Money & Markets Week Ahead for the week of January 10, 2021: Let’s see how the 2021 IPO market is shaping up.

Last week, the Nasdaq index topped 13,000 for the first time in history despite increased COVID-19 hospitalizations and a riot in the nation’s capital.

Other major indexes moved higher as well.

Here are some things investors should watch on Wall Street this week:

On the 2021 IPO Front

As it is early in the calendar year, there are no initial public offerings (IPOs) on the schedule this week.

Looking back, 2020 was a big year for IPOs as special purpose acquisition companies (SPACS) drew a lot of headlines.

IPO proceeds topped $78 billion in 2020, according to Renaissance Capital. That’s the second-largest total in the last decade.

218 IPOs launched in 2020

Here are some of the IPO highlights of 2020:

- Cloud firm Snowflake Inc. (NYSE: SNOW) came to market with the largest software IPO valuation at $33.2 billion.

- Vacation rental online marketplace Airbnb Inc. (Nasdaq: ABNB) launched its IPO like gangbusters, priced at $68 per share — well above its intended range.

But 2021 could be an even bigger year. Here are some IPOs to keep an eye on in the new year:

- Coinbase — This cryptocurrency exchange plans to launch its IPO sometime in February. Its valuation could top $8 billion. With bitcoin hitting all-time highs recently, I expect Coinbase to come in strong. It boasts more than 35 million investors around the world. The big question here is whether Coinbase is turning a profit.

- Roblox — This isn’t your ordinary online gaming company. It is not only a platform but a creation system. One in four of its users are under the age of nine. It has more than 960,000 developers on the platform and more than 31 million daily active users. Its IPO is expected to launch sometime in the first quarter of 2021 at a valuation of around $8 billion.

- Instacart — 2020 and the COVID-19 pandemic was a big deal for this product delivery service. The company has agreements with more than 400 retailers with 30,000 stores. That means it reaches 80% of the U.S. and 70% of Canada. It recently raised $200 million in a fundraising round, which followed a $225 million round. The bottom line is that Instacart could be one of the biggest IPOs of the first half of the year.

- Robinhood — The online brokerage app took off in 2020 with the stock market’s resurgence following the “coronavirus crash.” The platform has nearly 13 million users while providing zero-commission trading via its mobile app. There is no firm date for the IPO, but I expect it sometime this year.

Deeper Dive: Taiwan Semiconductor Earnings

Earnings are light this week until Friday. That’s when banks kick off the fourth-quarter earnings season.

But one company driving a lot of 5G headlines will close out the third-quarter earnings season on Thursday.

Taiwan Semiconductor Mfg. Co. Ltd. (NYSE: TSM) is at the center of the 5G rollout.

What is TSM? Taiwan Semiconductor develops and sells integrated circuits and semiconductors.

This technology is found in products like smartphones, tablets and computers. It’s integral in adapting these devices to 5G technology speed.

The big difference with TSM is that it also serves as a foundry. That means TSM manufactures semiconductors for other companies that, in turn, sell them to big tech institutions.

Last time out: In their last quarterly report, TSM reported earnings per share of $0.92 on revenue of $12.4 billion.

That beat Wall Street expectations on both counts. Analysts expected earnings of $0.84 per share on $11.8 billion in revenue.

TSM Beats Wall Street Expectations

The company has beaten or met expectations for both earnings and revenue in nine of the last 10 quarters.

What to expect this time: While the rollout of 5G technology was slowed by the COVID-19 pandemic, TSM kept on trucking.

While the company is a big player in 5G technology, TSM is still creating semiconductors and chips for current technology, which is what likely has kept its numbers as good as they are.

Expectations are for the company to report earnings of $0.93 per share on $12.7 billion in quarterly revenue.

I suspect those numbers will be pretty close to accurate. I could see another beat on both counts, but probably not to the degree of the last quarter.

Money & Markets Week Ahead: Data Dump

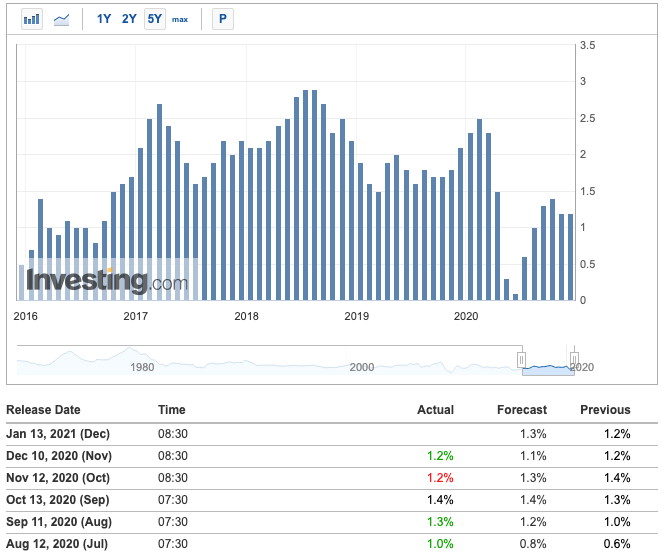

The U.S. Bureau of Labor Statistics will release its consumer price index for the month of December on Wednesday.

Those numbers will include month-over-month and year-over-year comparisons.

The index measures the price of goods and services, and it’s a component for measuring trends in purchasing and inflation.

In November, the index showed a 1.2% increase in the cost of goods and services. That was no change from October.

Analysts Forecast 1.3% Increase in CPI for December

The cost of goods and services has declined slightly from September and October.

Also, on Wednesday, the Federal Reserve Bank will release its Beige Book, which is a comprehensive report of economic conditions in all 12 Federal districts.

It is released eight times a year and typically two weeks before the meeting of the Federal Open Market Committee.

In its last release, the book indicated a modest or moderate expansion in economic activity across the country.

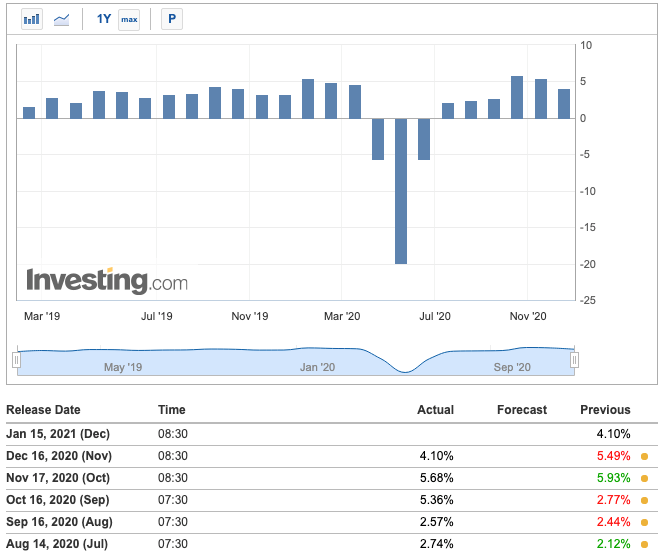

More sales data will drop on Friday when the U.S. Census Bureau releases its retail sales report for the month of December.

If the reading is higher than expected, it is a bullish signal for the dollar, while a lower-than-expected reading is bearish.

In November, the reading indicated a 4.1% change in retail prices — much lower than the 5.5% expectation.

Retail Sales Index Sluggish Over Last Three Months

In each of the last five quarters, retail sales have come in below expectations, suggesting a slowdown in the economic recovery from the COVID-19 pandemic.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports dropping this week:

Monday

SYNNEX Corp. (NYSE: SNX)

VOXX International Corp. (Nasdaq: VOXX)

KushCo Holdings Inc. (OTC: KSHB)

Tuesday

OrganiGram Holdings Inc. (Nasdaq: OGI)

EXFO Inc. (Nasdaq: EXFO)

Wednesday

Infosys Ltd. ADR (NYSE: INFY)

IHS Markit Ltd. (NYSE: INFO)

Wipro Ltd. ADR (NYSE: WIT)

Thursday

Taiwan Semiconductor Mfg. Co. Ltd. ADR (NYSE: TSM)

BlackRock Inc. (NYSE: BLK)

Platinum Group Metals Ltd. (NYSE: PLG)

Friday

JPMorgan & Chase Co. (NYSE: JPM)

Citigroup Inc. (NYSE: C)

Wells Fargo & Co. (NYSE: WFC)

PNC Financial Services Group Inc. (NYSE: PNC)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.