Everyone likes to rail against California as a miserably high-tax state, but a study released this week shows the liberal haven doesn’t even crack the Top 10 of worst states to live in when it comes to taxes.

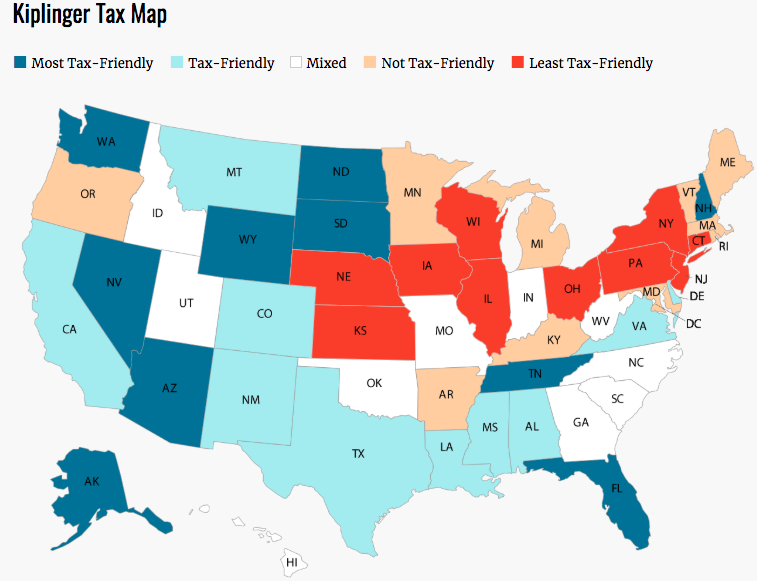

Kiplinger’s, a personal finance publication, listed the Top 10 best and worst states by tax-friendliness. To conduct the study, Kiplinger’s created a hypothetical family with two kids and an income of $150,000 a year, with an additional $10,000 coming from dividends. It then analyzed how that family would fare against a state’s property, income and sales tax policies.

California was actually labeled “tax-friendly,” but that would probably change if the hypothetical family made more money.

“When they talk about California tax, they focus on the 13.3% (income tax) rate, which is the top rate — but that is for people making more than $1 million,” Kiplinger’s Tax Editor Rocky Mengle told MarketWatch in an interview concerning the study. Mengle said taxes are much lower for lower-income families because “California has a fairly progressive income tax, with nine brackets.”

So what state ranked the worst? Illinois takes the bitter tax cake carried with its 2.32% property tax, which is nearly double the national average, according to SmartAsset. High income taxes helped Connecticut and New York round out the top three.

The 10 Least Tax-Friendly States

- Illinois

- Connecticut

- New York

- Wisconsin

- New Jersey

- Nebraska

- Pennsylvania

- Ohio

- Iowa

- Kansas

On the flip side, Wyoming, Nevada and Tennessee are the most tax-friendly because the first two don’t have an income tax and Tennessee’s income tax is limited to interest and dividends, not salaries or other wages. Florida, a retirement hotbed, couldn’t quite crack the Top 3 despite its lack of a state income tax.

The 10 Most Tax-Friendly States

- Wyoming

- Nevada

- Tennessee

- Florida

- Alaska

- Washington

- South Dakota

- North Dakota

- Arizona

- New Hampshire

As far as retirement planning goes, Mengle argues these studies can be useful for relocation because it reveals duties — like estate and inheritance taxes — that may not have been on someone’s radar while planning out their golden years.

Another example is Social Security income, which is taxed in 13 states: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia.