&P 500 stocks, you don’t have anything interesting to say in the annual letter. You have to justify your expense as a money manager.

So you look for a few interesting stocks. They just need to be smaller, lesser-known stocks, but large enough to make a difference. That generally excludes stocks under $5, which are so small that they become a hassle.

The average stock trading under $5 has a market cap of $817 million. Maybe a large investor tries to invest 2% of their $1 billion portfolio in each position. That’s $20 million.

For an $817 million stock, a 2% position is about 2.4% of the shares outstanding. That’s a big, illiquid position. It might be tough to get out of it.

So the large investor only buys $10 million of the stock — 1% of the portfolio.

In a few months, the position gains 30%. That’s a $3 million gain. It’s also a 0.3% gain for the $1 billion fund. All he needs to do is sell.

But he knows selling will push the stock down. He does it anyway and manages to exit with a 0.2% gain. That was a lot of work … and a lot of risk. And the small gain didn’t help increase his bonus.

A 30% gain isn’t much to the guy managing a billion dollars. But to you and me, it really moves the needle. That’s another benefit — those large, rapid gains are the domain of small investors like you and me.

What Happened When MNST Crossed the $5 Stock Line

As Adam says, there are good reasons large investors won’t trade these stocks. But they do watch them.

Because when a stock does trade above $5, the SEC rules are no longer a problem.

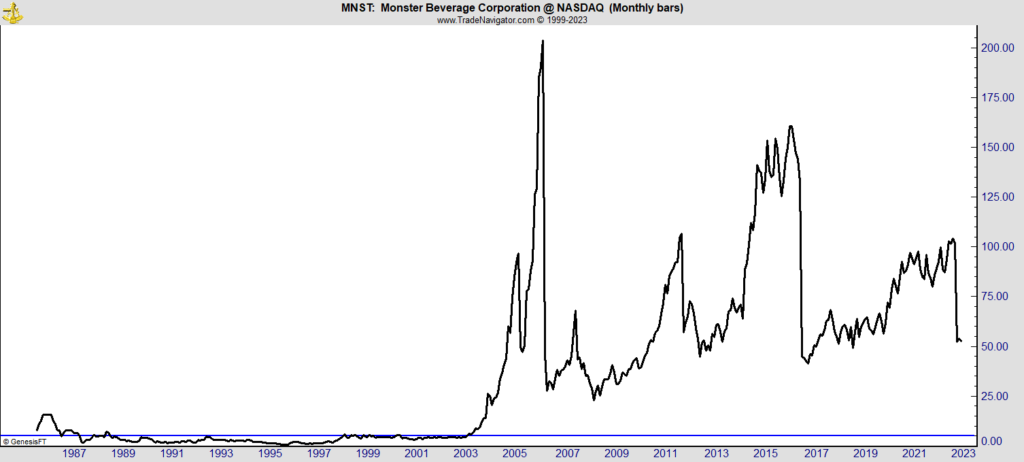

One of the best-performing stocks of all time is Monster Beverage Corp. (Nasdaq: MNST). Before it sold energy drinks, the company was known as Hansen’s Natural Soda. The stock began trading in 1986 but stayed mostly below $5 until 2003.

After breaking above $5, MNST gained more than 5,200% in 39 months.

It seems strange … but the day before it crossed $5, large investors couldn’t buy it. As soon as it crossed $5, they jumped in. They knew the company had potential. And the stock is now one of the best-performing stocks of all time.

That’s right — a “natural soda turned energy drink” maker is one of the best performers in history. And a big reason for that is the $5 rule.

And there are plenty of similar stock stories over the long history of markets.

The best part is that you don’t need to follow tech stocks and try to find winners in hard-to-understand sectors. You can enjoy big gains by buying stocks that institutions want to own before they can own them. And Adam has a strategy for that.

If you’ve been following along in Stock Power Daily, you’ve already got his $5 stock watchlist. It contains 298 stocks that are potential candidates to be something like MNST.

Tomorrow, though, Adam is cutting well over a hundred stocks from this list that don’t meet his strict criteria.

He’ll show you why tomorrow, and provide the second version of his free $5 Stocks to Watch report for you to follow along.

If you don’t already have that list, go here to grab it.

Until next time,

Mike Carr

Senior Technical Analyst