As a trader, I was never more excited to see a month end.

October was brutal.

So much so that the S&P 500 and the Nasdaq 100 indexes entered correction territory.

This happens when an index falls at least 10% from its most recent highs.

But history suggests this may not be a reason to sell everything and hibernate for the winter.

Let me tell you why and share how the Green Zone Power Ratings system can guide you through what might happen next.

How the Nasdaq Hit Correction Territory

Let me preface everything by saying that corrections like what we just experienced aren’t as rare as you may think.

Since its founding in 1971, the tech-heavy Nasdaq 100 has fallen 10% from its most recent high nearly 70 times. And there have been countless close calls, with the index falling 7%, 8% or 9%…

This time, however, it’s legitimate … and it only took about three months to get there:

It’s prudent to point out that the Nasdaq reached correction in March 2021 and ripped higher soon after. Before that, in February 2020, the index fell on COVID fears only to hit all-time highs in August on a resurgence in tech stocks.

Here are three huge reasons the Nasdaq fell into correction:

- Interest rates remain elevated — tech companies rely on borrowed money to continue development. The higher interest rates are, the more expensive it is to borrow … creating pressure and less profits.

- Little to no progress on reducing inflation — higher inflation drops money’s purchasing power, leading to higher production costs for companies…

- Geopolitical instability — conflict creates supply chain issues, a drop in consumer confidence and currency fluctuation … all things that negatively impact tech companies.

Our Green Zone Power Ratings system, however, tells us that it’s not a time to panic and sell off tech stocks.

A Nasdaq 100 Ratings X-Ray

I recently ran all the stocks in the Nasdaq 100 through an X-ray of our Green Zone Power Ratings system.

By plugging in every stock, I can get a complete ratings picture of not just individual stocks, but the index as a whole.

Here’s what I learned:

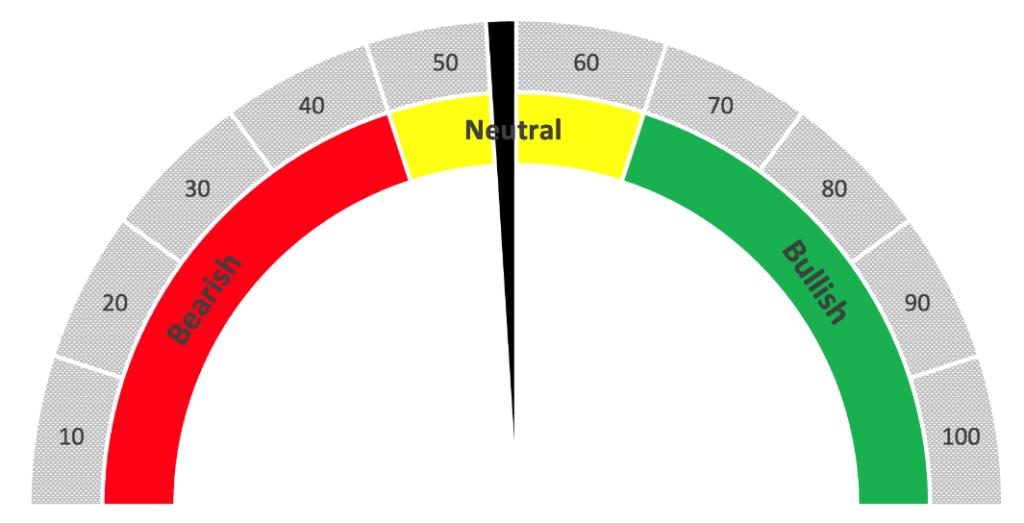

Nasdaq 100 Rates “Neutral”

Despite the recent 10% drop, the entire Nasdaq 100 still rates a “Neutral” on the Green Zone Power Ratings system. That simply means it should perform in line with the S&P 500 over the next 12 months.

That tells me this isn’t a time to sell off all of your tech holdings, but rather find those stocks that continue to rate “Bullish” and above.

The reason is that if those stocks held a “Bullish” rating or higher when the entire index was heading to correction territory, the expectation is they will perform even better when the correction reverses.

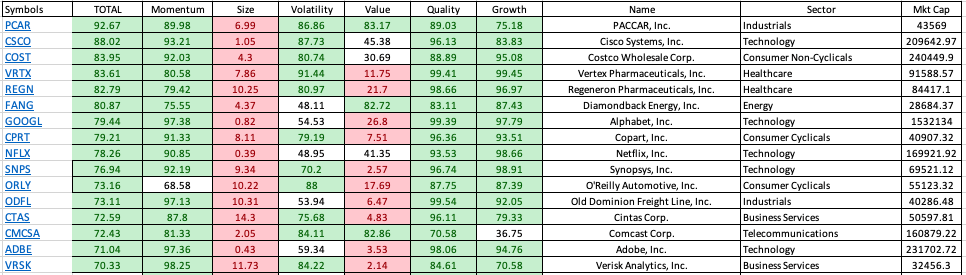

Sixteen stocks meet that criteria while 19 rate “Bearish” or below.

Here are the 16 stocks that rate “Bullish” or better on the Nasdaq 100 Index:

As you can see, there are plenty of massive, well-known names on the list that our system rates high, even while the index pushed lower.

Bottom line: These kinds of market corrections are not uncommon, nor should they be feared.

Recent history tells us the Nasdaq roars back to gains after these 10% drawdowns.

Our Green Zone Power Ratings system shows us what stocks are the best to invest in when that happens.

Needless to say, I’ll be keeping a close watch on our system to pinpoint the best stocks that will soar higher when this correction ends.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets