That old adage that real estate is the No. 1 game in town keeps running through my head.

It sure doesn’t feel like that’s the case in 2023.

As Matt pointed out yesterday, we’re stuck in a high interest rate environment for the foreseeable future. Combine 8%+ mortgage rates with tight supply, and you run into the perfect storm of expensive loans on expensive properties.

Something has to give, right?!

It got me thinking about the broader real estate sector. Because you can do so much more than just invest in physical property. You can buy real estate investment trusts (REITs) for steady income, or buy real estate brokerage stocks or homebuilders.

The best part is that Adam O’Dell’s proprietary Green Zone Power Ratings system gives us a chance to get a quick snapshot of any number of stocks we’re considering.

Let’s do just that today with some popular real estate stocks.

Zillow’s COVID Bump and Slump

Back in July 2020, my wife and I were on Zillow every day hunting for new digs. We’d been back in Florida for about six months and living with her parents while we figured out our next step.

COVID was in full swing, and we were desperate to get out. We closed on our townhouse shortly after in the world’s strangest real estate transaction, and I’m thankful every day for our timing.

We weren’t the only ones excited about Zillow back then.

After the COVID crash, Zillow Group Inc. (Nasdaq: Z) stock soared more than 675% to its February 2021 peak as the pandemic real estate boom took off.

But the hype didn’t last. Throughout 2021, Z stock sank lower, and it’s been trading in a fairly tight range since mid-2022.

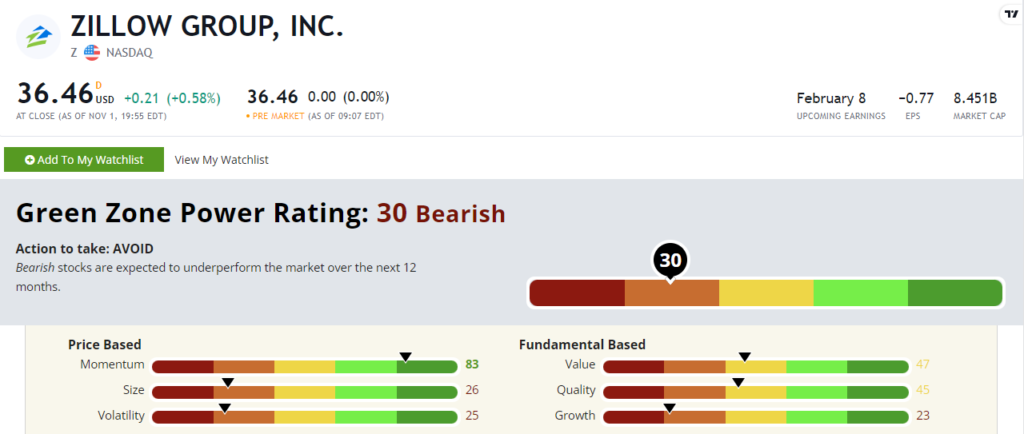

And looking at its Green Zone Power Ratings, this is one to avoid right now.

Zillow stock rates a “Bearish” 30 out of 100, which means we expect it to underperform the broader market from here.

This is a massive, $8 billion company, hence its 26 rating on the Size factor. It also has higher price swings due to its 25 rating on Volatility. It’s more volatile than 75% of the market!

Since the stock has managed a 17% gain over the last year, its Momentum rating is still well in the green. But zooming in, it’s actually lost almost 19% of its stock value over the last six months. Its other poor ratings are a drag on the price. And with the state of the housing market, it’s tough to imagine another huge bump like we saw in 2020.

A Risky Residential REIT

Matt’s story yesterday got me thinking about residential REITs. These investment trusts buy and manage rental properties, which sounds like a strong business when homes are too expensive. Everyone’s got to live somewhere…

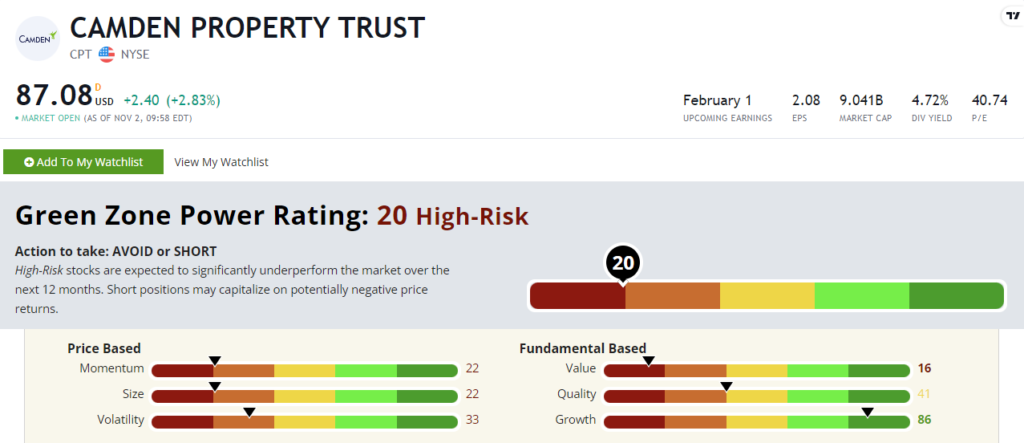

And one of the biggest in the business is Camden Property Trust (NYSE: CPT). This $9.2 billion trust owns luxury apartments across some of the fastest-growing real estate markets such as Atlanta, Charlotte, Houston and Dallas.

But one glance at Green Zone Power Ratings tells me to steer clear. With a “High-Risk” 20 out of 100, CPT stock should vastly underperform over the next 12 months.

It scores in the red on 4 out of 6 of Adam’s factors. Year to date, CPT stock has declined almost 22%, which explains the 22 on Momentum. Its price-to-earnings ratio is also at 41, compared to 25 in the broader real estate investment trust industry. That’s partly why it scores a 16 out of 100 on Value.

CPT does boast a solid 4.7% dividend yield at the moment. As a REIT, Camden does have to pay out 90% of its taxable profits to its investors. But as we’ve mentioned before, the best dividend stocks are ones that deliver capital gains on top of a consistent payout. That’s the best of both worlds scenario!

So after a little research, I landed on two real estate stocks to avoid. And if you want to look up any others, just look for the search bar at the top of this page and start searching!

Until next time,

Chad Stone

Managing Editor, Money & Markets

P.S. I mentioned homebuilders up top, and if you’re looking for a “Strong Bullish” company that’s working to increase the home supply and solve America’s housing crunch, Adam has you covered.

He recommended a homebuilder stock earlier this year to his Green Zone Fortunes subscribers, and it’s still within his buy zone. It’s even lower than his initial recommendation, but the stock has surged more than 15% higher this week alone! If you want to find out how to access Adam’s highest conviction homebuilder stock, click here.