Before the pandemic, increased globalization seemed to be a certainty. Companies headquartered in the world’s richest countries often produced goods in low-cost countries. As wages rose in those countries, manufacturing often shifted to even lower-cost countries.

This practice boosted corporate profits. It also kept consumer inflation low. And it helped boost shareholder returns since low inflation justifies higher stock market valuations.

Now, there could be a shift toward nationalism. In the U.S., supplies of masks and other items in high demand at the height of the pandemic led companies to boost local manufacturing capacity. The same is true in other advanced economies.

In addition to that, early access to vaccines is leading to increased output in advanced economies. The result is that a global economic recovery is following a K-shaped pattern.

This means many benefit from growth. They are in the upward slope of the K. Many others still suffer from the slowdown. They form the downward-sloping line in the K.

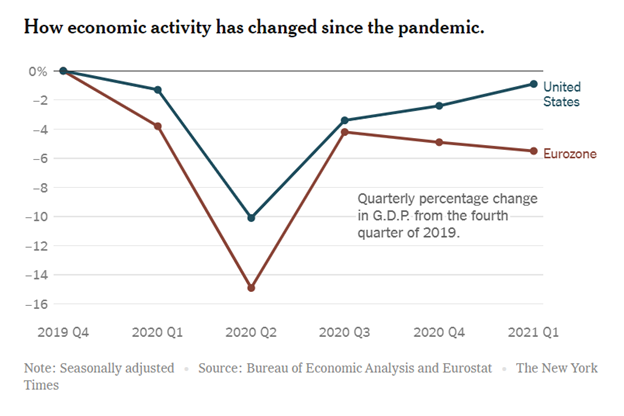

The K-shape will widen the divide between countries around the world. The chart below shows the widening gap between the U.S. and the Eurozone.

K-Shaped Recovery Shows Widening Gap Between U.S. and EU

Source: NYTimes.com.

Lackluster K-Shaped Recovery in Europe Is Concerning for the U.S. Economy

In the first quarter of 2021, as vaccine rollouts accelerated, the U.S. reported an economic expansion of 1.6% and has now almost fully recovered to pre-pandemic levels.

The eurozone economy contracted by 0.6% and is now falling rather than returning to normal.

Experts attribute the divergence to government intervention. According to Ángel Talavera, lead eurozone economist at Oxford Economics in London: “It’s quite hard to see growth when most European countries are still facing restrictions, the U.S. is going to grow more this year. The sheer amount of fiscal stimulus is going to create a boom.”

Comparisons with India and Latin America show an even sharper K-shape. A lackluster recovery in the rest of the world threatens the recovery in the U.S.

Is this stupid … or brilliant?

I found a way to trade the markets making the same trade every week.

We do this because any given week, this trade can knock it out of the freaking park.

I recommended 59 of these trades last year. We saw five trades go up 100% or more — each in a week or less.

And a total of 18 went up 50% or more — in an average of two days each.

All told, someone could have doubled every dollar they invested last year trading this way.

I want to give you the same chance.

P.S. I’ve been telling my readers that someone could double their money in a year with this. By the end of 2020, I proved that to be true. My “One Trade” strategy has never had a losing year across 12 years of back testing. And last year’s live results were even better. Click here to see how it all works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.