Today, you’ll see last week’s sector performance chart looks dramatically different than the previous week’s…

In short, the market bounced … and it did so vigorously!

For today’s edition of What My System Says Today…

- I’ll show you which sector led the market rally higher…

- Offer a “Top 10” list of strong stocks in that sector, according to a simple momentum screen, and…

- Offer a list of 10 “worst” stocks in a lagging sector, which we recommend you avoid.

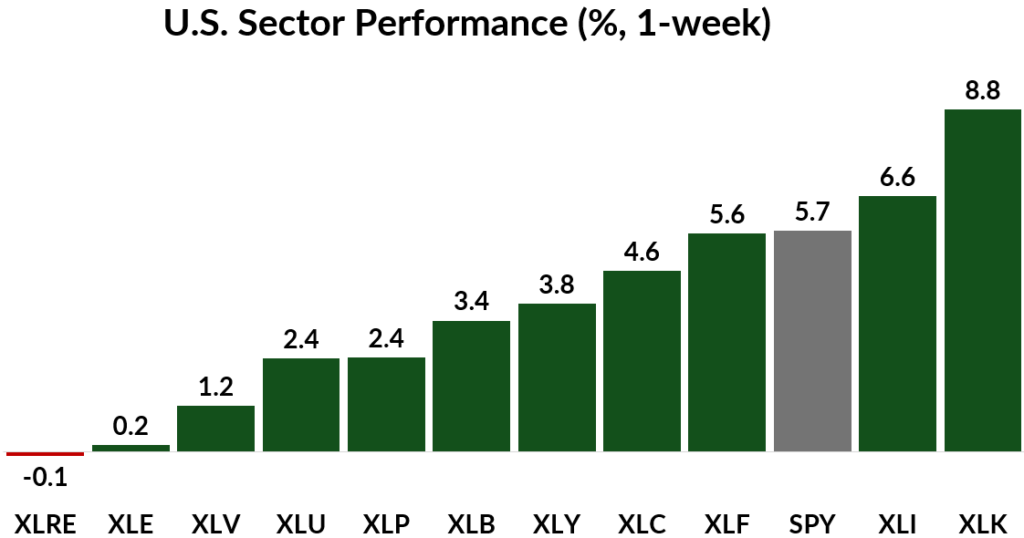

Here’s how the major U.S. stock sectors fared during last week’s screaming-higher market rally:

Key Insights:

- The S&P 500 (SPY) closed the week 5.7% higher.

- 10 out of 11 sectors showed a positive gain for the week.

- Only two sectors managed to beat the broader S&P 500.

- The technology sector rallied the strongest, with an 8.8% gain for the week.

- Real estate (XLRE) was the only sector with a slight loss, at 0.1%.

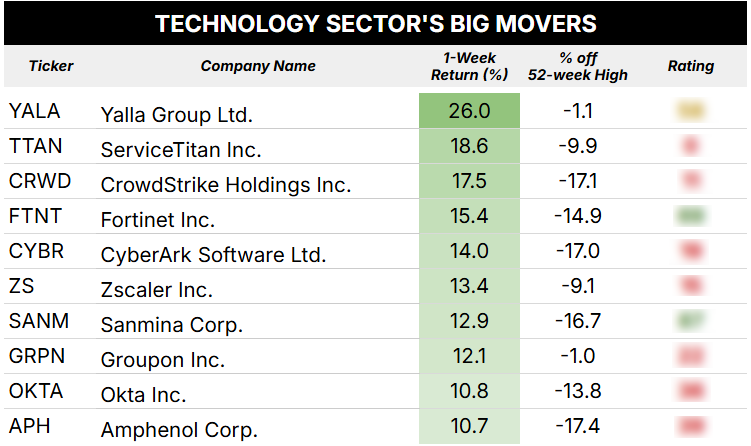

Now, let’s take a closer look at the technology sector’s top-performing stocks through the lens of a simple momentum screen…

The Best-Performing Sector: Technology

Technology stocks had a particularly strong showing following President Trump’s 90-day tariff pause announcement. The tech sector closed the week almost 9% higher, outpacing the broader S&P 500 by a convincing margin.

So let’s see which stocks drove that outperformance:

To construct this table, my team and I ran a scan of all technology stocks that closed last week within 20% of their 52-week highs. Of those stocks, you’re seeing the top performers from last week.

Buying top-performing stocks … from a top-performing sector … while they’re flirting with “new highs” territory…

Well, that’s a classic “momentum” strategy.

Right off the bat, you may notice the lack of Magnificent Seven stocks above…

Most stocks in that widely followed group gained between 5.2% (Apple) and 8.1% (Amazon), with a notable exception being Nvidia’s 17.6% gain.

But there’s a different reason the Mag 7 stocks didn’t make it through this momentum screen: they’re further than 20% below their recent highs.

Microsoft is the closest, down just 16.6% from its peak. Most of the pack is down between 24% (Apple) and 28% (Nvidia), with Tesla being the notable laggard, down 48% from its recent highs.

All told the technology sector and Mag 7 stocks had a strong showing last week, but they still have a lot of ground to cover before reaching “new highs” territory.

Conversely, stocks in the table above posted market-crushing gains last week and are, relatively speaking, within spitting distance of seeing higher highs.

Green Zone Fortunes subscribers can check each stock’s ratings to see which ones are best poised to beat the market by 2x to 3x ahead…

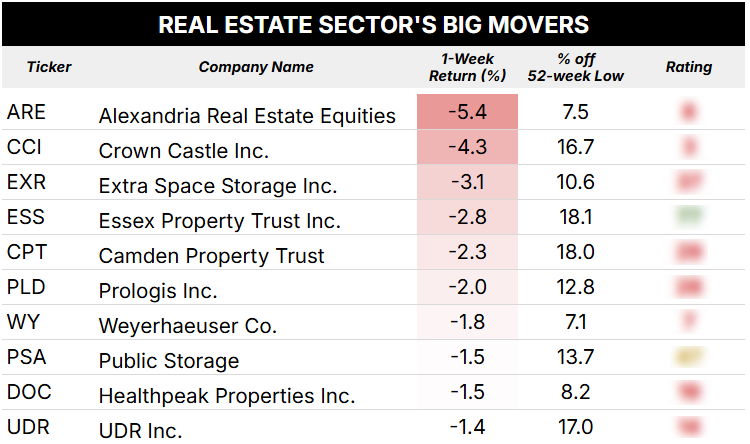

Last Week’s Laggard: Real Estate

Wednesday’s broad market rally gave reprieve to what had been a very bearish market.

The Real Estate sector (XLRE) was the only sector to record a loss. It was slight at just -0.1% but still quite a distance from the S&P 500’s 5.7% gain.

Let’s see what stocks contributed to the drag on real estate sector stocks:

To construct this table, my team and I ran a scan of all real estate stocks that closed last week within 20% of their 52-week lows. Of those stocks, you’re seeing the worst performers from last week.

Shorting the worst performing stocks … from a poorly performing sector … while they’re flirting with “new lows” territory …

That’s also a classic “momentum” strategy.

If you’re not into short-selling, you can use the analysis above as your “don’t touch” list.

Of note, the turmoil in the bond market last week created a wave of new uncertainty in real estate demand as mortgage rates surged over 7% at one point — their highest level since February.

Some of that turmoil can be attributed to a hedge fund’s leveraged trade, which had to be unwound rapidly, displacing the price of U.S. Treasury bonds as it was done.

But some of the credit can be given to fears of adversarial selling the Chinese government could undertake in with their massive U.S. Treasury holdings.

All told, we’re keeping a close eye on rate-sensitive sectors as this trade war unfolds. For now, the real estate sector looks a bit dicey.

The stocks above are trading within 20% of “new lows” territory, so we advise caution in those names.

To good profits,

Editor, What My System Says Today