Winnebago Industries Inc. (NYSE: WGO) was founded in 1958 and has been manufacturing recreational vehicles (RVs) since. Has that turned Winnebago stock into a profitable investment?

The company was founded by the Winnebago tribe in Forest City, Iowa and employs more than 3,000 people.

Winnebago sells RVs through a network of dealerships located across the United States.

In addition to selling RVs, the company also rents out storage space for vehicles and provides financing options for customers.

The company went public in 1972 and has a market capitalization of just under $1.6 billion as of December 2022.

Today, we’ll look at Winnebago’s history, financials and run it through our Stock Power Ratings system to tell you how it stacks up among more than 8,000 stocks we rate.

Winnebago’s History

Winnebago has produced iconic recreational vehicles since its start in 1958.

Winnebago created its first RV for consumers in 1966. After that, it quickly became an industry leader in quality and innovation.

Over the years Winnebago has deployed a variety of leading-edge technologies to create some of the most popular RV models on the market today.

The company has had the same basic business model since it began production in 1958.

Initially, it focused on creating quality motorhomes, and these remain a core part of Winnebago’s product lineup today.

However, this once small-town company has come a long way. It’s expanded offerings include commercial buses and travel trailers, as well as parts and services.

Winnebago now caters to not just RV enthusiasts, but to a wide variety of clients.

Winnebago Stock Power Ratings

Winnebago Industries is reporting healthy increases in revenue year over year, as well as keeping its profit margins steady.

The RV-manufacturing giant has been able to keep up with the market demand for recreational vehicles despite minor swings throughout the economic cycle.

Winnebago has diversified its product line and patient investments in technological advances have ensured that Winnebago stays at the top of its game.

Has that created a stock that’s worth a look? Here’s what our Stock Power Ratings system says about Winnebago stock.

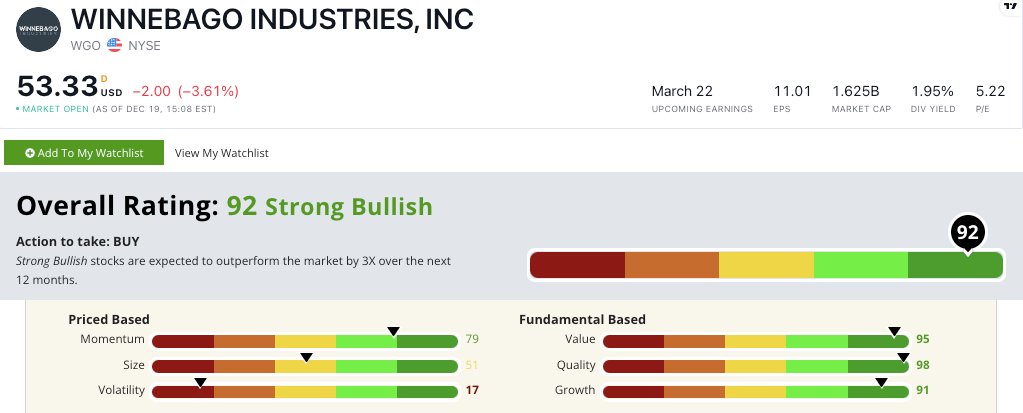

WGO stock scores 92 out of 100!

This means our system says this stock is “Strong Bullish” and it should outperform the broader market by 3X over the next 12 months.

Where WGO excels is on our quality factor … where it scores a 98.

The company has positive double-digit returns on assets, equity and investment along with positive net and operating margins.

WGO stock is also a strong value … scoring a 95 on that factor.

Its price-to ratios (earnings, sales, cash flow and book value) are all lower than its industry peers.

The bottom line: As you can see, Winnebago has a long and successful history in the RV industry.

Its name is synonymous with recreational vehicles.

The company has been able to adapt its business model as times have changed, which has helped it to remain profitable.

And Winnebago stock looks well set to continue its success from here.