Last weekend, I was speechless.

My wife and I planned a quick trip up the coast to Kennedy Space Center, and I had no idea what to expect.

I’m more of a thrill seeker, opting for the giant rollercoaster over sleepier shows and attractions.

But that Saturday, admiring all the NASA program has achieved over the last 66 years, might’ve changed me.

The highlights for me had to be the bus trip around the massive Vehicle Assembly Building and the Apollo exhibit — especially the firing room simulation of the Apollo 8 launch.

Getting a sense of how BIG everything has to be to make it beyond Earth’s orbit is truly humbling. Not to mention the willpower and courage it took to keep pressing on despite failure after failure…

It was a pretty emotional day (in a good way).

Left: The Saturn V rocket looms over the Apollo exhibit at Kennedy Space Center. Right: Me standing in front of the decommissioned Atlantis shuttle. (Not sure what I’m doing with my hands, ha!)

We wrapped our experience exploring Gateway, the newest exhibit at the complex.

While learning about what SpaceX, Boeing, Northrop Grumman and more are achieving in the great beyond now, it got me thinking about investing in space stocks.

And we have a great starting point for exploring that idea in our Green Zone Power Ratings system.

A Snag With Space Stocks

Without access to SpaceX stock and no intention to go public through an initial public offering, as per CEO Elon Musk, we have to look elsewhere.

I know, I know… we’d all love a piece of SpaceX’s $180 billion market cap.

Another snag is that many of these operations are tiny. Our system doesn’t even rate stocks like Intuitive Machines Inc. (Nasdaq: LUNR) due to its $102.8 million market cap.

That doesn’t mean these are bad stocks. They could turn out to be massive windfalls in the coming years.

But I’d rather stick to the system.

Let’s start with some of the other big names driving innovation and exploration on the Space Coast.

Boeing Has Bigger Issues

Boeing Co. (NYSE: BA) plays a massive role beyond Earth’s orbit.

It’s working with NASA to develop the CST-100 Starliner, a reusable vessel capable of carrying up to seven passengers into low-Earth orbit or four crew to the International Space Center.

It also has its eyes on deep space, the moon and Mars, with its Space Launch System rocket.

But Boeing has bigger problems to focus on back on Earth with its troubled 737 Max airliner among other ongoing issues.

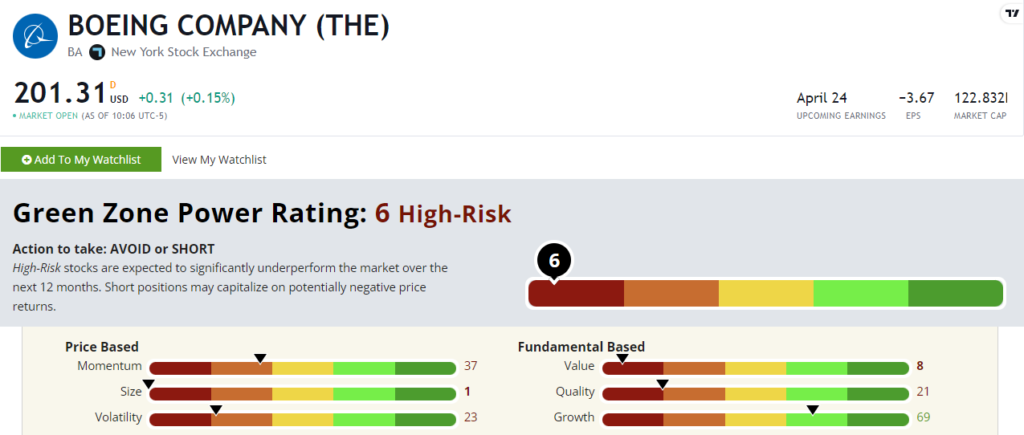

And that’s reflected in its “High-Risk” 6 out of 100 Green Zone Power Ratings.

Stocks that fall into this category in our system are set to significantly underperform the market over the next year.

Looking a little closer, its 37 on Momentum and 23 on Volatility are enough to steer me away.

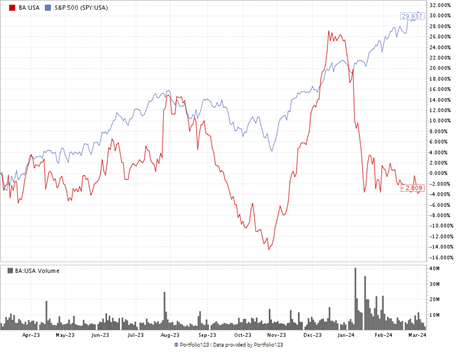

BA stock has lost 20% of its value in 2024 alone! Zooming out, the stock rallied 45% from October to January, but it’s actually down 3% over the last year.

Just look at the volatility here…

BA Stock: Anything But Steady

Boeing could maneuver through these headwinds with great finesse, but Green Zone Power Ratings says to look elsewhere for a market-crushing space stock.

Lockheed Looks Better

Lockheed Martin Corp. (NYSE: LMT) also has its eyes on the sky.

Later this year, it plans to send a crew of four aboard Artemis II — a spacecraft designed in conjunction with NASA — around the Moon and back in 10 days.

It also partnered with Jeff Bezos’ Blue Origin to develop a sustainable human landing system that will carry humans back to the Moon’s surface for the first time since 1972.

And Green Zone Power Ratings look a little more favorable for LMT. It rates a “Neutral” 46 out of 100 in our system, which means it should move in line with the market over the next year.

This is one to watch.

With decent ratings on Value (54) and Growth (58), paired with a strong 88 on Quality, the fundamentals for Lockheed Martin stock look solid. A high Quality rating means that the company has a healthy balance sheet and manageable debt.

The biggest thing holding the stock back now is a lack of momentum. Its stock price is down 9% over the last year compared to the broader S&P 500’s 29% gain.

Bottom line: Finding a solid space stock based on Green Zone Power Ratings is tough right now, but with a little digging we found two stocks that aren’t buys.

Avoiding the laggards is key to curating a market-crushing portfolio.

Now, back to planning our next Cocoa Beach trip. After seeing the relics of the past, we’re itching to witness a launch up close. I want to feel that sonic boom!

Until next time,

Chad Stone

Managing Editor, Money & Markets