Good news for metal bulls: My intermediate target on gold is $1,609. And that’s just for starters. Longer term, gold could go much higher than that.

Even Citigroup has upped its target on the yellow metal, saying gold could reach $1,500 by year-end and as high as $1,600 in the next 12 months. They say this “bullish gold fever is justified.”

Should you be buying gold? Yes! And gold miners? Make that a “Heck, yes!”

My Supercycle Investor subscribers are sitting on a bunch of open gains in miners — to the tune of 67.6%, 36.2%, 17%, 15.5% and 10%. We plan to ride those picks MUCH higher. (Click here to see how you can join us today.)

Why? Because miners are leveraged to the metal. If gold goes from $1,200 to $1,400, that’s a 16.6% move. But what does that move mean for a gold miner with all-in mining costs averaging $1,100 per ounce? That means its profit margin per ounce has gone from $100 to $300.

In other words, the miner’s profit margin has TRIPLED!

That’s the power of leverage. And that’s why we use miners to ride any rally in the metal.

So speaking of that rally, let me give you my three reasons why gold is going to $1,600 — and beyond …

Reason No. 1: An Ultra-Accommodative Fed

Federal Reserve Chairman Jerome Powell has turned fully dovish on interest rates, and the rest of the Fed is lining up behind him. “Crosscurrents have reemerged,” Powell said in his testimony to Congress. Powell also repeated that the Fed would act as “appropriate” to keep the recovery going, and he also noted that weak inflation could be “more persistent.”

That’s dovish. Dovish. Dovish!

Meanwhile, the minutes of the last Federal Reserve Open Market Committee (FOMC) meeting were released. In it, multiple Fed policymakers said rate cuts were needed to cushion the effect of a trade war with China and to address the fact that inflation continues to fall short of the Fed’s 2% target.

That’s enough dovish feathers to stuff a good-sized pillowcase.

As a result, the market was recently pricing in a near-certainty of a 25-basis-point cut, and a 58% chance of a 50-basis-point cut this month. What’s more, the market is starting to cut in 75 basis points (three 25-basis-point cuts) by the end of the year.

Now let me tell you, I think the REAL reason Powell is open to cutting rates is because President Trump threatened to fire him if he didn’t.

Is it good or bad that the Fed is now subservient to the White House? It doesn’t matter. I just play the ball as it lies. And right now, it lies in the direction of more rate cuts coming, and soon.

Why does this matter for gold? Because higher interest rates prop up the U.S. dollar. Rate cuts weigh on the dollar. Since gold is priced in dollars, the metal tends to move opposite the currency. The dollar goes down? Gold goes up. It’s simple, really.

There are many other forces powering up gold, including massive central bank buying and the fact that it hasn’t been worth anyone’s while to build a new gold mine in years. And all those forces combine in the next chart I’m going to show you.

Reason No. 2: The Big Breakout

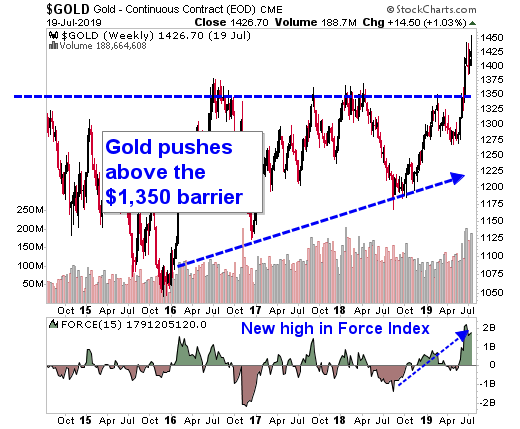

Gold is breaking out big-time. I’m not just talking on a weekly or monthly scale, though it’s doing that, too. I mean gold has broken out after consolidating sideways for six years. Take a look at this weekly chart …

For six long years, the $1,350 level held gold in check. Now, that level has shattered like a glass ceiling. At the same time, momentum is hitting new highs. That’s a strong sign that there will be follow-through on the breakout.

Reason No. 3: Bulls Fly at Half-mast

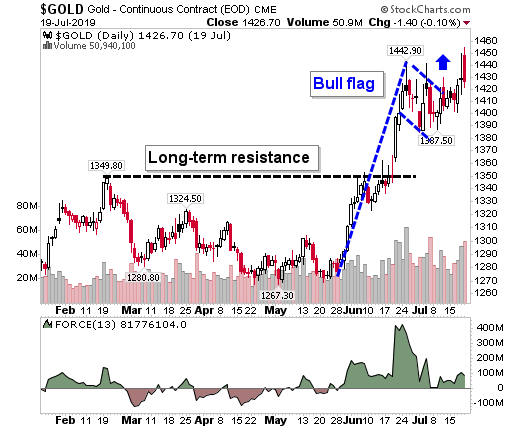

So how high can gold go? Let me show you my intermediate-term target, with a DAILY chart I gave my Supercycle Investor subscribers.

Gold sure looks like it is forming a “bull flag” pattern. The old saying goes, “Flags fly at half-mast.” That means if this bull flag resolves successfully, we could see gold surge to $1,609.

Gold could test lower levels down to its breakout as it hammers out this flag. And if it resolves in a bullish manner, gold could surge much higher than $1,609. That’s just an initial target.

I’ve recommended five gold and silver miners to my Supercycle Investor subscribers to ride the next leg of this rally. Some of those positions are up quite a bit already.

So, is it too late to buy? No! Make that, “heck, no!” It’s still early, just days in this big breakout.

Before you buy anything, do your research. Due diligence. On every single stock you add to your portfolio.

And if you don’t have time for that, then consider the VanEck Vectors Gold Miners ETF (NYSE: GDX). If you’d bought the GDX when I talked about it in late March, you’d already be up more than 12%. That’s running rings around the S&P 500’s 7.5% return in the same time frame.

There’s more to come for metals … and miners. Make sure you don’t miss it.

All the best,

Sean Brodrick