Global trade, a key driver of the global economy, is in a precarious position heading into 2019 and it looks increasingly like there will be a major slowdown, the World Trade Organization’s chief economist says.

“It’s almost like a death from a thousand cuts.”

Per Bloomberg:

“When you look at those leading indicators, they continue to weaken. It’s almost like a death from a thousand cuts,” Robert Koopman said in an interview Thursday. “There’s not any one big change in those leading indicators but, boy, they are starting to add up.”

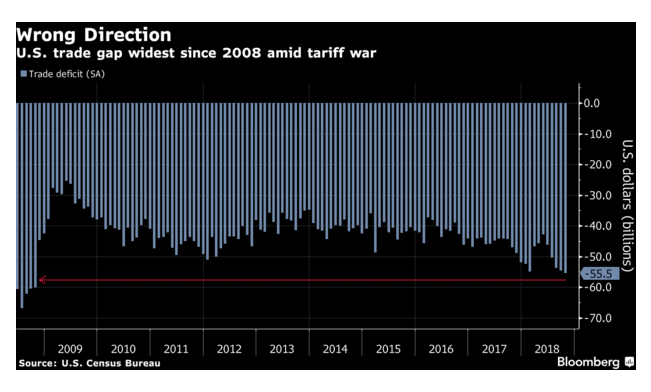

Financial markets around the world have been increasingly volatile as concern grows for a global economic slowdown due to President Donald Trump’s trade wars. On Wednesday, Fed Chair Jerome Powell pointed to investor and business fears over trade tensions, and companies like FedEx and other firms also have warned of being slammed by slower growth.

In September the WTO downgraded its global growth forecast, predicting the volume of goods moving around the world would grow to 3.9 percent this year — down from 4.7 percent in 2018 — before slowing to 3.7 percent in 2019.

Koopman said the organization was holding to those forecasts for now, though he added that risks were rising that they could be downgraded again early next year.

Down Arrow

A WTO tracker of leading indicators such as purchasing manager indices from around the world and air and sea freight points to slowing global trade momentum, he said.

“If we have an expectation that it is going to move in any direction it’s going to be down,” Koopman said of the 2019 projections.

Reasons for concern are surfacing in all the world’s major economies, Koopman said, citing the Fed’s downgrade this week of its own projections for U.S. growth next year. “We’re concerned about the EU. We’re concerned about China. We’re concerned about the U.S.,” he said.

Koopman said the biggest concern is not over the direct impact of the tit-for-tat tariff wars that the U.S. has engaged in, most prominently with China but also with allies from the EU to Canada. Though U.S. and China together account for almost 40 percent of global output, the goods traded between the world’s two largest economies represented less than 3.2 percent of global trade, according to the WTO.

Instead, Koopman said, the real risk is how those trade conflicts could weigh on businesses and consumer sentiment and spending around the world.

“The shoe that all of us are waiting to see is: Does the uncertainty — the policy uncertainty raised by this conflict — spill over into investment and consumer behavior,’’ Koopman said.

There are some initial signs that business investment is being hit and that consumers in both the U.S. and China are starting to hold back on purchases, Koopman said.

“It isn’t a disaster yet,” he said. “It’s weak, but if we start to see a downturn, real declines in investment, that could be pretty problematic for global trade and global growth in general.”

The WTO’s 3.9 percent forecast for global trade growth this year is down from 4.7 percent in 2017. Still, that’s not bad historically: Global trade volumes grew at a rate of just 1.8 percent in 2016.