Last week’s stocks, Lennar and KB Home, had their earnings moves drowned out a bit thanks to the overall market volatility we experienced.

The broader markets dropped more than 2% last Monday on fears of contagion from the Chinese property developer, Evergrande, possibly going under.

So far, there are no signs China wants to step in and bail the company out. Being the second-largest property developer in China, if the company defaults on its debts, a lot of other companies and industries are going to feel the pain.

Even though China may not offer a bailout, it will need to stimulate its economy to keep lending markets working properly.

But all investors are paying attention to is the risk of mismanagement causing a widespread fallout.

That’s why we got the drop on Monday.

This news took away some of the earnings impacts on individual stocks because prices were already swinging on these worries.

But, as things settle down, it opens up larger moves for the upcoming earnings season as investors catch up.

Today, we’ll be looking at two stocks that are more sensitive to economic growth. An industrial manufacturing company, Worthington Industries Inc. (NYSE: WOR), and payroll processing giant, Paychex Inc. (Nasdaq: PAYX).

Here’s what to expect this week…

Earnings Edge Stock No. 1: Worthington Industries (NYSE: WOR)

Earnings Announcement Date: Wednesday, before the open.

Expectations: Earnings at $1.86 per share. Revenue at $981 million.

Average Analyst Rating: Hold.

Worthington Industries, a key industrial company, has seen its stock plunge about 30% since March. That comes as the government works to pass a massive infrastructure spending bill that will surely boost revenues for the company.

While the pullback could signal more pain ahead, it looks like investors just got ahead of themselves.

They’ve been waiting for the infrastructure bill for over a year now, and investors sent the price of the stock up sharply in 2020.

With investors taking some profits, it likely clears the way for the stock to head higher from here. And that’s going to start with a solid earnings report along with an upbeat outlook — something analysts will be looking for this week.

WOR Is Ready to Rally

The downtrend since March has already lasted for six months.

That’s a long time for any price channel to last when it is this defined, but with the stock trading around the bottom of the channel, we can expect a positive move on earnings this week.

Shares could pop 10% and still be stuck in this downward price channel.

But as I mentioned, I’m expecting the stock to head higher in the months ahead. So there’s more upside here than the short-term swing back to the red resistance line on the chart.

This is one stock to keep on your radar even if this earnings report is weak, and 2022 should be a great year for the company.

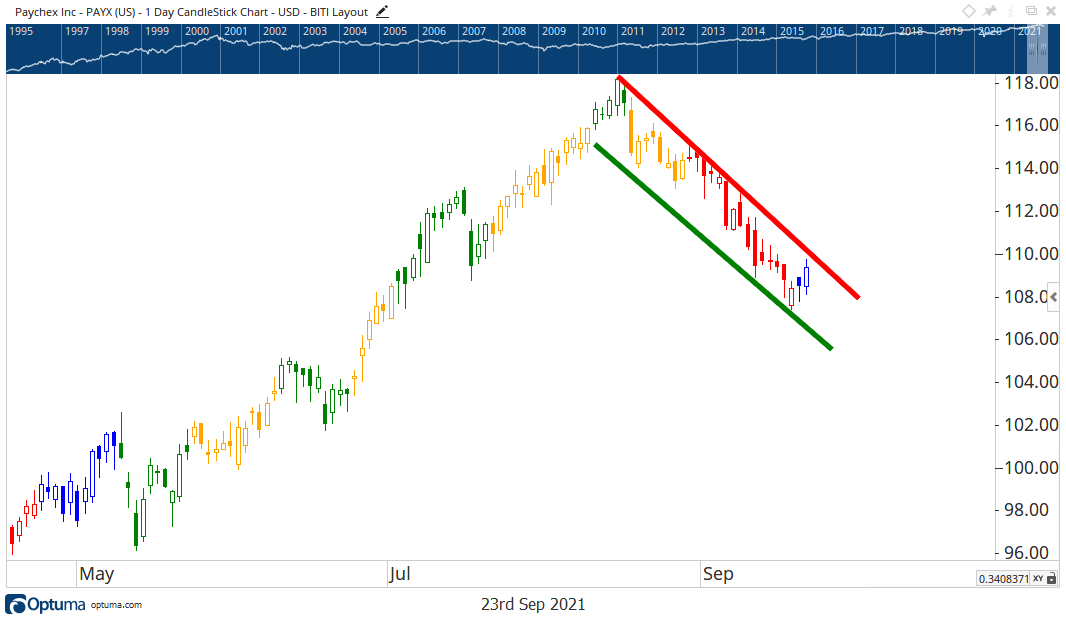

Earnings Edge Stock No. 2: Paychex, Inc. (Nasdaq: PAYX)

Earnings Announcement Date: Thursday, before the open.

Expectations: Earnings at $0.80 per share. Revenue at $1.04 billion.

Average Analyst Rating: Hold.

Employment services company, Paychex, may be one of the biggest beneficiaries of surging job growth. It’s putting people back on payrolls and creating demand for its services.

But, as we saw with Worthington, investors are taking profits.

The stock has dropped almost 10% in the last month, and the big news was the delta variant. We don’t hear much about it now, just a month later, but in August, it was the reason for delaying the return to the office and causing an uproar over wearing masks.

The jobs report for August showed just 235,000 new positions, compared to expectations of 720,000. That’s a big miss, and investors have continued to sell based on that news.

After the drop, now may be the time to get bullish on the stock, though…

A Bullish Signal for PAYX

It’s been in a downward price channel as well, but a big move on earnings will break out of this narrow trend.

That will be our signal that things are turning around for the company, and our economy if PAYX has a favorable earnings report and price action that breaks out to the upside.

If it struggled last quarter though and doesn’t offer a promising outlook, shares could take another sharp move lower and continue on its downward trajectory.

Either way, this earnings report holds a pivotal moment for the stock, and all eyes will be on how Paychex is handling the volatility in the jobs market.

That sets up for a likely sizeable move this week for the stock.

Chad Shoop is a Chartered Market Technician and options expert for Banyan Hill Publishing. He is the editor of three leading newsletters: Quick Hit Profits, Automatic Profits Alert and Pure Income. His content is frequently published on Investopedia and Seeking Alpha. Check out his YouTube Channel to see his latest market insights.

Click here to join True Options Masters.