Money & Markets Week Ahead for the week of August 30, 2021: I preview Zoom earnings as workers slowly make their way back into offices.

I also look at how the initial public offering (IPO) market has fared so far in 2021. And I look ahead to an important economic gauge: consumer confidence.

Let’s look at some key market insights for the week ahead on Wall Street.

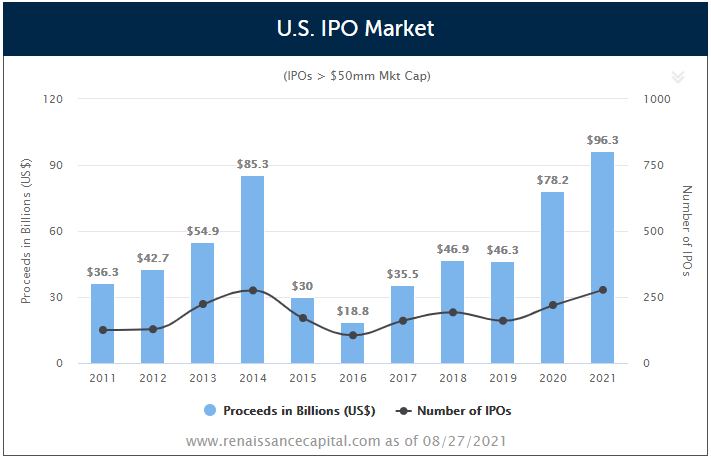

On the IPO Front: 2021 So Far

The initial public offering (IPO) market has been busy in 2021.

So far, 277 IPOs with values greater than a $50 million market cap (stock value times outstanding shares) have been priced in 2021, according to Renaissance Capital. That’s nearly a 152% increase from the same time last year.

Those IPOs have raised more than $96 billion in proceeds — almost $20 billion more than all of what was raised in 2020.

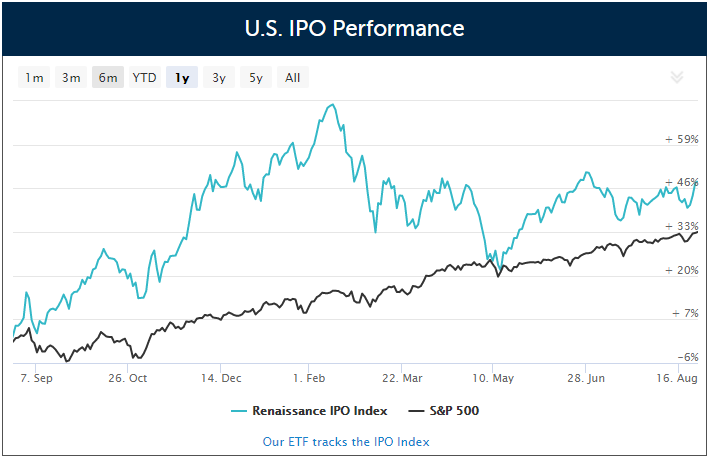

But you can see in the chart below that IPO market gains have cooled.

The Renaissance Capital IPO Index shows a trailing 12-month gain of 47% compared to the S&P 500’s gain of 33%.

There were some huge IPOs like Airbnb (Nasdaq: ABNB) and Coinbase Global Inc. (Nasdaq: COIN) that came out at the end of 2020 and into the first quarter of 2021. That tracks with overall market trends. Financial markets see a lot more action throughout the winter and spring months, while activity slows in the summer.

There are some big IPOs slated for later this year, including Instacart, Nextdoor, Stripe and Discord.

Deep Dive: Zoom Earnings

Investors made a lot of money off the work-from-home trade after COVID-19 forced a sea change in how businesses function in 2020. One of the biggest beneficiaries of this investing trend was Zoom Video Communications Inc. (Nasdaq: ZM). It will report earnings on Monday.

Zoom stock soared 350% higher between early April 2020 and its peak in mid-October.

Zoom Stock Has Leveled Off

It’s trading more than $200 per share lower than that peak. Its earnings should provide a glimpse into how it’s handling the shift back to the office.

Zoom’s financials have looked good. It has recorded a streak of earnings and revenue beats. During its most recent earnings call, it reported a $1.32 earnings-per-share increase — a full 32% higher than the expected 99 cents forecasted.

Revenue is the same story. It brought in $956 million in the quarter ending April 2021, a full $50 million more than expected. Looking at Zoom’s balance sheet, its total assets have more than doubled to $5.3 billion since the quarter ending July 2020.

The Skinny on Zoom Earnings

Employees are slowly making their way back to office. The delta variant is throwing a wrench in these plans. (Many of the larger companies have already postponed returning until early 2022.) Zoom’s earnings call on Monday should reflect some of this shift.

Zoom stock has flattened out after its explosive growth in 2020. Now we’ll find out how it plans to sustain that growth as the world returns to normal.

Data Dump: Consumer Confidence

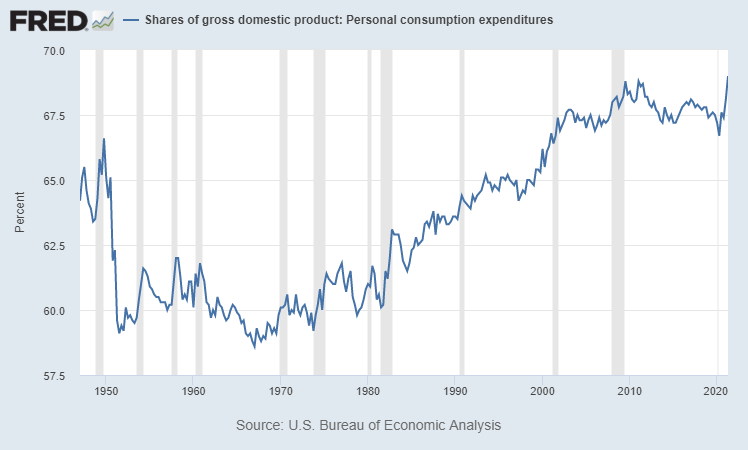

Consumers drive economic growth. Personal consumption accounts for more than two-thirds of U.S. gross domestic product (GDP), according to the U.S. Bureau of Economic Analysis.

Consumers Are the Economy

On Tuesday, the Conference Board will release its monthly Consumer Confidence Survey for August. The report details consumer attitude, how they plan to spend their money and expectations for the stock market, interest rates and inflation.

With consumers driving almost 70% of economic growth, this survey is a great one-stop-shop for insights into the economic recovery.

The Consumer Confidence Survey was flat in July, but the reported 129.1 reading was five basis points higher than expected. July’s reading was the highest since February 2020 — before the height of the COVID-19 pandemic.

Lynn Franco, Senior Director of Economic Indicators at The Conference Board, noted that consumers were still optimistic about growth in the short term but were worried about inflation in the coming months. She also said a larger percentage of surveyed consumers planned to make big purchases like homes, major appliances and cars, which should bolster economic growth through the second half of 2021.

The skinny: With the influx of new delta variant cases, August’s Consumer Confidence Survey should be a good indicator to keep an eye on. It will tell us if consumers are going back into saving mode, or if they are ready to push the economy even higher.

Economists expect readings to be around 124. For context, the index dropped to 85.7 in April 2020 and did not read above 100 until March 2021.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out this week:

Monday

Zoom Video Communications Inc. (Nasdaq: ZM)

H&R Block Inc. (NYSE: HRB)

Tuesday

Crowdstrike Holdings Inc. (Nasdaq: CRWD)

NetEase Inc. (Nasdaq: NTES)

Designer Brands Inc. (NYSE: DBI)

Wednesday

Chewy Inc. (NYSE: CHWY)

Asana Inc. (NYSE: ASAN)

Five Below Inc. (Nasdaq: FIVE)

Thursday

Broadcom Inc. (Nasdaq: AVGO)

Lululemon Athletica Inc. (Nasdaq: LULU)

Hewlett Packard Enterprise Co. (NYSE: HPE)

American Eagle Outfitters Inc. (NYSE: AEO)

Friday

DocuSign Inc. (Nasdaq: DOCU)

Domo Inc. (Nasdaq: DOMO)

Best,

Chad Stone

Assistant Managing Editor, Money & Markets