In today’s Marijuana Market Update, I cover a couple of exciting prospects:

- Mergers and acquisitions in the cannabis space.

- New additions to our YouTube channel.

Pessimistic Outlook for Cannabis Sector?

The last two years were rough on the cannabis industry, especially when you look at mergers and acquisitions.

In 2018, the cannabis industry boomed with 324 mergers and acquisitions (M&A) accounting for more than $7 billion in value — a massive jump from the 163 deals worth $1.9 billion in 2017.

However, as the cannabis industry started to contract in 2019, the number and value of mergers and acquisitions followed suit, with only 249 deals worth about $5 billion.

The COVID-19 pandemic didn’t stop transactions in the cannabis space, but it certainly slowed them down.

As of the third quarter of 2020, there were just 124 deals valued at $615 million, excluding the $4 billion reverse merger between Aphria and Tilray Inc. (Nasdaq: TLRY).

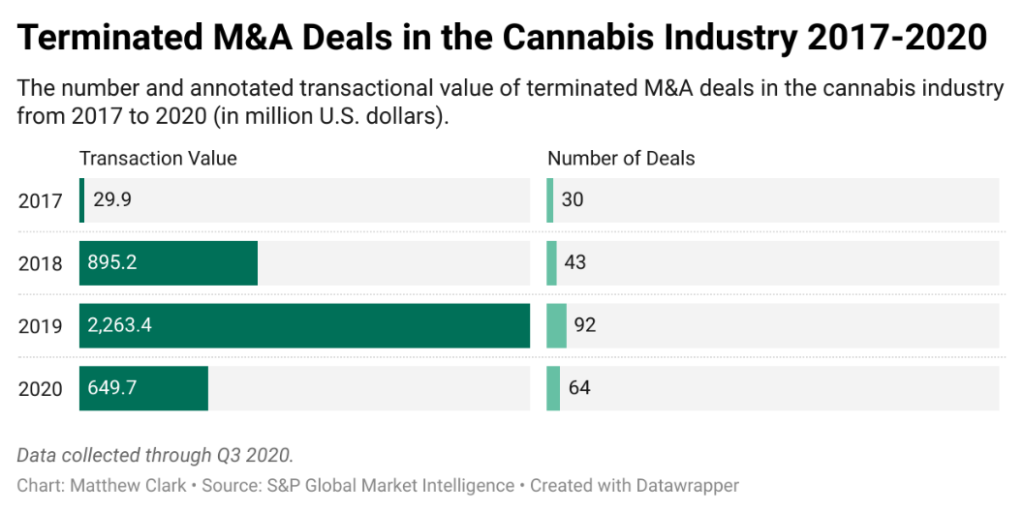

Another telling aspect of the cannabis M&A space is the number of terminated deals over the last four years.

In 2019, the cannabis industry saw 92 deals terminated, with a value of more than $2.2 billion — one of the biggest was Cresco backing out of buying Tryke Companies.

While there was a general slowdown in 2020, the 64 canceled transactions, valued at nearly $650 million, were still more than the total of actual transactions that year.

One might look at this data and these trends and expect the M&A market in cannabis to slow further in 2021, especially when considering the lack of movement for federal legalization in the U.S. and the fluctuation of cannabis stock prices.

But I have reason to believe that’s not an accurate assessment of the market.

2021’s Cannabis Mergers and Acquisitions

Just in May, there were several substantial merger announcements in cannabis:

- Hexo Corp. (NYSE: HEXO) just announced its $768 million acquisition of Redecan — a privately owned licensed producer in Canada.

- Curaleaf Holdings Inc. (OTC: CURLF) is acquiring one of the largest outdoor cultivation facilities in the U.S. for about $67 million — Colorado-based Los Suenos Farms.

- Trulieve Cannabis Corp. (OTC: TCNNF) announced a $2.1 billion acquisition of Harvest Health and Recreation, a Florida-based brand.

- GrowGeneration Corp. (Nasdaq: GRWG) has announced nine different acquisitions in 2021, according to Cannabis Business Times.

And 2021 kicked off with Ireland-based Jazz Pharmaceuticals PLC (Nasdaq: JAZZ) signing a $7.2 billion deal to acquire British pharma company GW Pharmaceuticals PLC (OTC: GWPRF).

All of these M&A deals in 2021 are coming though capital is still hard to come by for cannabis companies.

Until banking restrictions lift, cannabis companies have to dig into profits to enter into any M&A deals. As a result, what we’ll witness this year and in future years — regardless of where federal legalization stands — is the continued consolidation of the cannabis sector.

Bigger companies will look to small-scale cannabis businesses as an easy way to get footholds in new markets.

Larger cannabis businesses will be strategic in their deals — looking for companies in states in which they can gain a larger footprint and companies that can scale.

California still has a large group of independent operators, which could be prime ground for larger cannabis companies to seek out mergers.

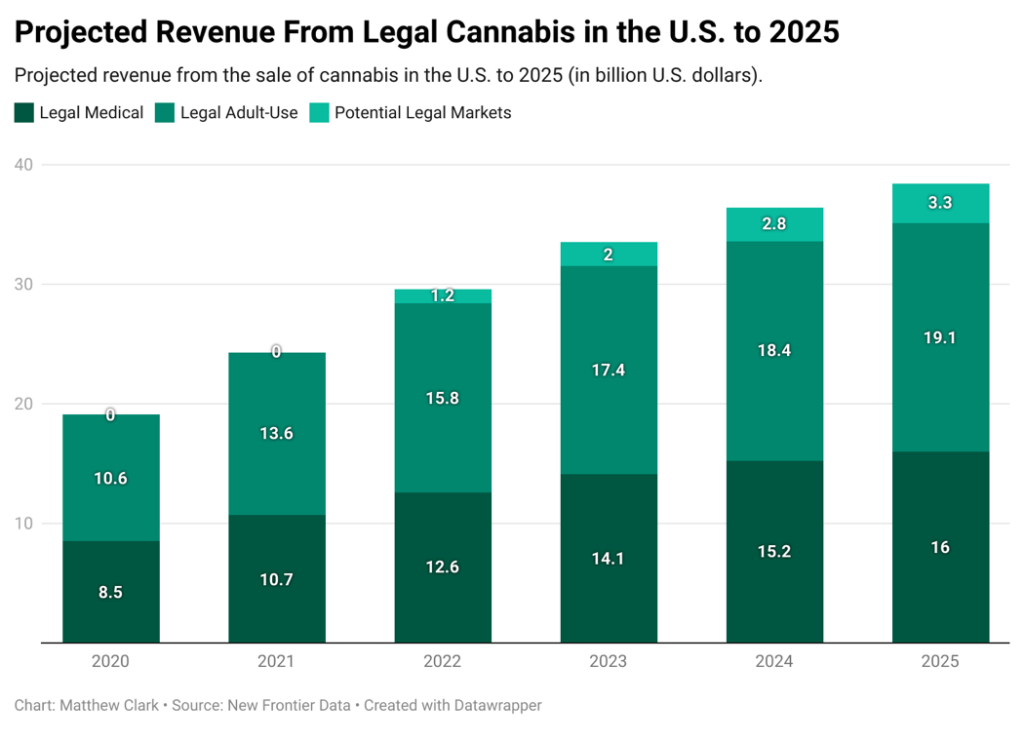

As you can see in the chart above, New Frontier Data projects that the U.S. legal cannabis market will reach a valuation of more than $35 billion by 2025 — meaning there’s a lot of market share for these companies to acquire.

That doesn’t consider the $3.3 billion in potential revenue from states that approved legalization measures in November 2020 and through the legislative process in 2021.

So, after a couple of harrowing years for the cannabis sector, my conviction is that 2021 will see strong M&A activity, regardless of whether Congress passes federal legalization.

New YouTube “Join” Feature

The newest additions to our YouTube channel are available to you today!

Click here or watch the video below to get the full story:

After a lot of hard work from the team, we’re thrilled to announce that we’ve enhanced our community by creating a new membership opportunity.

Before you ask, nothing that you see now will change — I’ll still bring you cannabis market insight each week.

However, we’re offering members new exclusive content, including:

- Interviews with cannabis insiders.

- Blog posts, stock analysis and company breakdowns.

- More content related to our Cannabis Watchlist.

- Monthly live chats with me, where we’ll discuss cannabis stocks, the cannabis sector and much more.

To find out more, please click here.

That said, I want to thank all of you who watch our videos. We do it because we want to bring you the best insights into cannabis and investing.

If you do have a cannabis stock you’d like me to look at or want to share your thoughts on our community expansion, email me at feedback@moneyandmarkets.com.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask your questions to Chief Investment Strategist Adam O’Dell.

Green Zone Fortunes co-editor Charles Sizemore also has a weekly series called Investing With Charles, where he breaks down dividend investing each week.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.