Economists express complex, even contradictory, ideas in simple terms — the idea that the cure for high prices is high prices, for example.

When prices are high, consumers demand less. As demand drops, prices drop to entice consumers back into the market.

Sometimes, that idea works.

It works best when neither the Federal Reserve nor Congress shovels trillions of dollars into the economy.

With the Fed changing its course and Congress deadlocked, high prices are starting to cure high prices.

It’s good news on inflation, but it’s bad news for the economy.

Economy Slows in 2022

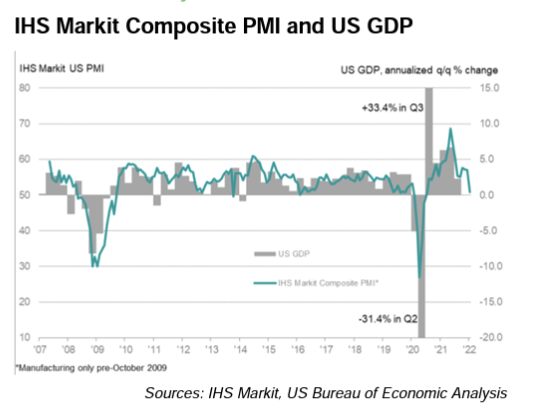

Data showing the drop in demand is in the IHS Markit Flash U.S. Composite PMI Output Index for January.

The index plunged from the December reading. The reading of 50.8 is an 18-month low.

That brings it back to the level it reached in July 2020, when the recovery from the pandemic shutdown was just beginning.

We saw a broad-based decline in the data. A separate index, tracking the service sector, also reached an 18-month low. Manufacturing fared better, reaching only a 15-month low.

This is an important economic indicator because we can correlate PMI data to changes in GDP. The most recent reading is consistent with GDP growth of less than 2%.

Source: MarkitEconomics.com.

Because the omicron variant made January a wash, the economy can recover in the next two months and deliver a strong quarter of growth.

But there doesn’t appear to be a catalyst for growth of more than 2%, the level seen for much of this century.

Easing quarantine restrictions drove growth in the second half of 2020.

The government stimulus checks fueled growth in 2021, and folks spent the savings they accrued during quarantines.

Now, we’re back to where we were before the pandemic: a normal, everyday economy, which means slow growth and a meandering return to low inflation.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters