If you’re shopping for high-yield closed-end funds (CEFs), two numbers are critical:

- The dividend: There are about 500 CEFs out there, and they boast huge payouts of 7% on average. Many also pay monthly.

- The discount: Due to a quirk in the CEF structure, these funds often trade at discounts to the per-share value of their portfolios. Called the discount to net asset value (NAV), this indicator is the clearest indicator of imminent price gains I’ve ever seen in an investment.

A Proven Gain Predictor

Thanks to the discount to NAV — which is available on any fund screener — you literally have a CEF’s market price on a string.

Consider the DoubleLine Income Solutions Fund (DSL), a long-time holding of my Contrarian Income Report service. The “Bond God” himself, Jeffrey Gundlach, runs DSL; he’s known for his history of accurate contrarian calls, including his warning of a building subprime-mortgage crisis in 2007.

There’s a problem with investing in DSL, though: Gundlach’s star power and the fund’s 11.7% dividend, paid monthly, make it a tough (but not impossible) fund to buy at a discount; as I write this, it trades at a 1.5% premium to NAV.

We always demand a discount when investing in CEFs, so I don’t see DSL as a great place to put money now. But it is worth putting on your watch list, because you can make a mint by getting in when DSL’s market price does drop below its NAV.

For example, on December 21, 2018, DSL traded at a very unusual 14% discount. Buyers who jumped in saw that markdown flip to a 5.3% premium over the next 11 months. That disappearing discount catapulted DSL to nearly triple the return of the corporate-bond benchmark SPDR Bloomberg Barclays High-Yield Bond ETF (JNK). DSL even beat the S&P 500 — something income plays like this fund simply aren’t supposed to do!

Discount Disappears, DSL Soars

And these returns include dividends — so a third of DSL’s 33% return in that 11-month period was in cash!

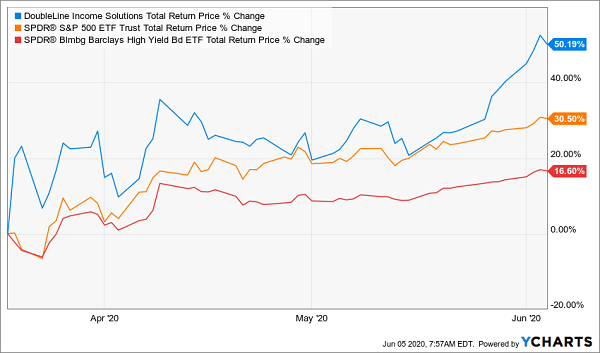

Fast-forward to the COVID-19 crisis, and history is repeating itself: On March 18, 2020, DSL’s discount bottomed at 28% — an all-time low — before bouncing to today’s 1.5% premium. That sent the fund’s market price soaring, driving an incredible 50% total return in just under three months:

Discount Vanishes, DSL Skyrockets

This is no coincidence, by the way. I’ve seen it happen over and over again with CEFs; it’s why they’re my favorite play for outsized income and gains.

Now that we’ve talked about how you can “work” a fund’s discount for upside, let’s move to the other side of the story: How these discounts make our CEF dividends bigger — and safer.

Big Discount, Big Dividend

With regular stocks, most people don’t connect a company’s value — usually measured by the P/E ratio — to the size, or safety, of its dividend.

If anything, we might think the dividend on a “cheap” stock is more of a worry because some stocks are cheap for a reason: broken business models, inefficient operations or, perhaps, an industry that’s been disrupted by a company like Amazon.com (AMZN).

With CEFs, though, the script flips. These funds’ discounts are driven more by the mood of CEF investors than anything relating to the fund itself, which is why we could so accurately call DSL’s next move up.

And that, in an interesting way, makes the dividend safer.

Here’s why: Let’s say you own the Gabelli Dividend & Income Trust (GDV), run by another high-powered manager: value-investing guru Mario Gabelli.

Source: Gabelli Dividend & Income Trust March 31 fact sheet

It’s easy to see that GDV is well-positioned for the post-lockdown world: As paper money becomes a relic, American Express (AXP) and MasterCard (MA) stand to gain. The value of telecoms and tech plays like Verizon Communications (VZ) and Microsoft (MSFT) these days is obvious, and, with people cooking more meals at home, Mondelez International (MDLZ) is a smart stock to own.

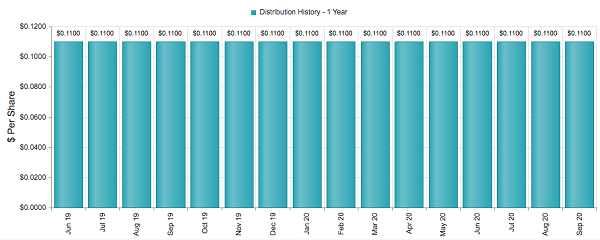

GDV also yields an outsized 7%, and its dividend is one of the steadiest among CEFs, having grown steadily since the market bottomed at the end of the last financial crisis, in 2009. Here’s what that solid payout looks like dropping into your account every month:

Gabelli’s Pandemic-Proof Monthly Dividend

Source: CEFConnect.com

But despite all this, GDV trades at a 10% discount to NAV today.

Here’s how that undeserved discount supports our payout: When we buy GDV, we pay the discounted market price. And when we calculate yield, we add up its monthly payouts and divide the total by that price.

But here’s the twist: Gabelli and his crew don’t care about GDV’s market price (at least when it comes to dividends)! They’re fixated on the yield on NAV — or the annual dividend divided by the per-share NAV — because that’s how much they have to earn on GDV’s portfolio to support the payout. And because per-share NAV is higher than the market price, that yield comes out to 6.2%, which is obviously much easier for them to get than 7%.

(To put that in context, either return is easy for GDV to earn: its annualized total NAV return is 9.6% over the last decade, according to CEF Connect.)

The takeaway? If a CEF’s dividend looks unsustainable, make sure you check it against the fund’s NAV, not its market price. The payout could be a lot safer than it seems.

To learn more about generating monthly dividends as high as 8%, click here.