Most summers in Silicon Valley, venture capitalists (VCs) take advantage of the nice weather to vacation, play golf and enjoy the beaches on either coast …

That’s because the level of activity in early stage companies is typically very low in July and August.

So the big VC firms tend to kick back and relax.

But let me tell you, hardly anybody is playing golf this year … I’ve never seen a summer this active.

2019 is shaping up to be a banner year for early stage technology investments. Record after record is being shattered.

This has enormous implications for the technology market. And investors need to pay close attention.

Here’s why …

A Booming Trend

Longtime readers of mine will know I pay close attention to VC activity. Understanding where private firms are deploying capital informs smarter investment decisions when these companies go public. It also provides a lens into the most promising new technologies.

And for promising young tech firms, there has never been a better time to raise private capital …

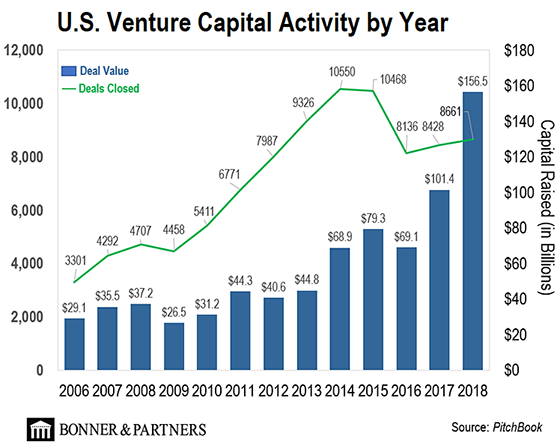

As you can see, the amount of venture capital flowing into private companies has been steadily rising since the early 2000s. VCs raised $156 billion in 2018 alone. And 2019 is shaping up to surpass that record.

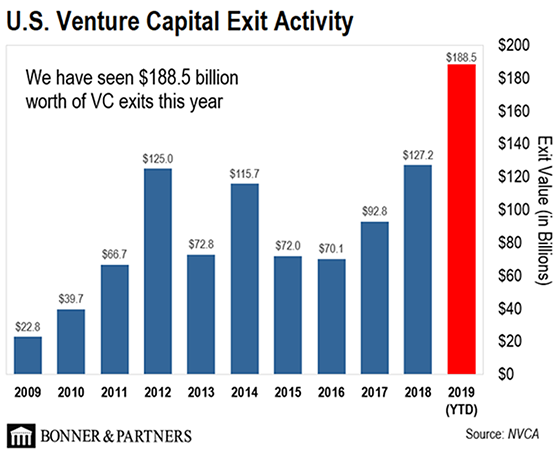

Importantly, 2019 has also seen record “exits” for VC-backed IPOs. An exit is when a venture capital firm sells its stake in a company it backed while the company was private.

As the chart below from the National Venture Capital Association (NVCA) illustrates, we have already seen $188.5 billion worth of VC exits in the wave of IPOs that have hit this year.

That’s an all-time record … And it’s only July.

Now, I know many of you will ask … Why should I care about VC investments or exits?

The answer is simple …

Virtuous Cycle

Imagine you’re a Silicon Valley venture capital firm. One of your early stage deals just had an exit, and you received a big payout. What would you do with that money?

You’d recover your original investment, plus some additional profits to further grow the business, and set some money aside.

But you’d take the majority of the profits you made and put it right back into the engine that created that wealth for you. And the limited partners, the individuals or funds that invest in the venture capital funds, will likely do the same.

This is the virtuous cycle of early stage investing.

Private capital flows into early stage technology companies.

Those companies go public, offering VCs and limited partners an exit and everyday investors a chance to finally invest in those companies.

Venture capital firms and limited partners take their money and reinvest in the next generation of bleeding-edge technology companies.

The cycle feeds off itself.

And right now, we’re seeing the benefits of that dynamic.

IPO Boom

In 2016, I predicted we were on the verge of a massive tech IPO boom. Here’s what I wrote to my readers:

(There is) a huge backlog of some of the greatest technology companies … waiting to go public … And some are among the greatest technology companies in history. Think of it like a massive bottleneck … a dam ready to explode.

2019 is the year that dam burst.

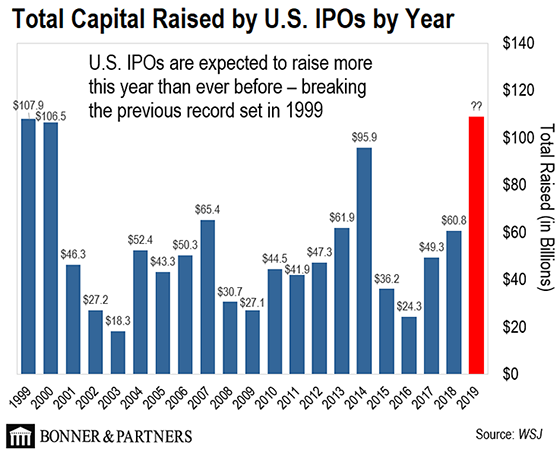

As you can see, the 2019 IPO frenzy is expected to eclipse the dot-com boom of 1999 … when 547 IPOs raised $107.9 billion. But unlike 1999 — when unproven companies went public at record pace — today’s IPO companies are more mature, with a clear business path.

Ultimately, 2019 will be a banner year for tech IPOs. And that will give investors the chance to invest in the most exciting companies on the planet.

Already, companies like Uber, Lyft, Pinterest and Slack have gone public. For the first time in years, average investors will have the chance to invest in leading-edge technology companies by simply clicking a button in their online brokerage accounts.

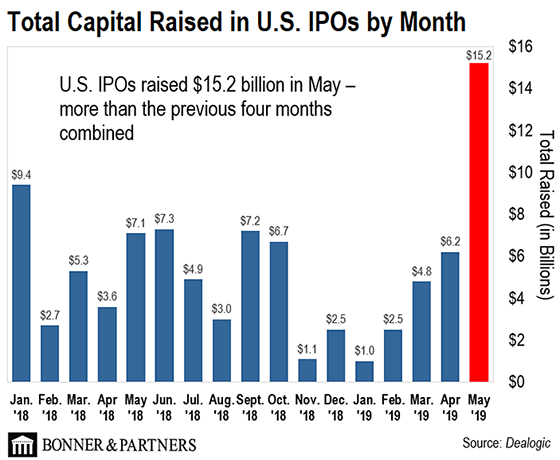

And this trend is only picking up. Take a look at total capital raised in IPOs since the start of 2018, broken down by month.

As you can see, May 2019 was a great month for IPOs. In fact, U.S. IPOs raised more money during the month of May than they did from January to April combined.

What does this all mean to you as an investor?

It means that, for the first time in years, everyday investors will be able to invest in the best early stage technology companies on the market.

In my 30 years working in high technology, I have never seen a market this robust. The amount of wealth creation we are witnessing right now is extraordinary.

This is where the highest investment returns will be in the years ahead. There has never been a better time to invest in quality technology stocks.

Regards,

Jeff Brown

Chief Technology Analyst, Bonner & Partners

P.S. There’s one final detail of this story I didn’t have time to get to here. There is one subsector of the technology market that has been overlooked for years. But I believe it has the potential for some of the highest, and quickest, returns available. I’m talking about doubling or tripling your original investment in months. The returns could easily be even higher.

And before you ask, no, I’m not talking about AI, 5G, or blockchain technology. I still love these technologies, but this idea is something else entirely.

I’ll give you all the details on July 24 at 8 p.m. ET. Go here to sign up.

• This article was originally published by Bonner & Partners. You can learn more about Bill and Bill Bonner’s Diary right here.