Even though we aren’t entirely through earnings season, it’s never a bad time to look ahead…

Analysts have already started to reveal their third-quarter earnings expectations for companies in the S&P 500.

With concerns looming over tariffs and inflation, conventional wisdom suggests a more pessimistic outlook.

However, that would be wrong…

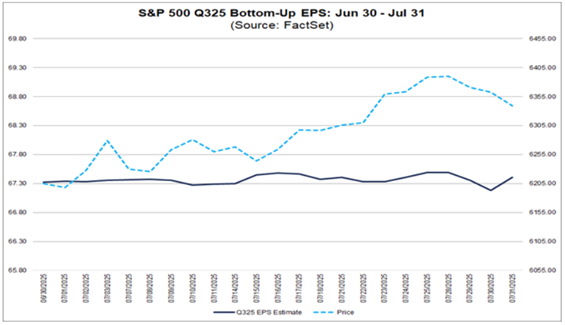

Bottom-up earnings estimates (the aggregation of median EPS estimates for all companies in the S&P 500) actually increased 0.1% in July (the first month of Q3).

The estimate for the S&P 500 went from $67.32 to $67.40.

Typically, analysts reduce earnings estimates in the first month of a quarter, with an average decline of 0.5% over the last five years.

However, this is the first time since the second quarter of 2024 that analysts have actually increased their estimates for the first month.

On a sector level, analysts are especially bullish on energy. Earnings expectations for the sector are up 3.8% for the next quarter. On the other hand, expectations for health care are down 5.2%. We’ll see how things play out in the coming weeks.

Before I get into “bullish” and “bearish” earnings potentials next week, let’s look at how things played out this week.

Energy Companies Beat Expectations, Still Lower EPS

I was watching the energy and utilities sector earnings closely over the last few days.

Last week, I mentioned Atmos Energy Corp. (ATO), Duke Energy Corp. (DUK), Sempra (SRE) and Occidental Petroleum Corp. (OXY), all reporting earnings this week.

To some surprise, all but one — Sempra — beat expectations on earnings, but all four fell short of their previous quarter’s earnings per share (EPS):

- Atmos Energy — $1.16 vs. the previous quarter $3.03.

- Duke Energy — $1.25 vs. the previous quarter $1.76.

- Sempra — $0.71 vs. the previous quarter $1.39.

- Occidental Petroleum — $0.39 vs. the previous quarter $0.77.

The quarter-over-quarter earnings drop continues the trend of energy and utility companies reporting declines in their EPS.

A 21% year-over-year drop in oil prices has hampered energy companies, while utilities have been forced to battle rate-of-return regulation that degrades the amount companies recover on their investments.

The good news is that three of these companies did beat analysts’ expectations for quarterly EPS.

The bad news is that their EPS lags behind the previous quarter, putting a dent in annual earnings.

Thus far, none of the four were hammered too hard for coming in below their previous quarter’s EPS. Two of the four have posted double-digit year-to-date gains:

- Duke Energy — up 16.1%.

- Atmos Energy — up 13.5%.

- Sempra — down 6.7%.

- Occidental Petroleum — down 14.6%.

The other bright spot is that both energy and utilities are expected to rebound into positive earnings territory from the third quarter of 2025 through the second quarter of 2026. We saw that play out a bit with utilities being the only sector in the green last week.

Now, let’s look at potentially “bullish” earnings for next week.

“Bullish” Earnings to Watch

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

As a majority of S&P 500 companies have already reported earnings, I expanded this screen to include those not listed on the benchmark index.

Here are the top 10 companies that made the list based on the gap between the estimate and the previous quarter’s EPS:

The obvious one that stands out to me is Alibaba Group Holdings Ltd. (BABA).

Alibaba is a Chinese-based technology company, specializing in e-commerce, retail and internet technology.

The surprising thing here is that Chinese companies have been adversely impacted by U.S. tariffs imposed by the Trump administration.

However, Alibaba’s e-commerce site has a global reach, meaning its revenue stream is diverse. Thus, it can withstand these tariff increases … whatever they end up being.

Even with that diversification, a $2.07 jump in EPS from quarter to quarter is pretty remarkable. It constitutes a 2,300% increase in earnings.

Alibaba’s diversity certainly makes that kind of a jump somewhat realistic, and I do believe the company will surpass its previous quarters’ earnings.

BABA Trades Flat Since May 2025

After rebounding from the initial reciprocal tariff announcement in April, BABA has traded somewhat flat to date.

I am interested in seeing if an impressive earnings beat impacts the stock price, as the stock is already “Bullish” on our Green Zone Power Rating system.

Now, we’ll switch gears and analyze potentially “bearish” earnings for next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

So, like our “bullish” screen, I expanded beyond the S&P 500.

Here are the nine companies that passed this screen:

Deere & Co. (DE) is an American staple in the agricultural world.

However, tariffs are the driving force behind a projected drop in its quarterly earnings.

In May, the company expected a $500 million impact from tariffs through the end of its fiscal year (October).

Deere imports 10% of the components used in its American plants from Mexico and 1% from Canada. Additionally, sales of its roadbuilding machinery, primarily produced in Germany, are subject to a 10% global tariff.

Lower crop prices and higher farm production costs are also hurting Deere’s bottom line, as farmers are scaling back from making significant equipment purchases until the dust settles from trade negotiations.

Deere is likely to drop its EPS from the previous quarter, and I would not be surprised to see the company miss expectations because of these tariff impacts.

Earnings season is slowing down, but there’s still plenty to keep us busy.

Have a great weekend, everyone!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets