As a journalist, I learned that when tackling a complex issue, it’s always best to find someone smarter than you on the subject.

Over the last several weeks, I’ve been jumping into the banking sector … particularly looking at banks in danger of failing — in addition to ones that already have.

After three banks’ massive failures, I want to know if there are any other institutions in the danger zone.

So I enlisted the help of Bill Moreland over at BankRegData.com, who pointed me to two critical data sets that are a fantastic starting point when analyzing a bank’s health.

Of course, we have our own proprietary tool that gives us a quick snapshot of a stock’s projected health as well: the Green Zone Power Ratings system.

So today, I want to focus on those two data sets and then use our proprietary system to show you one bank to stay away from.

Deposits and Delinquencies

The first set of data that gives a good read on a bank’s financial status is core deposits.

For banks, core deposits are one of the most stable and cheap forms of funds because they attract low interest-rate risk.

Two examples of core deposits are money kept in your checking or savings account.

Contrast that with certificates of deposit or money market accounts, which are more vulnerable to short-term interest rate changes.

The more core deposits a bank gets, the more money it can lend out. Essentially, deposits create loans.

The other important dataset is delinquencies.

Banks earn money from interest rates. The higher the interest rates, the more money a bank can make.

But that profit is offset when they have loan delinquencies — when payments are past due.

Bottom line: A bank that is in solid financial standing likely has high core deposits collecting more interest payments and low delinquencies so they get to keep those profits.

KeyCorp: A Snapshot of Deposits and Delinquencies

The bank I’m focusing on today is KeyCorp (NYSE: KEY). It operates KeyBank — a Cleveland, Ohio-based institution providing retail and commercial banking services, student loan refinancing and mortgage services.

First, I want to examine the bank’s core deposits.

Remember, in order to loan out more money, those core deposits need to grow. But that isn’t the case for KeyCorp:

As you can see from the chart above, core deposits at KeyCorp have declined by more than 10% since the third quarter of 2021.

Next, let’s look at loan delinquencies … specifically residential loans — the second-largest concentration of loans for KeyCorp:

Again, banks ideally want their loan delinquencies to go down because the more delinquencies, the lower the profits.

KeyCorp’s delinquencies are trending in the wrong direction. Loan delinquencies are up — therefore profits are lower.

And that’s helped create a stock that’s not worth buying right now.

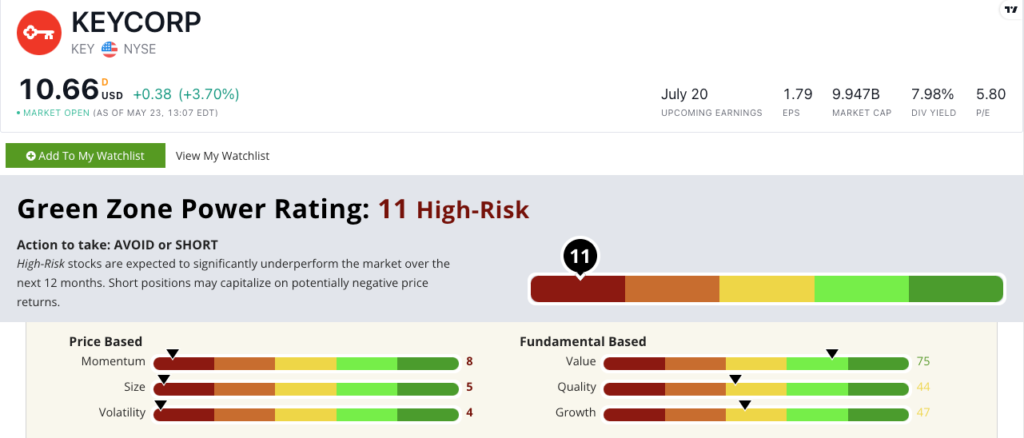

Green Zone Power Ratings: KeyCorp

KeyCorp stock rates a “High-Risk” 11 overall on our proprietary Green Zone Power Ratings system.

This means we expect KEY to significantly underperform the broader market over the next 12 months.

The stock scores in the red on all three of our price-based factors (momentum, size and volatility).

It does rate a “Bullish” 75 on our value factor, but it’s neutral on our other two fundamental factors (quality and growth).

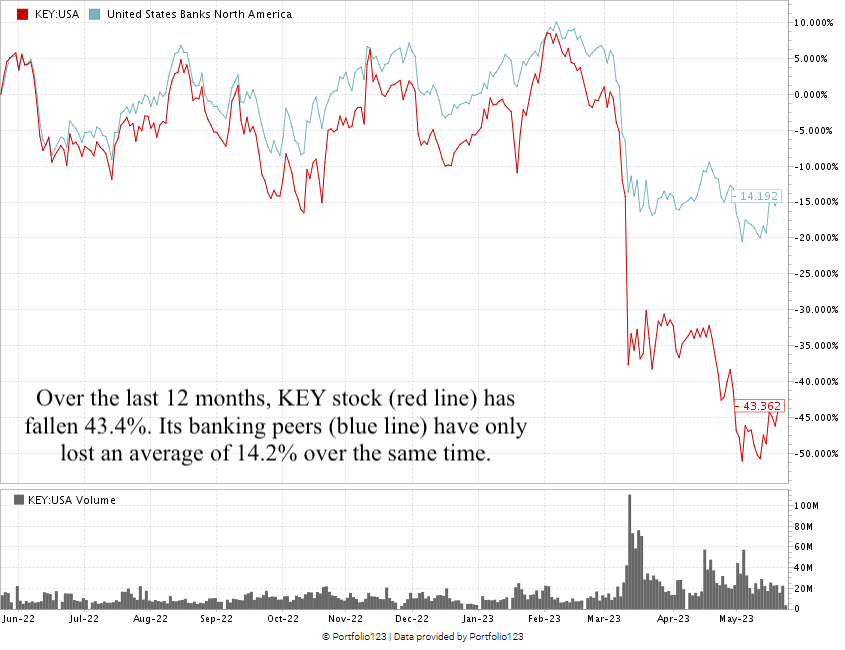

The stock’s momentum tells you all you need to know:

Created in May 2023.

Over the last 12 months, KEY has fallen 43.4%. Its U.S. bank peers have lost an average of 14.2% during the same time.

KEY scores a “High-Risk” 11 on our proprietary Green Zone Power Ratings system. We expect it to significantly underperform the broader market over the next 12 months.

Bottom line: This mini banking crisis may turn into something much worse as 2023 rolls along. More banks struggling with a decline in deposits and an increase in loan delinquencies could collapse like we’ve seen with Silicon Valley Bank, Signature Bank and First Republic.

Troubling data for KEY in both areas show potential danger for this bank.

And our Green Zone Power Ratings system shows us it’s a stock you want to keep out of your portfolio.

Adam O’Dell has also been tracking this banking situation closely. And he believes we’re in the early innings of a broader crisis.

He’s found 282 banks that are at a high risk of failure now. And he’s got an “off Wall Street” trade that he believes will help investors make gains as this situation develops.

Elite investors have already banked profits with this trade. And Adam’s going to show you how you can do the same next Wednesday. Click here to sign up for his free upcoming presentation.

Stay tuned: Tomorrow, Chad is going to walk you through how he used Green Zone Power Ratings to create his own shortlist of banks to avoid.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets