While the broader market has taken a breather over the past few days, there are still new bullish opportunities cropping up every day … if you know where to look.

That’s why we’re always running the numbers and identifying stocks that are gaining favor among investors.

Let’s see what my “New Bulls” screen says for this week…

Are You Picking Up What I’m Putting Down on Bullish Stocks?

The formula for my “New Bulls” screen is driven purely by the Green Zone Power Rating system. That might just make it the best screen we run here in What My System Says Today.

What do you think? Drop me a note at Feedback@MoneyandMarkets.com and let me know what you enjoy most about this revamped daily newsletter.

Every week, this “New Bulls” screen is showing us bullish stocks that are now poised to outperform the market by 2X to 3X — no matter the direction of markets or outside “noise” in the news cycle.

Let’s see what’s popped up on my system’s radar this week.

As a reminder:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”).

- The stock must have been rated less than 60 for each of the last four weeks.

In short, these are stocks that have been rated “Neutral” or worse … but now are rated “Bullish” or better.

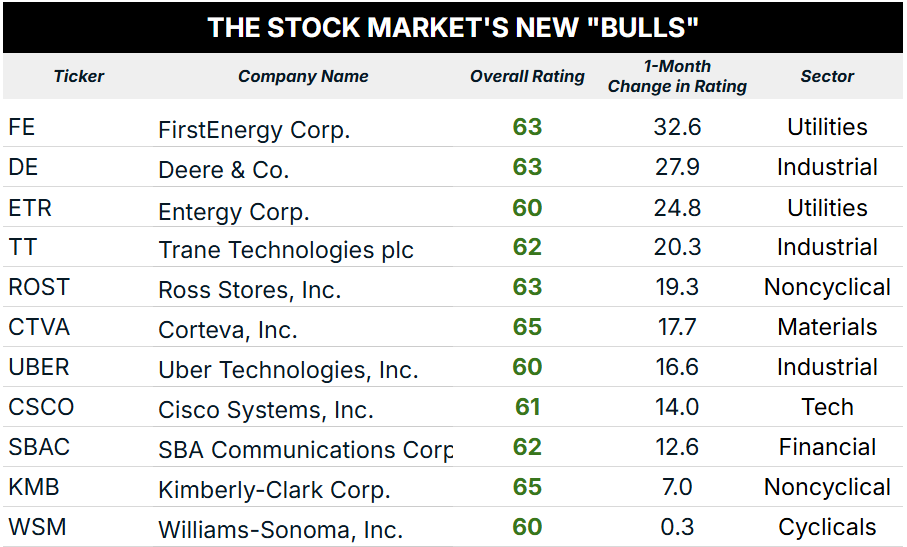

Here are the 11 stocks from the S&P 500 that made the list this week:

Right off the bat, I’m noticing a couple of things here.

For one, we don’t have any stocks that have soared straight into the 80-plus “strong bullish” range, as we’ve previously seen with a few stocks in past weeks. Each stock is only barely in the “bullish” (60 to 80) range of the Green Zone Power Rating system.

There’s also a distinct lack of tech stocks in this list, with only one making the cut: Cisco Systems Inc. (CSCO). Looking at the sectors overall, we have:

- 3 stocks in the industrials sector.

- 2 stocks in consumer staples (aka “non-cyclical”).

- 2 stocks in utilities.

- 1 in the tech sector.

- 1 in the materials sector.

- 1 in financials.

- And 1 stock in the consumer discretionary (aka “cyclicals”) sector.

As I see it, a diverse spread like this is really encouraging! It tells me that investors are casting a wider net, and that’s a great sign for the broader bull market’s strength going forward…

While my Green Zone Fortunes model portfolio doesn’t currently own any of the “New Bulls” listed above, we do hold 26 highly rated stocks across a wide range of sectors and economically significant mega trends.

Next week, we’ll be adding a “Strong Bullish” stock from the capital markets industry. The company’s product suite is completely “tariff-proof” and in high demand.

The stock barely budged during the recent sell-off … it pulled back less than 10%, while many technology-sector stocks fell 20% … 30% … 40% or more.

I believe this company is a prime “shakeout” winner, poised to make hay from the unconventional policies moves of the Trump administration.

You can gain access to my team’s full research and recommendations on this stock the moment we deliver our monthly report by claiming a membership to Green Zone Fortunes today.

To good profits,

Editor, What My System Says Today