New construction seems to be everywhere in the U.S.

Management consultant FMI Corporation forecasts $1.9 trillion in new construction in the U.S. by 2025.

New homes and office buildings all need electrical wiring to ensure reliable power.

The chart above shows new construction spending in the U.S.

By 2025, spending will increase 35.7% from 2020.

All of this new construction will need stable electrical wiring for power.

Today’s Power Stock supplies industrial wire, cables and connectors around the world: Encore Wire Corp. (Nasdaq: WIRE).

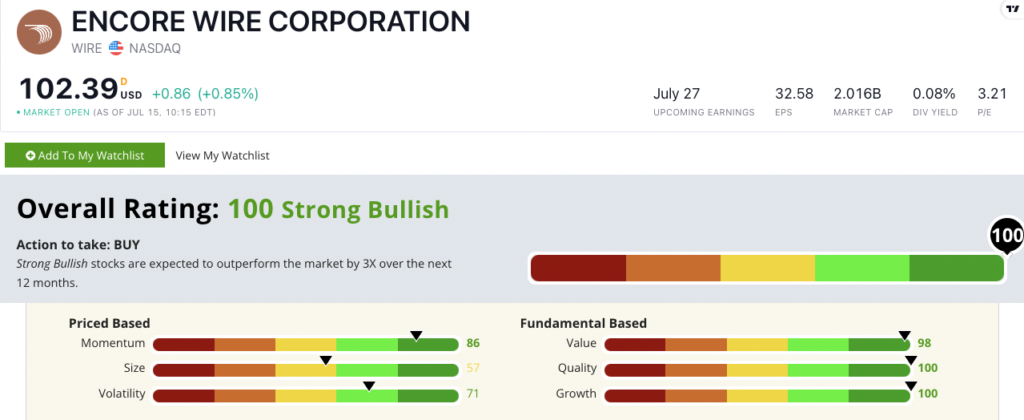

WIRE Stock Power Ratings in July 2022.

Texas-based Encore Wire stock scores a “Strong Bullish” perfect 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

WIRE Stock: Fundamental Giant With Strong Momentum

Encore Wire crushed it in 2021.

Here’s proof:

- Recorded $2.6 million in sales for the year — that’s double the year before!

- Gross profit margin was 33.5% in 2021, more than doubling the prior year’s 15.2%.

WIRE’s fundamentals show it’s an outstanding stock.

WIRE scores a perfect 100 on both our growth and quality metrics.

It also earns a “Strong Bullish” 98 on value.

Its price-to-earnings ratio is 3.2 — more than five times lower (i.e., cheaper) than the industry average!

The company’s price-to-cash flow ratio is 3, while its peers average over four times as much at 13.6.

These numbers tell us WIRE is a terrific value compared to the rest of the electrical equipment industry.

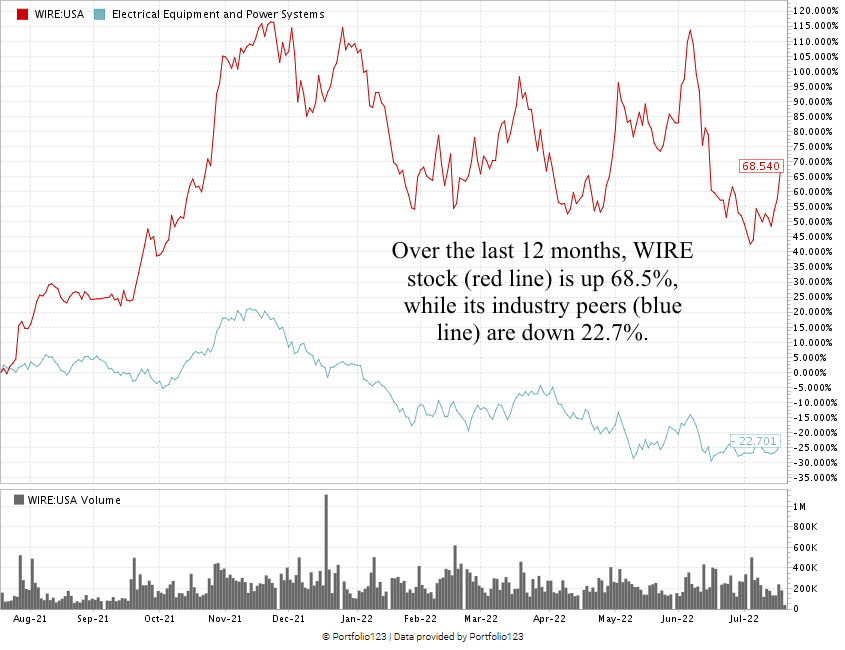

You can see in the stock chart above that from July to November 2021, WIRE jumped as much as 113%.

It pared those gains this year, but the stock is still up over 60% for the year. Its industry peers, on the other hand, are down 22% over the same time.

WIRE is crushing its cousins, folks.

Encore Wire Corp. stock earns a 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Whether buildings use traditional electricity or green energy, they need wiring.

A global leader in the field, WIRE is a prime candidate for your portfolio.

Stay Tuned: Greek Telecom Provider

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on why the largest tech company in Greece is a solid buy.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.