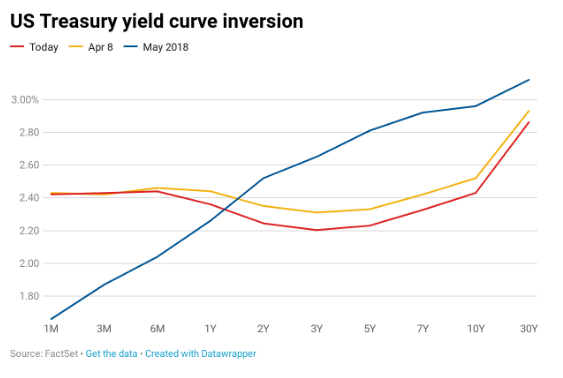

With trade war fears renewed again after multiple negative statements about a new deal with China from U.S. President Donald Trump, the yield on the 10-year Treasury fell below the 3-month Thursday, inverting part of the yield curve in what has long been a signal for an incoming recession.

The yield curve is a line that plots the interest rates of bonds that have equal credit quality but differing dates of maturity (ie. 10-year and 3-month). The yield curve is used as a benchmark for other debt in the market, like mortgage rates and bank lending rates.

The spread between the two Treasurys is generally positive to make up for inflation risks for investors.

The yield curve has been a reliable indicator of recession in the past, though, there has been some debate of late on whether it’s as accurate as it used to be.

The Fed still considers an inversion of the 3-month and 10-year curve a key economic barometer.

This morning, the yield on the benchmark 10-year Treasury, at 2.426%, dipped lower than the 3-month at 2.429%. The curve also briefly inverted in March.

“I think that we’re going into a recession. Look, I’m not going to sit here and pinpoint the day, the week or the month it’s going to happen, but it’s out there,” Gluskin Sheff chief economist David Rosenberg said in an interview with CNBC. “I think people tend to forget that the cause of the recession are the lags between the monetary policy tightening cycle and the eventual hit on GDP growth.

“So of course we’re talking about trade right now, but my premise all along is that there is no Get Out of Jail Free card after you’ve had a monetary policy tightening cycle like we had.”

As we’ve covered in depth today here on Money & Markets, trade tensions have risen significantly this week after Trump said China “broke the deal.”

Trump sent the markets roiling with a Sunday tweet announcing the tariffs on $200 billion worth of Chinese imports would rise from 10% to 25% on Friday.

China of course fired back, saying Beijing would retaliate with “necessary countermeasures.”