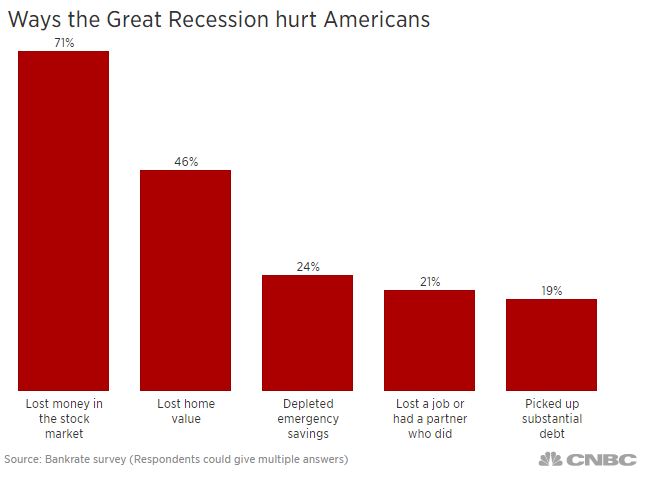

The Great Recession rocked a lot of households in the mid-late 2000s. While it has officially been over for 10 years, many Americans are still dealing with the economic aftermath, according to a survey from Bankrate.com.

“There are still tens of millions who are struggling to even get back to where they were before the economy took a turn for the worse,” Mark Hamrick, senior economic analyst at Bankrate.com, told CNBC.

Over half of the 2,700 people polled in the survey said their finances were impacted negatively by the crisis, and of those people, half admitted to being worse off now than they were before the crisis hit.

With inflation, it would stand to reason that people would be making more money now than they did in the past, but the survey revealed that this may not be the case. Only 46% of the interviewees said their paychecks have grown since before the recession, and one-third of the people who lost their jobs during the event said their pay is now lower than it was before.

The median family income in 2000, after factoring in inflation, was $58,544, which is only slightly lower than the median in 2016 of $59,039. In the same amount of time, though, costs for medical procedures, childcare, and education have skyrocketed.

Certain aspects of the economy have bounced back, though. Unemployment is at 3.6% today, down from a whopping 10% spike in 2009. Gross Domestic Product rose at an annual rate of 2.6% during the fourth quarter of 2018 and continued to rise to a somewhat shocking 3.2% in the first quarter of 2019. The recession saw the GDP tank at 4.3%, which was the largest decline since World War II, according to CNBC.

Hamrick says this survey is helpful because it provides an individual case-by-case look at the overall effect economic events can have on a population.

“Surveys like this help to provide the detail and the colors of the economy, which remind us that individual results vary,” he said.

He argues that other factors that impact recovery from the recession include where people live, their job sector, and even gender. About 27% of women polled said they were worse off financially, compared to 19% of men.

“Women face bias in the workplace and that exhibits itself in the pay and opportunities for advancement that they’re given,” Hamrick said.

Hamrick warned that the next economic downturn could be even more damaging.

“Many Americans are still digging out from the recession,” he said. “Even a modest downturn is going to cause further harm to Americans’ personal finances.”