Last time I made a case for the $17 billion global salmon market being ripe for disruption.

In short, consumer preferences are shifting toward climate-friendly protein sources. That favors fish production over chicken, pork and beef … and it favors production that’s geographically close to its customers. That cuts down on the cost and environmental impact of shipping products halfway around the world.

Land-based Recirculation Aquaculture Systems (RAS) are already proving advantageous over traditional sea-case salmon farms.

And one company’s “Super Salmon” model is ready to revolutionize the fish farming process, putting more money in the pockets of its investors.

What is the “Super Salmon” Model?

First, let’s play with the lemonade-stand analogy …

Imagine your kid is running a serious lemonade-stand operation, and you want to help her become a master of business.

She sources lemons from the grocery store and earns a $0.50 profit for each cup she sells.

One day, she meets a neighbor who passes by on a morning run. The guy is interested in your daughter’s lemonade stand because he happens to grow “Super Lemons” in his backyard.

See, as a botany Ph.D. and avid grower, he’s discovered a new breed of lemon — the result of cross-breeding a conventional lemon and a special species of lemon that’s previously been ignored.

Your neighbor’s Super Lemons produce 70% more juice than conventional lemons. And they cost 25% less to plant and grow to harvest weight, to boot!

After a five-minute chat and a glass of her wares, he wants to partner with your daughter to get his Super Lemons to market.

As her business advisor, you explain to your daughter that for a lower cost, she’ll be able to produce more lemonade. And that will increase her profits, from $0.50 per cup to $1 per cup.

It’s a no-brainer. And, of course, your enterprising daughter is on board with the plan!

“Super Salmon” Slash Costs

As far-fetched as it may sound, the small innovative salmon-farming company I’ve found is doing precisely that.

They’ve used genetic-engineering techniques — things like selective breeding and gene editing — to create a “Super Salmon.”

This “Super Salmon” grows to its typical harvest weight of almost 9 pounds in just 18 months, versus the 26 months it takes for a conventional farm-raised salmon. That allows the operation to output 70% more fish.

And the Super Salmon requires 25% less feed, which is what land-based RAS operations spend the most on.

Get this … this company has calculated its profit margins to be 2X greater than those of conventional salmon farms.

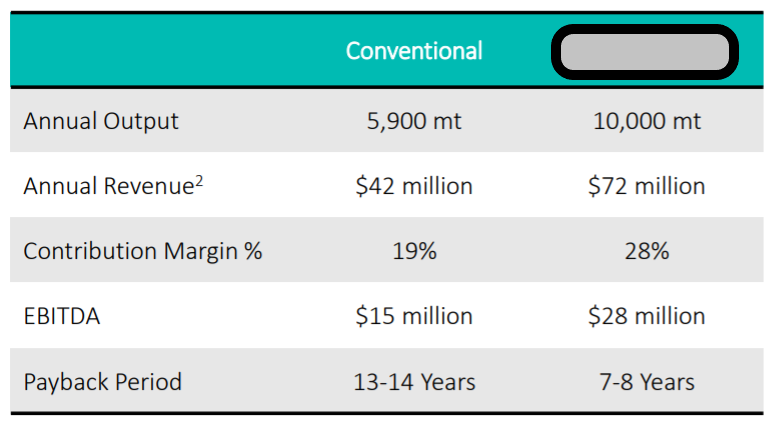

Here’s a table from the company’s latest investor presentation. It shows the economics of conventional salmon farming on the left, and that of its “Super Salmon,” on the right.

As you can see, annual output of the Super Salmon model is calculated to produce $72 million in revenue versus $42 million from the conventional model — an improvement of 71%.

Then, owed to a wider profit margin (28% versus 19%), the company’s net earnings (“EBITDA” in the table) are calculated at $28 million, versus $15 million under a conventional model. That’s nearly a doubling of its profits!

Of course, those specific numbers apply to an annual output level of 10,000 metric tons (MT) of Super Salmon. It’s an illustration that shows the relatively superior profitability of the Super Salmon model overall.

Currently, the company that’s pioneering this Super Salmon model is producing 1,200 MT batches … and it’s only just finished harvesting its first batch. An additional six batches have been started — which is enough to produce roughly one batch per quarter between now and the first quarter of 2023.

A quick back-of-the-envelop calculation shows this operation expects to earn a bit more than $8 million in revenue per 1,200 MT batch of its Super Salmon, and a net profit of more than $3 million.

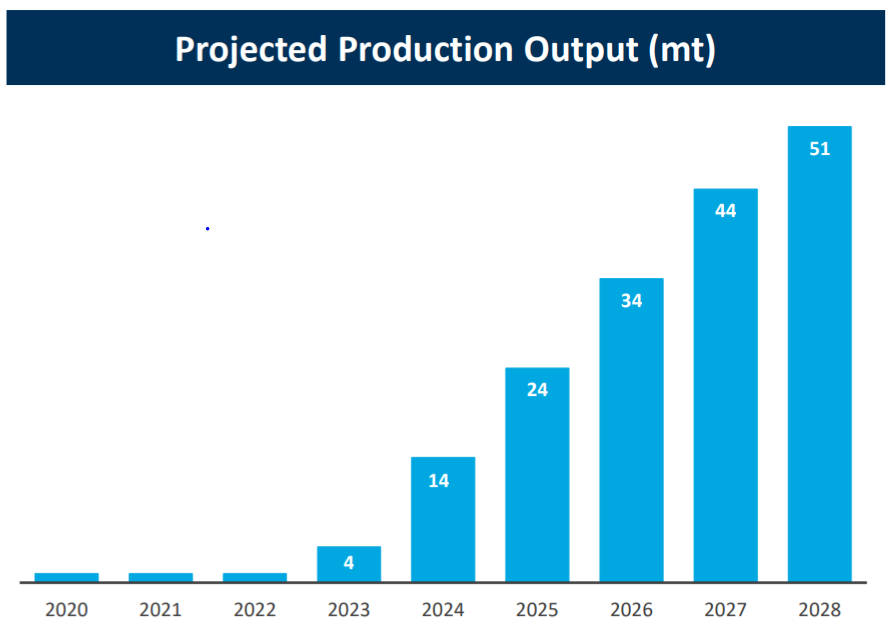

Obviously, these are “small potatoes” numbers relative to the $17 billion global salmon market. But this is only the beginning for this company … it has plans to ramp up production to 50,000 MT over the next several years.

At those levels, this operation could be netting north of $140 million per year!

This sets this innovative aquaculture company up for a massive runway of growth and profitability ahead. Currently, shares of the company’s stock are trading for less than $6. And it’s not hard to understand why the shares are so cheap — the company isn’t quite profitable yet, and with a market capitalization of just over $400 million … almost nobody knows about them!

But I don’t expect shares to stay this cheap for long. Assigning a reasonable price-to-earnings ratio of 25 to the company’s potential 2028 earnings of $140 million gives us a price target of $50 per share — roughly 10-times greater than the stock’s current price!

Of course, that’s a loosely-held target because so much can change in the next few years. Still, I think it highlights the potential for this company’s stock to grow many multiples of its current valuation.

It’s just getting started and it has a competitive moat thanks to its first-mover status in this cutting-edge application of DNA science in aquaculture.

I’ve made a detailed special report on this company available to subscribers of my Green Zone Fortunes service. And this stock is only one of my top four DNA buys for the genomics revolution.

If you would like to learn more, including one company leading the DNA mega trend with its technology I call “Imperium,” check out my special presentation here.

Join my Green Zone Fortunes service today and you’ll gain access to these special reports, my highest-conviction monthly stock recommendations based on my Green Zone Ratings system and guidance on the best times to buy and sell across multiple stock trends I’m following closely.

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets