Have we finally reached the tipping point?

That question is on a lot of our minds now…

Consumer price inflation sank to 3.2% for the 12 months that ended in October — the lowest annual reading since March 2021. Wholesale inflation for October also cooled 0.5% to 1.3% year over year. That’s the largest monthly drop since April 2020!

Pair that with weaker jobs data and a Federal Reserve that has pressed pause on interest rate hikes, and you get the massive stock market rally we’ve enjoyed over the last couple of weeks. It’s a welcome change after a rough October, that’s for sure!

Our Chief Research Analyst Matt Clark has discovered some interesting data that may clue us in on what’s next for the broader market. Watch out for that in Monday’s Stock Power Daily.

So I figured it made sense to look a little closer at some of these stocks that are driving major indexes higher. We have the perfect tool to do that with Green Zone Power Ratings after all.

We’ll get into it with one of the biggest tech stocks out there…

META Looks Strong

One of my favorite things to do with our proprietary ratings system is search for a ticker shortly after the company reports earnings — when shares are ripping higher or crashing down to earth.

Seeing a company rating gives me insight into where that share price should head next.

Shares of Facebook parent company Meta Platforms Inc. (Nasdaq: META) dipped to around $288 in the days following its October 24 earnings call. Now shares are 15% higher and trending up and to the right again.

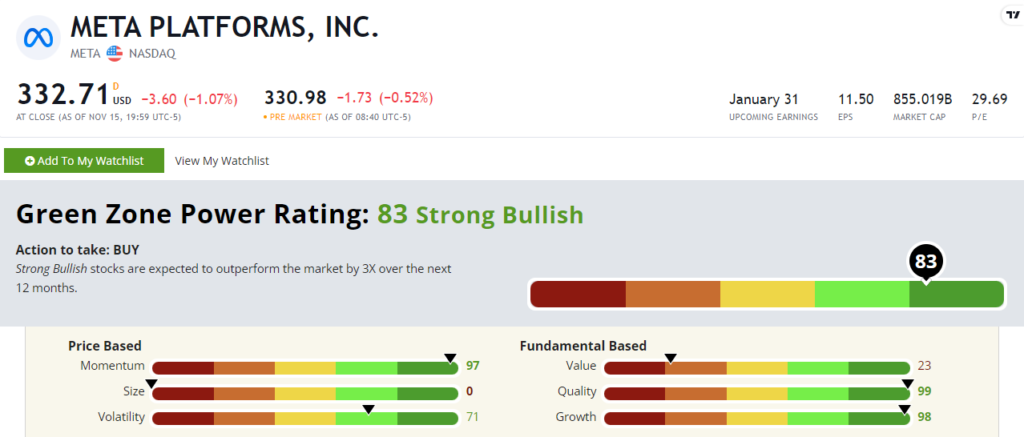

And Green Zone Power Ratings show META stock is set to continue its outperformance from here.

Meta Platforms stock rates a “Strong Bullish” 83 out of 100 in Green Zone Power Ratings. That means it’s expected to outperform the broader market by 3X over the next 12 months.

As I mentioned last week, META being a massive tech stock drags its Size and Value ratings down. It has an $855 billion market capitalization. This isn’t an unknown small-cap stock…

But everything else looks stellar!

Year to date, META stock has gained an incredible 166%, which is why that Momentum rating tops the charts at 97 out of 100.

And a closer look at its latest earnings report shows why it boasts a 98 rating on Growth. Revenue for the last quarter was at $34.1 billion, a 23% year-over-year increase. Net income grew by an annual rate of 163% as well!

These are all great signs for META stock as we see if this rally will continue throughout the holiday season.

Into the Unknown

Of course, the stock market isn’t full of METAs. And some rallies can’t be trusted.

That brings me to Virgin Galactic Holdings Inc. (NYSE: SPCE)…

Near term, SPCE stock looks like a fantastic opportunity. It’s up 25% over the last month. It even gained 10% on Wednesday after appointing a new member to its board of directors.

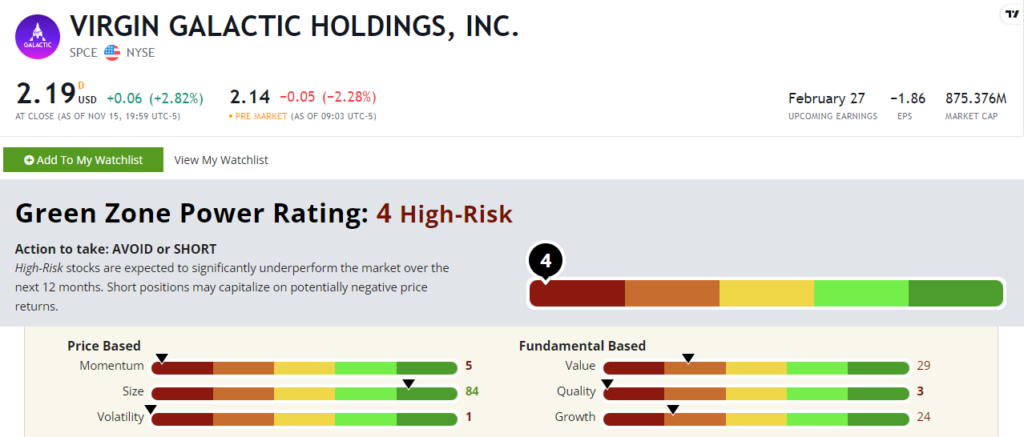

But if you run it through Green Zone Power Ratings, you get a more accurate picture of the stock’s prospects going forward.

SPCE stock rates a “High-Risk” 4 out of 100 in Adam’s system. That means it’s due to vastly underperform the broader market over the next 12 months.

I mentioned Virgin Galactic stock has gained 25% over the last month, but zooming out shows a 37% loss year to date. That’s why SPCE rates a 5 out of 100 on Momentum.

Virgin also reported a -6,053% net profit margin and -$114.2 million in operating income for the quarter ending in September 2023. I understand space tourism is a wildly innovative industry, but losses are losses. And it shows why SPCE rates a 3 out of 100 on Quality.

There may be more short-term potential here, but Green Zone Power Ratings says to stay away if you’re looking to buy and hold.

Momentum, Value and Quality Are the Keys

This rally has been a welcome change after a nasty October. And Green Zone Power Ratings will help you find some strong stocks participating in the march higher. If you want to look a ticker up, just look for the search bar above.

Of course, you could also follow Adam’s guidance in his premium Infinite Momentum Alert stock trading advisory.

Each month, he uses his Momentum, Value and Quality factors, along with powerful artificial intelligence technology to target the 10 best stocks to buy and hold for the next four weeks.

He has just released his next batch of recommendations, so now is the perfect time to sign up and make the most of a holiday rally. Click here to learn how to gain access now.

Until next time,

Chad Stone

Managing Editor, Money & Markets