It’s official … tariffs are here.

On Tuesday, 25% tariffs on goods imported into the U.S. from Canada and Mexico went into effect, along with an additional 10% duty on goods coming from China.

And the response was swift:

- Canada announced retaliatory 25% tariffs on $155 billion of American goods.

- The Chinese government slapped another 15% of duties on U.S. agriculture imports, like chicken, corn and wheat.

- The Mexican government is expected to place retaliatory tariffs on American goods this weekend.

In the 24 hours since President Trump has done everything from threatening another salvo of levies to mulling potential relief for certain sectors, like automobile manufacturing, that are really feeling the pressure as profit margins are already razor thin.

New headlines are crossing our feed by the hour. It’s tough to keep up…

Welcome to the Trade War of 2025.

We’re already seeing the impact, as the market was in turmoil even before these tariffs went into effect.

This leads me to this week’s charts…

Giving It All Away

Just before the November 2024 presidential election, the S&P 500 dropped to around 5,700 points.

Following Donald Trump’s victory, the benchmark index rose to a record-high near 6,100 points — a 7.9% gain in just over three months.

Granted, the road to that record was volatile, but it was a record nonetheless.

Since that high, amid fears of tariffs and subsequent retaliation, the market has given nearly all of those post-election gains back.

The sell-off is led by a basket of stocks most sensitive to tariffs — stocks for companies reliant on imports from Canada, China and Mexico.

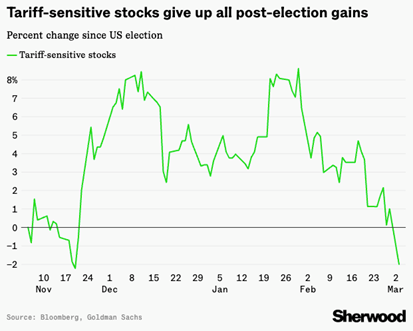

Their post-election drop has been profound. Check out this chart from Sherwood:

The basket of tariff-sensitive stocks highlighted by Goldman Sachs gained more than the S&P 500 in December 2024 and again in late January 2025.

Since then, this group of stocks has dropped 2% from its starting point just after the election. These stocks are now worse off than they were in November!

This massive reversal includes a 3% drop on Monday, when Trump announced the tariffs on Canada and Mexico would proceed. It was the largest single-day loss for the group since the Federal Reserve warned of tariff risks in December.

Monday’s sell-off was highlighted by General Motors (GM), which fell nearly 3% in afternoon trading after Trump’s tariff announcement. From Monday’s opening to Tuesday’s close, GM dropped 10.1%

Since Monday’s opening bell, the Dow Jones Industrial Average has lost roughly 1,400 points to trade around the 42,500 level. On Tuesday, the S&P 500 also hit its lowest level in four months.

And the impact may not be over…

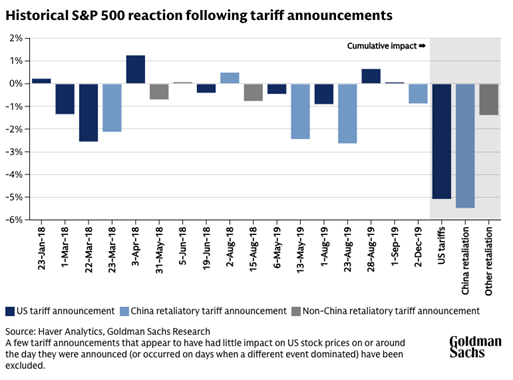

This chart from Goldman Sachs shows the returns of the S&P 500 following tariff announcements.

Since 2018, during President Trump’s first term in office, the market has had deeper negative reactions to retaliatory tariff announcements.

And it’s clear that investors are putting a lot of weight behind Trump’s words this time around as well … and understandably so.

While Canada and China have already implemented their tariffs, Mexico will not announce its tariffs until this weekend.

This matters because, in 2024, America’s largest trading partner was Mexico — which accounted for more than 14% of total trade.

Between imports and exports, the U.S. traded $337.5 billion in goods with Mexico. That’s more than Canada ($335.3 billion) and China ($332.2 billion).

I expect a negative market reaction to whatever tariffs the Mexican government announces over the weekend, putting further pressure on not just the broader market but also stocks reliant on goods from south of the border.

This includes automakers like Ford, GM, BMW, Tesla and Volkswagen, as well as technology companies like Dell, Apple and Samsung.

These sectors of the market are certainly worth watching as the Trade War of 2025 continues to take shape.

That’s all from me today.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets