The investing world often feels like a popularity contest. What is it saying now about this chip stock?

Intel Corp. (INTC) was once the prettiest girl in school as one of the largest chipmakers by revenue.

Companies wanted to install Intel chips in their personal computers (PCs) and other products, and people wanted to buy those computers in droves.

But Intel’s popularity waned alongside the PC market…

In 2023, the PC shipments fell 14.8%, marking the second straight year of double-digit declines.

Suddenly, it’s as if Intel was forced to eat lunch alone because no one was buying what it had to offer.

But now, after multiple stories have broken over the past few months hinting at potential acquisitions or spin-offs, you might be wondering…

Is Intel “Mr. Popular” again?

Today, I’ll look at Intel’s fall from grace and what it means for you as an investor.

Chip Stocks: It’s All About Revenues…

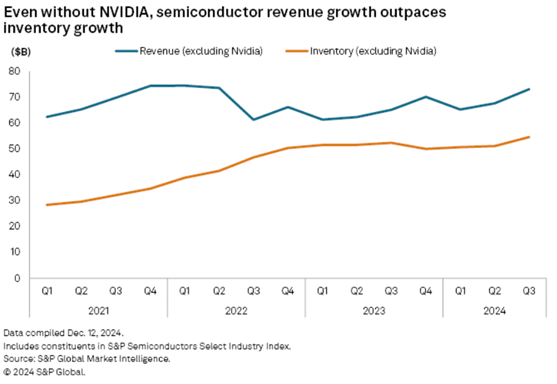

In 2022, major semiconductor companies like Nvidia Corp. (NVDA), Qualcomm Inc. (QCOM) and Advanced Micro Devices Inc. (AMD) all posted declining revenue.

The eight largest semiconductor companies in the U.S. combined reported a nearly $10 billion revenue drop for the year.

However, after a rough first quarter of 2023, the tide started to turn, and semiconductor companies picked up steam, thanks in large part to the massive artificial intelligence (AI) mega trend.

Revenues for companies in the S&P Semiconductor Select Industry Index topped $100 billion in the third quarter of 2024.

A bulk of that gain comes from Nvidia and increased demand for its AI-related chips.

However, Nvidia wasn’t the only semiconductor company gaining additional revenue:

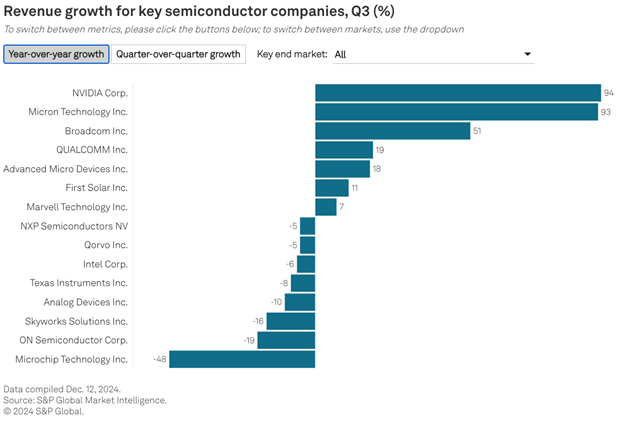

Right in the middle of the chart above, you’ll see what was once the leading chipmaker by revenue: Intel Corp.

Its revenue grew in 2024 … but not overwhelmingly so.

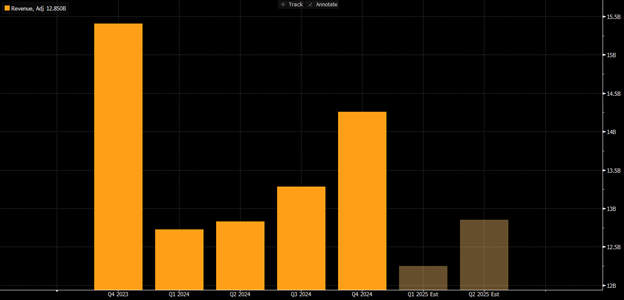

INTC Revenue Still Below 2023

After a pickup in revenue in 2023, Intel struggled in 2024 — never gaining ground on the previous year’s growth. Estimates suggest 2025 won’t start any better.

The slowdown is related to headwinds in the PC market that I mentioned earlier and a significant increase in market competition in the semiconductor space.

Intel’s Murky Future

Last fall, INTC stock soared after news of Qualcomm’s “friendly” deal to acquire it.

The boost was made even stronger the following week when Apollo announced its interest in a $5 billion investment.

Just this week, Intel announced the launch of its new Xeon 6700/6500 processors, which are processors optimized for AI data center and workload usage.

There have also been reports of a potential deal where Intel may be broken up and sold to Taiwan Semiconductor Manufacturing (TSM) and Broadcom (AVGO).

However, none of those reports has propelled INTC to its former glory yet:

INTC Trading Below 200-Day Moving Average

Despite INTC’s stock pop, it remains below the 200-day exponential moving average and dangerously close to its 50-day moving average … mainly due to the bearish price movement since the start of 2024.

The complexity of a deal with Qualcomm, along with U.S. government regulators flexing their antitrust muscle, is likely why Qualcomm’s interest in Intel has cooled significantly.

And while those initial reports involving a Taiwan Semiconductor and Broadcom deal could hold some promise, details are thin right now. This deal would also face potential pressure from regulators.

As an investor, you have to look at all the angles.

And here’s one more fact to consider…

Based on Adam’s Green Zone Power Ratings system, Intel still rates a “High Risk” 1 out of 100 and rates in the red in five of the six metrics that make up its overall rating.

None of these propositions to bring Intel back to the cool kid’s table are a guarantee.

And our ratings system says Intel is one stock to avoid right now.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets