One of the most exciting parts about investing with Green Zone Power Ratings is how the system can lead you into unexpected new investments…

It’s the perfect tool for someone who doesn’t mind stepping “off the beaten path” to rake in outsized, long-term gains that you’d never hear about on CNBC or in the Wall Street Journal.

For example, in January 2020, the world was obsessed with electric vehicle (EV) stocks. Shares of Rivian, Lucid and Fisker were all soaring.

Green Zone Power Ratings warned us off these stocks and pointed toward semiconductor stocks instead.

Sure enough, we tripled our money while EV stocks crashed by upwards of 90%.

The same thing happened a few months later, in October 2020. At the time, the investing world was obsessed with cryptocurrency, Tesla and FAANG stocks.

Those high-tech topics were all over the financial media.

Once again, Green Zone Power Ratings pointed us in a different direction — toward construction and homebuilder stocks, including one relatively unknown stock that has since raked in over 640% in gains since then.

Meanwhile, Tesla’s shares are still more than 50% off their all-time high!

Time and time again, investing with Green Zone Power Ratings has allowed us to see through the media hype and find profitable, durable investments that can outperform over the long term.

And that’s exactly what it’s doing for us right now…

A Massive “Real-World” Revolution for the Digital Era

Shipping is something that most of us don’t even think twice about.

All we have to do is hit that big orange “buy” button on Amazon, and our goodies land on our doorstep two days later.

We all know there’s a massive logistics supply chain behind each purchase.

During the global COVID-19 lockdowns, we all became acutely aware of how shipping shortages impacted prices and the availability of goods.

Yet very few investors really understand how the shipping industry works — and how it’s transformed over the last decade…

During the early 2000s, shipping stocks tended to follow a somewhat risky business model. They combined highly cyclical revenues with massive capital expenditure on continued shipbuilding. Most companies carried large amounts of debt and used equity sales to fund their growth.

Then came the global financial crisis in 2008 … The industry was forced to adapt and evolve.

Successful shipping companies reduced their debt levels, ran their fleets more efficiently, and cut capital expenditures. They also kept a close eye on their net asset value (NAV) to inform decisions on share buybacks and dividend payouts.

It took about a decade for these changes to trickle through the industry.

But the results were nothing short of revolutionary.

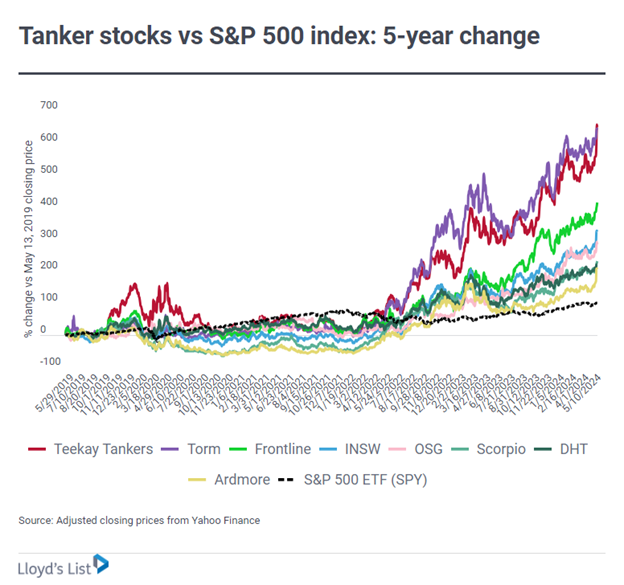

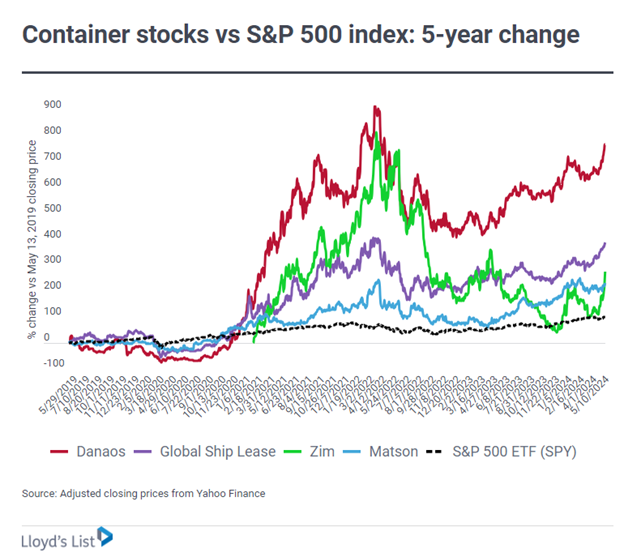

The shipping industry emerged leaner and meaner than it had ever been. It went on to beat the S&P 500 by upwards of 10X during the five-year period from 2019 to 2024.

Tanker stocks did especially well when compared to the S&P 500 index:

And other shipping sectors, including everything from dry bulk and LPG to container shipping, have all soared as well:

This leaves us with just one critical question about the ongoing shipping revolution…

Is There Still Time to Cash in on the Shipping Revolution?

Yes, absolutely!

In fact, right now is an outstanding time to invest if you haven’t already.

We’re currently in the middle of a multiyear trend that will see sustained higher shipping prices.

With Houthi rebels wreaking havoc on the Red Sea and Russia’s invasion rerouting most of the region’s export goods, demand for shipping is higher than ever.

On the supply side of the equation, shipbuilders are scrambling to help grow the global fleet. However, their production capacity is limited (and most have years of backlogged orders at this point).

So over the long term, there are plenty of great reasons to be bullish about the shipping sector.

But once again, it’s all about those Green Zone Power Ratings.

Because even though strong mega trends are driving the broader industry higher, there are still winners and losers — just like any other sector.

Paid-up Green Zone Fortunes subscribers will know that we’ve already locked in one of the sector’s strongest performers. Since I recommended it in August 2023, the portfolio’s first shipping stock is up more than 80%.

This month, I’m recommending adding another shipping stock to your Green Zone Fortunes portfolio. If you’re not already signed up to receive my recommendations, you should do so by going HERE.

I’ll keep a close eye on this mega trend and keep you posted as it continues to unfold.

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets