The mechanics of tariffs are simple.

Tariffs — a form of tax on imports from other countries — are used to protect domestic industries or to retaliate against unfair trade practices.

In the United States, tariffs were widely used to generate revenue for the government from the late 1920s and early 1930s due to the Great Depression.

President Trump also used these levies in his first term to pressure as part of a massive trade war with China.

The political reasons behind tariffs are one thing.

To everyday Americans, the real question is: How will tariffs impact me and my investments?

It’s a great question, but it is not easily answered.

However, there is compelling data to dive into…

With President-elect Donald Trump vowing to use tariffs against trading partners like China, Canada, Mexico and even the European Union once he takes office on January 20, I thought it was prudent to illustrate how previous tariffs have affected the stock market.

Let’s dive into it…

We’ve Been Here Before…

The basic idea of a tariff is to protect local industries by making imports more expensive, thus driving consumers to domestic companies.

If it’s more expensive to buy lumber from Canada than it is from a local producer, you’re going to buy locally.

The mainstream media has spent hours attempting to dissect what will be subject to Trump’s next round of penalties, how much those tariffs will be, and what countries he will target.

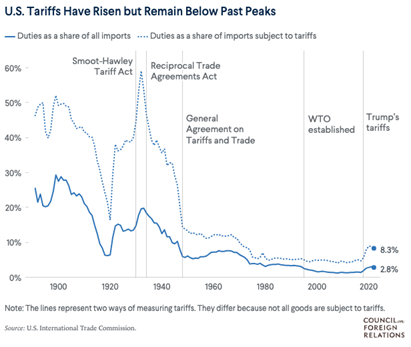

However, one thing is essential to note … no matter what Trump decides to do with tariffs; they won’t be nearly as high as they have been in the past.

Tariffs reached a peak in the 1930s at nearly 60%.

America was in the depths of the Great Depression, and federal income tax collection was low due to skyrocketing unemployment.

To make money, the U.S. taxed imports.

Finally, income tax supplanted tariffs in the latter half of the ’30s and the government’s tariffs were scaled back considerably.

Fast-forward to more recent times…

During the first Trump administration, tariffs rose above 8% — mainly aimed at one country, China … still nowhere near where they were during the Great Depression — where tariffs were more “global.”

How the Stock Market Reacts to Tariffs

As an investor, your biggest question surrounding potential tariffs is: How will this impact my investments?

In not so many words … not in a good way.

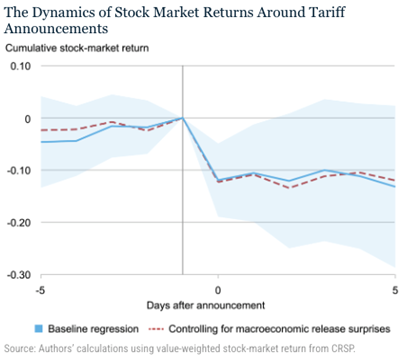

According to data from the Federal Reserve Bank of New York, during Trump’s first term in office — when he announced a slew of tariffs — the market didn’t respond well.

On days when tariffs were announced, either by the U.S. or by China in response to threats, the market fell a cumulative 11.5%.

The market responded more negatively when China retaliated against aggressive U.S. tariffs, with the most significant drops coming on two days in 2019:

- May 13, 2019 — China announced a hike on $60 billion of U.S. goods, and U.S. stocks sank 2.5%.

- August 23, 2019 — China raises levies on soybean and automotive imports, and the U.S. market sank 2.5% again.

On days when just the U.S. announced tariffs, the market fell a cumulative 5.5%.

Another key piece of data to examine is how the market progresses in days after tariff announcements.

Historically, after the market drops on days when tariffs are announced, it flattens out up to five days later.

I’ll issue caution with those words we hear all too often: Past performance is not indicative of future returns.

Just because it happened before doesn’t mean it will happen the same way again.

However, these levies create a sense of uncertainty that the market doesn’t like, so I believe it is safe to assume we could see a slight market pullback if they are announced.

The silver lining here is that the negative reaction is relatively short-lived.

With this potential volatility in the air, it’s even more important to have a tool to find individual stocks that can weather the storm.

That’s why Adam’s Green Zone Power Ratings system is essential to have in your investment arsenal.

Click here to see how you can join Green Zone Fortunes and gain unlimited access now.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets