The third-quarter earnings season is coming to a close amid a government shutdown and the benchmark S&P 500 touching new highs.

While analysts are still laying out their projections for fourth-quarter earnings, I came across some interesting data from market data firm FactSet that shows industry experts are confident this bull market will continue to charge higher over the next year.

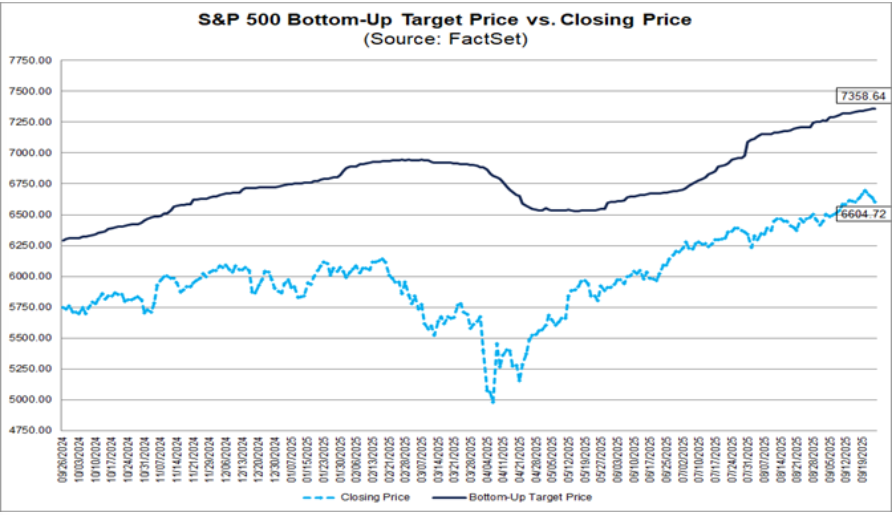

Check it out:

Analysts, in aggregate, predict that the S&P 500’s price will rise 11.4% over the next 12 months, based on the difference between the bottom-up target price and the index’s closing price (light blue line) at the end of September.

The bottom-up target is calculated by aggregating the median target price estimates of all companies on the index.

The health care sector is expected to see the largest increase, at 15.5%. The smallest increase is projected in the communication services sector at 7.5%. Either way, analysts expect all major sectors to gain ground.

It will be interesting to see if analysts accurately predict this new rise in the S&P 500.

We’ll keep an eye on this trend as the next 12 months unfold.

For now, let’s bring it back to the present and analyze potentially “bullish” earnings for next week…

“Bullish” Earnings to Watch

These stocks are expected to beat their previous quarter’s earnings per share (EPS), and thus, if those expectations are met or exceeded, they could potentially trade higher.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

As earnings season winds down, the number of S&P 500 companies reporting decreases.

Here is the one company that made this week’s list:

Popular soft drink manufacturer PepsiCo Inc. (PEP) had a rough start to 2025, experiencing a 1.8% year-over-year decline in revenue and a 9.3% drop in EPS for the first quarter.

The second quarter provided a bright side as PepsiCo increased its quarterly revenue by nearly $9 billion and its EPS slightly.

All told, PepsiCo has beaten the consensus EPS estimates in three of the last four quarters, and I expect it to do so again.

Notably, when PepsiCo beat expectations in the second quarter, its stock surged 7.5% in a single day.

Following a drop in early September, the stock has been trading in a range between $141 and $144.

Beating estimates a second time in a row could not only bolster PEP out of its range-bound trading, but could improve its “Bearish” rating on Adam’s Green Zone Power Rating system.

Now, we’ll look at potentially “bearish” earnings for next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

As with our “bullish” screen, I opened the door to all companies this week.

Here are the three companies that passed this screen:

While the projected $4 drop in EPS by AZZ Inc. (AZZ) is intriguing, I want to focus on Delta Air Lines Inc. (DAL).

The commercial airline giant had previously reported that demand was stabilizing and resilient, and that diverse revenue streams were helping to buoy its bottom line.

One thing to keep in mind … if the company’s EPS comes in as expected, it would represent a 6% year-over-year increase.

Fuel costs are down, and studies suggest that domestic air travel increased during the summer months; however, air travel prices rose 4% between June and July, which may have deterred some vacationers.

While analysts are expecting a down quarter, we might be in for a surprise…

I think Delta will beat expectations here, but its earnings will remain lower than the previous quarter.

That could certainly help its already “Bullish” rating on our Green Zone Power Rating system.

That’s all I have for you today.

Make sure to enjoy your weekend!

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets