Money & Markets Daily: The 5

It’s impossible to keep up with everything going on in financial markets and the economy these days. That’s where “The 5” comes in…

Let’s start your week off right by exploring the most significant trends and opportunities you need to know now.

1. “Have you tried turning it off and on again?”

Cybersecurity giant Crowdstrike Holdings Inc. (Nasdaq: CRWD) saw its worst nightmares come true on Friday when a flawed software update shut down networks and computer systems all over the world.

All flights from several major carriers were grounded, bank accounts were digitally frozen, and business ground to a halt as the company scrambled to issue a fix.

Workers on the ground did everything they could to keep operations running, with one Indian airline going so far as to issue handwritten boarding passes to passengers:

Global system outages forced ticket agents to go “old school” with handwritten boarding passes.

This is precisely the type of outage that cybersecurity companies are supposed to prevent. It’s the kind of attack most hackers could only dream of pulling off, and CRWD blundered into it.

According to Money & Markets Chief Analyst Matt Clark, this critical failure will have a lasting impact on the sector: “Businesses impacted by the outage are going to give serious thought to how their cybersecurity infrastructure is built.”

And we’re already seeing its impact on share prices…

2. Coding “SNAFU” Costs CRWD $8 Billion

Investors were quick to punish CRWD following the system crash. By the closing bell on Friday, shares had sunk 11%, wiping out more than $8 billion in market capitalization.

Some investors believe CRWD’s hardship could turn into a windfall for its competitors, but Matt urges caution. “This outage didn’t do any favors for the IT sector. Valuations were already high, and we were already seeing a rotation out of Big Tech stocks and into small caps, based on rate cut expectations.”

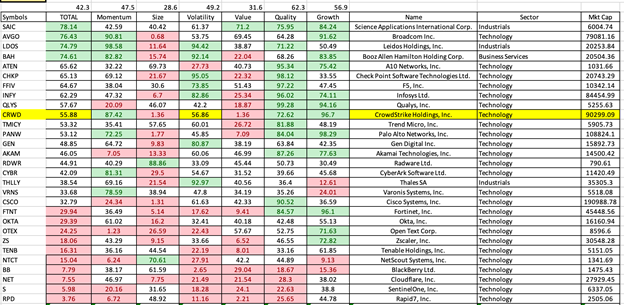

He shared an X-ray of the First Trust Nasdaq Cybersecurity ETF (Nasdaq: CIBR) to illustrate his point. This chart shows the Green Zone Power Ratings (and component factors) for each stock in the ETF:

As you can see, there’s quite a bit of red in there. And even the top-rated stocks aren’t breaking above an 80 overall rating. Size, in particular, is a challenging factor, reflecting how bloated many of these stocks have become.

Speaking of bloated…

3. History’s Coolest Political Convention

Last week saw the Republican National Convention’s blowout, a four-day event featuring Hulk Hogan, UFC founder Dana White, Kid Rock and — of course — former President Donald Trump.

It was a star-studded convention with dozens of enthusiastic speakers and a record 92-minute closing speech from newly-christened nominee Trump. That’s almost exactly as long as Dr. Strangelove for those out there keeping score.

We’re hoping that next month’s Democratic Convention will be just as exciting. With President Joe Biden stepping out of the race, there’s a good chance it will be. Vice President Kamala Harris is the current favorite to face off against Trump — but she’s not a shoo-in. Other contenders like California Governor Gavin Newsom could make a strong case for the candidacy…

Maybe they’ll get Stone Cold Steve Austin to announce the winner with a cold one in hand?

However this shakes out, we’ll keep a close eye on this hotly contested election and update you on how it will inevitably affect your portfolio…

4. Worst Week in TWO YEARS for “Mag 7” Tech Stocks

Mega-cap “Magnificent Seven” tech stocks took a staggering $1.1 trillion hit in market capitalization over the last week.

Paid-up Green Zone Fortunes subscribers will already know that Adam O’Dell predicted this to be “The Most Important Week of 2024” due to news that inflation is finally cooling.

“There’s a three-step chain of logic going on here,” Adam explains…

Step No. 1: The latest data shows inflation cooled to its slowest pace since 2021. This suggests it’s now far more likely that…

“Step No. 2: The Federal Reserve will begin interest rate cuts as soon as September. And in turn, that suggests…

“Step No. 3: Small-cap stocks are about to get the “rocket fuel” (rate cuts) that will propel them considerably higher (and lead them to outperform large-cap stocks).

Indeed, several of Adam’s small-cap recommendations have seen serious gains over the last week.

He plans to lean even further into this powerful trend after tomorrow’s Wealth Multiplier Summit (don’t forget to lock in your invitation HERE).

5. It’s Hot Fed Summer

In last week’s “The 5,” we mentioned that Fed officials had several upcoming speaking engagements and that we’d be paying close attention to their language and phrasing.

Fed officials are known for frequently using doublespeak and vague terms to hint at possible changes in policy. But this week, Fed Chair Jerome Powell cut right to the chase — telling investors that he wouldn’t wait for inflation to drop below 2% before he started issuing cuts.

That 2% number is, of course, the Fed’s mandated inflation target. And with inflation now hovering at 3%, Powell is essentially telling the market to expect a rate cut before the end of summer in September.

This is great news for stocks (especially small caps). Stay tuned for more insights as the situation develops…

— Money & Markets Team