One of the biggest impacts the coronavirus pandemic has had an effect on is oil prices.

Back on April 21, West Texas Intermediate crude oil — the U.S. benchmark for oil prices — plummeted 162% from its previous high of $61 a barrel in January 2020. That drop came because there was way too much supply and far too little demand as fewer people were hitting the roadways.

Now the price has rebounded to just under $40 per barrel, so oil is still quite cheap. That means gas at the pump is still cheap. In fact, according to AAA, the average price of a gallon of unleaded gas is $2.07 a gallon.

A year ago, it was $2.73.

As lockdown restrictions are lifted across the country, you can expect to see more and more people getting back on the road instead of flying for short trips or even longer vacations during the summer months.

But a lot of people want to make those trips in comfort, not sitting in a cramped Toyota Corolla the size of your kids’ lunch box.

Plus, most Americans will feel safer on the road with family than on a plane surrounded by strangers.

While the coronavirus pandemic beat down the travel and automotive industries as millions of Americans were locked down, Money & Markets Chief Investment Strategist Adam O’Dell’s system tells us there is a company related to travel showing a lot of potential for gains.

Getting the Travel Bug?

When I was a kid, I used to take long road trips and vacations with my grandparents.

We would drive from Kansas to Texas to visit relatives and fly to places like California and Florida. I was able to see the beaches of the Texas Gulf Coast, Disneyland, Disney World and a lot of points in between.

Those are memories that stick with me to this day.

As I get older, I start thinking about retirement and the prospect of taking my grandkids for road trips to visit a lot of the great places there are to see across the country.

And I’m sure I’m not alone in that dream.

But how does all of this relate to investing? I’ll tell you.

This is where Winnebago Industries Inc. (NYSE: WGO) stock comes into play.

Winnebago Stock in the Driver’s Seat

Winnebago of course manufactures and sells recreational vehicles of all sizes for use in leisure, travel and outdoor recreation activities. It’s one of the biggest names in its industry and has been for decades.

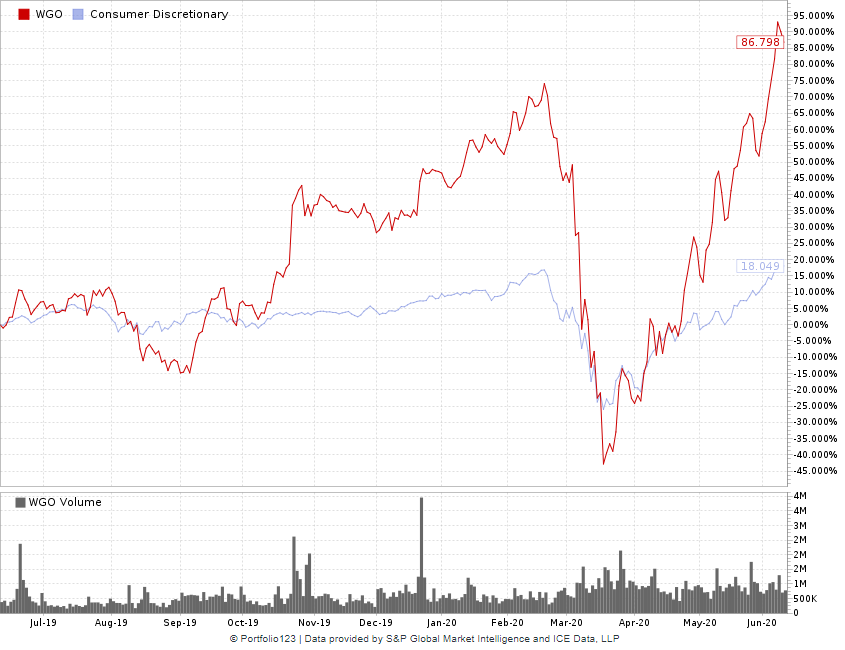

As you can see in the chart above, the company’s share price is growing far faster than the overall consumer discretionary industry. In a year, Winnebago stock has jumped 86% compared to just 18% for the rest of the consumer discretionary sector.

In digging deeper, O’Dell found that Winnebago scores highest on growth, quality and momentum factors. That makes it a stock on the move with a ton of upside potential.

Let’s drill down:

- Growth — In the last three years, Winnebago has boosted its sales by more than 26%. Not only is Winnebago growing top-line revenue, thanks to prudent cost management, that extra money is indeed hitting its bottom line, as seen in earning per share growth of more than double over the last four years.

- Quality — Winnebago shows strong quality as its return on assets, return on equity and return on investment are all blowing away the rest of the industry. Its return on assets is 7.5%, which is huge compared to minus-2.1% for the sector. It has a return on equity of 14.5% compared to minus-1% for the sector. And its return on investment is 10.6% compared to minus-2.5% for the sector.

- Momentum — Winnebago has strong momentum, especially when looking at its trailing total return. Since reaching a 52-week low around $20 per share in March, the company has skyrocketed to a 52-week high in June. That’s an 86% swing. So while many other stocks are still struggling to regain their pre-COVID highs, shares of Winnebago are motoring to new higher highs.

What Should You Do Now?

O’Dell’s system indicates Winnebago stock is strong on growth, quality and momentum.

These factors suggest Winnebago is currently a great buy.

As the coronavirus lockdowns continue to be ease up across the country, more and more people will want to alleviate their cabin fever.

Rather than taking long, pricey flights, people will want to travel regionally. Perhaps the “Great American Road Trip” is making a comeback!

What better way to do that than in style in a new recreational vehicle?

We think this shift in travel is going to pay huge dividends for investors who jump on the trend early. Winnebago (NYSE: WGO) is a great way to do that.