In early 2020, much of the economy shut down. The collapse in economic activity was unprecedented. Governments around the world, and especially in the United States, responded with massive levels of stimulus.

Some stimulus programs were targeted and designed to help those in need. Others were less targeted and distributed money even to households that didn’t experience significant losses. That money often went into savings.

Now, there are trillions of dollars in savings. According to The Wall Street Journal: “In addition to normal savings, economists at Barclays estimate that since the pandemic began, the equivalent of 7% of annual economic output has been saved in the U.S., while U.K. savings total 6% of gross domestic product and eurozone savings are at 5%.”

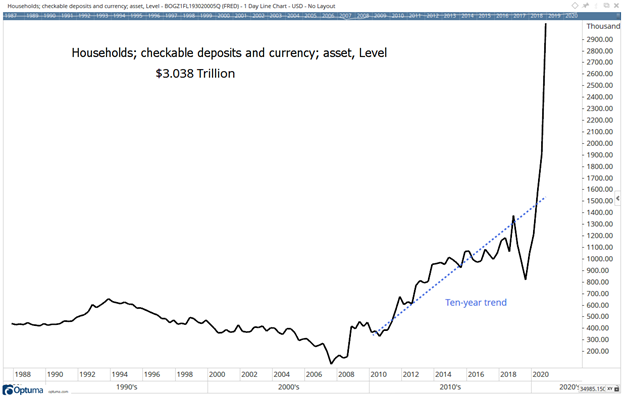

The chart below shows that in the U.S., much of these savings are sitting in checking accounts.

Americans Saved $3 Trillion Amid COVID-19

Savings Spending Spree Could Boost Stocks Post-Lockdown

The chart shows that households have been increasing savings for years. The amount in checking accounts fell from the early 1990s into the recession of 2007. At that point, it seems that households decided they need larger cash reserves and started to hold more in checking even as interest rates for those accounts fell to zero.

The increase could have been caused by the uncertainty of two recessions and two stock market declines of more than 50% in the first decade of the 21st century.

A regression line in the chart shows what normal checking deposits could have risen to under normal conditions.

The spike in the chart is due to pandemic relief programs. The data seems to show that many families saved their stimulus checks.

Based on the chart, there is about $1.5 trillion in excess savings. This closely matches the Barclays estimate cited above.

As the economy reopens, excess savings could fuel additional gains in the stock market. Some of the $1.5 trillion is likely to be directly invested in stocks.

Some of the excess funds will be spent in restaurants and other businesses that were forced to shut down. That spending will boost earnings, and that should boost stock prices.

This points to gains in the stock market in the long run. There will be pullbacks in the uptrend, but the bull market could continue for some time.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.